Microstrategy to sell $ 2 billion in stocks to buy more bitcoin

The former Microstrategy is making a special offer for convertible upper notes. The company will offer $ 2 billion of these assets and use revenues to buy more bitcoin.

Silor announced that his company did not buy any Bitcoin last week, which led to a boycott of the purchase. However, unlike these details, everything else appears to be suitable for the standard playing book.

The strategy continues to buy bitcoin

Since Microstrategy (recently renamed to the strategy) began obtaining Bitcoin, she became one of the largest BTC holders in the world. Earlier this month, the company broke the series of successive purchases for 12 weeks, and quickly resumed it quickly.

Today, Michael Sailor Recognized The company stopped its purchases again, but not for a long time:

Last week, the strategy did not sell any shares of the shared category A in light of the market display program, and did not buy any Bitcoin. As of 2/17/2025, we got 478,740 BTC, they got 31.1 billion dollars Almost at $ 65.033 per bitcoin coins.

Specifically, a few hours after Silor made this first publication, follow him with another advertisement. The company plans to submit a 2 billion dollar convertible notable notes.

These stock offers, of course, will help the strategy to finance more bitcoin purchases. This is a fixed technology for the company, making a similar offer last month.

The strategy used some different tactics to continue the main acquisitions of Bitcoin. I have sold enough Blackrock now 5 % of the company, and the Strip’s favorite stocks (STRK) was strong. The company’s enormous BTC value has been greatly estimated in the value, but the company maintains these assets accurately.

Bitcoin has been somewhat volatile over the past few weeks, which could represent an opportunity for the strategy. After hitting the rise and landing, its price is unified slightly less than the $ 100,000 sign. This is not a significant decrease in the price in the large scheme, but it will continue to help get more assets for the same investment.

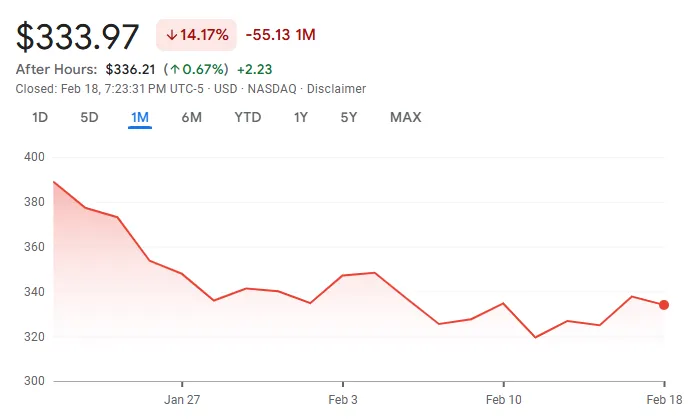

Meanwhile, the price of the MSTR share has recently. It remains approximately 15 % last month.

Ultimately, this entire process looks beautiful by the book. The strategy has clearly developed its intentions to buy more bitcoin through this stock sale, just like many other modern offers.

Although there are rumors that the company may face difficulties in fulfilling this strategy, it has not yet appeared. Currently, Sailor looks satisfied with the same look – the maximum shock.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.