How low bitcoin decrease after 20 % decrease?

Bitcoin price continued today with the loss of more than 20 % of its highest level ever. However, the current performance suggests that the storm has not yet ended and that another wave of disappointments may be present for investors. Therefore, let’s see what experts say and the BTC decrease in the bear.

Bitcoin Slide 20 %: More down?

Bitcoin has lost 16 % over the past thirty days, with a decrease of 11 % per week. Moreover, approximately 20 % of the last ATH is bleeding from 109,114.88 dollars. This reflects the appetite for investors risking and fading in the market in the area of digital assets. It is worth noting that this is also evident through the massive external flow of Spot Bitcoin ETF in the past few days, with $ 754.6 million on February 26.

Meanwhile, BTC Value today fell about 3 % from yesterday to $ 86,147, with a one -day trading volume decreased 12 % to $ 70.33 billion. It is worth noting that Crypto has decreased to 82,131.90 dollars in the past 24 hours, with a height of 89,23.08 dollars touching. Moreover, Coinglass data showed that the open interest of Bitcoin Futures also decreased by 6 % yesterday, reflecting the dark market morale.

More BTC DIP: Keys to watch

Experts remain optimistic with caution despite the fermentation storm in the wider digital assets, as shown in the collapse of the last encryption market. A group of critics in the market also believes that these last bitcoin prices are a healthy correction, which may attract more investors to enter at a lower price.

For the context, in one of the last X Post devices, the famous market expert Michael Van de Bob said that BTC should carry a mark of $ 87,000 for a strong recovery. However, he also noted that failure to keep this level could lead to a huge sale that may push the BTC price to $ 70,000. Nevertheless, Note Bob The correction of the bitcoin price is “great” for investors to buy “25 % of the highest level.”

Bitcoin price to 70 thousand imminent dollars?

It is difficult to predict accurately the low price of bitcoin if the bears persist in control. However, according to market trends and expert comments, it seems that BTC may find its next support for about $ 70,000. After saying this, it is very likely that the encryption will slip to the next level.

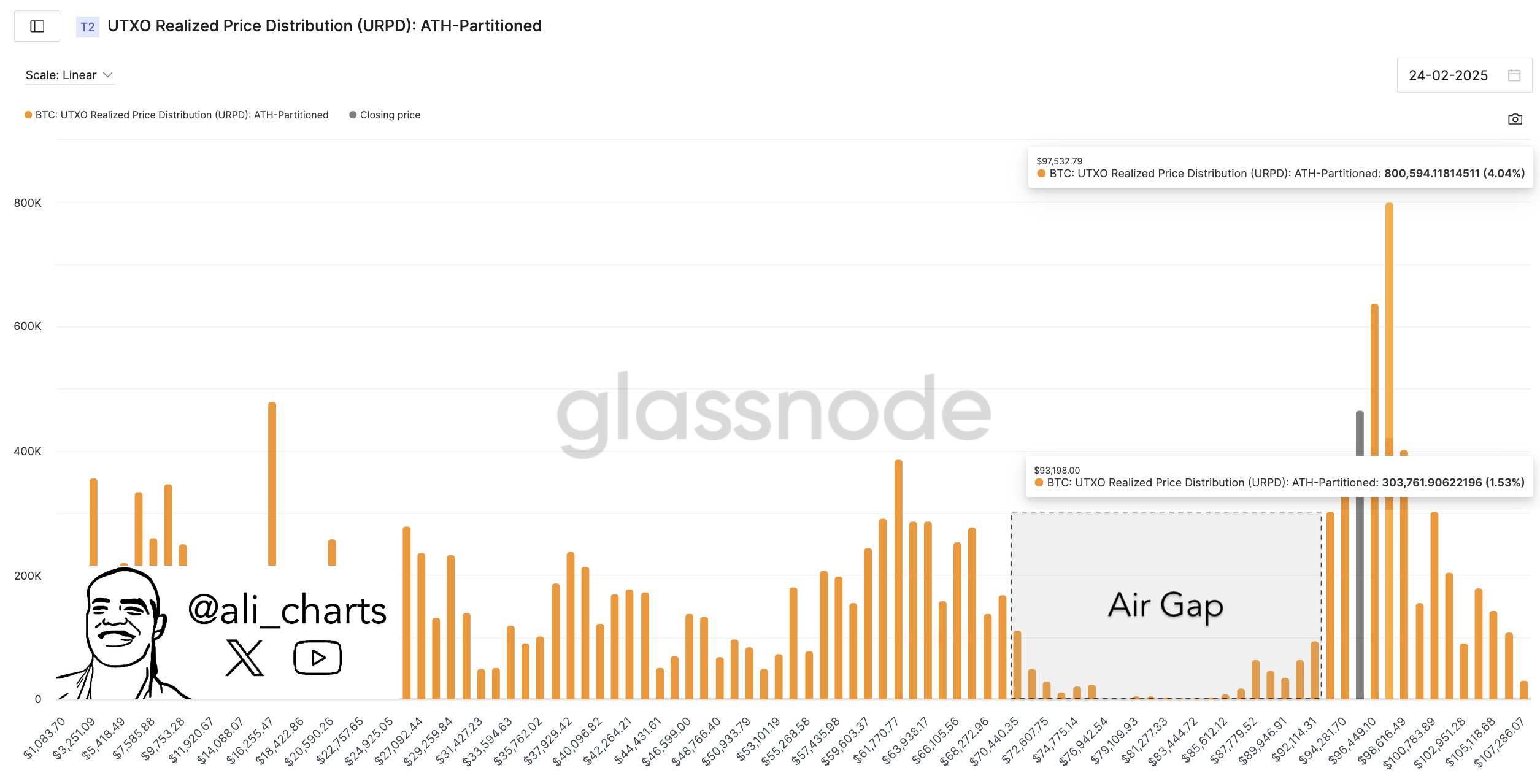

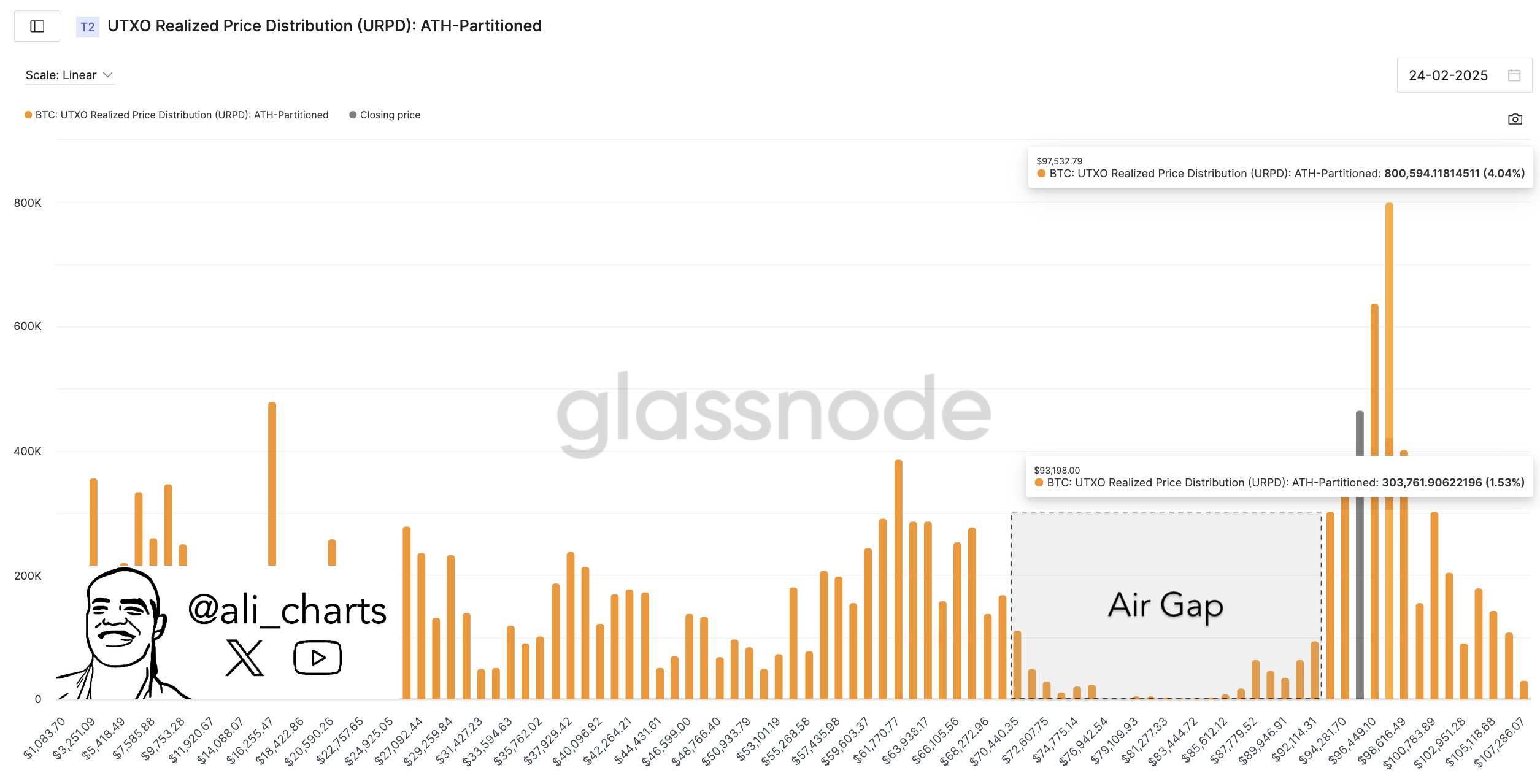

Meanwhile, he was echoed by feelings similar to Michael Van de Bob, another expert Ali Martinez recently said that BTC is less than $ 93,198 and you will find its support at $ 70,440. Given this, the price of Bitcoin may slip to the 70th area if investors continue to stay on both sides.

At the same time, the last predic prediction of BTC also hints with a correction to $ 70,000 by the end of the year. Therefore, investors may circulate with caution amid the volatile market scenario. But what if the main encryption began to recover?

BTC recovery is possible? Below are the price levels to watch

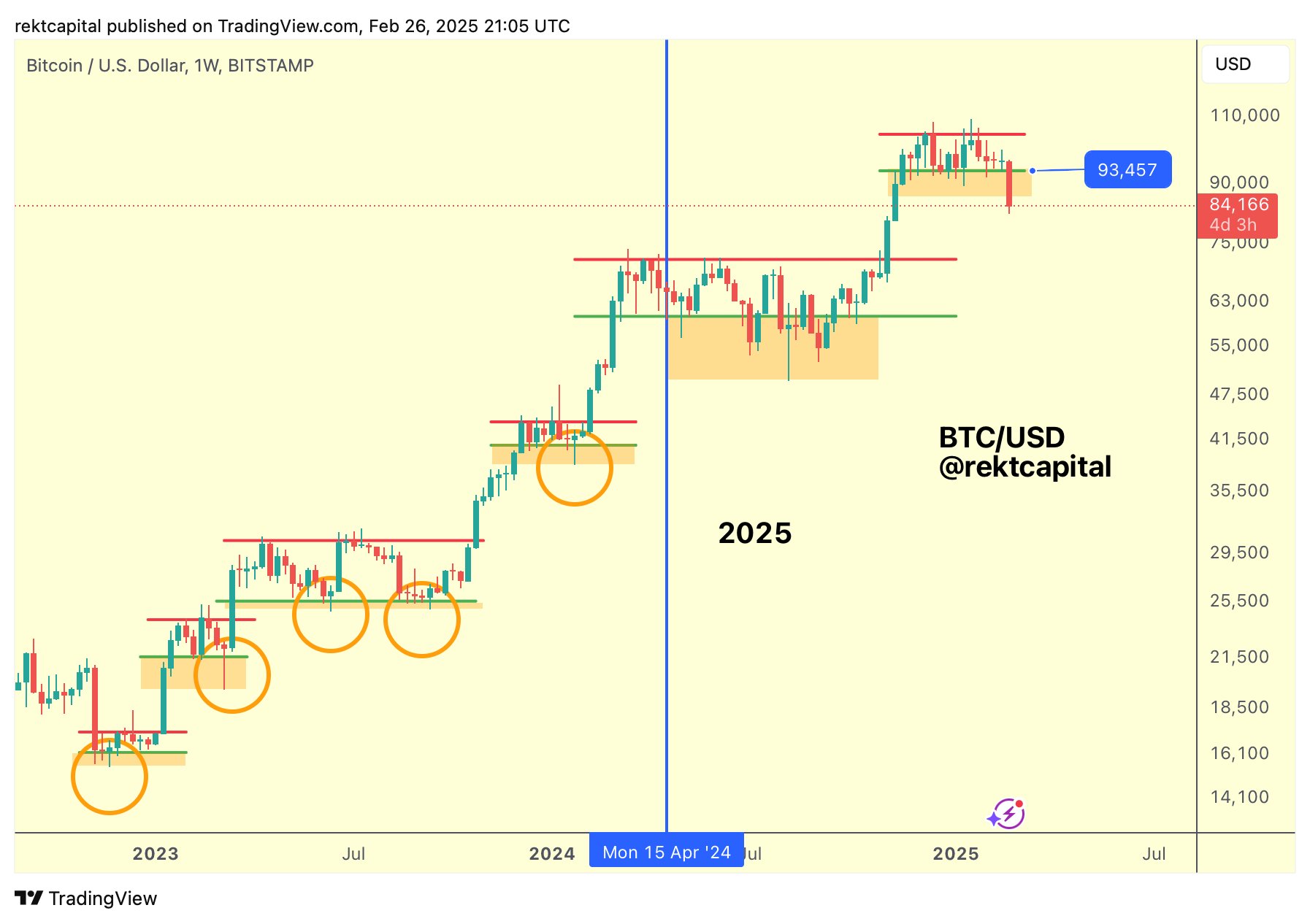

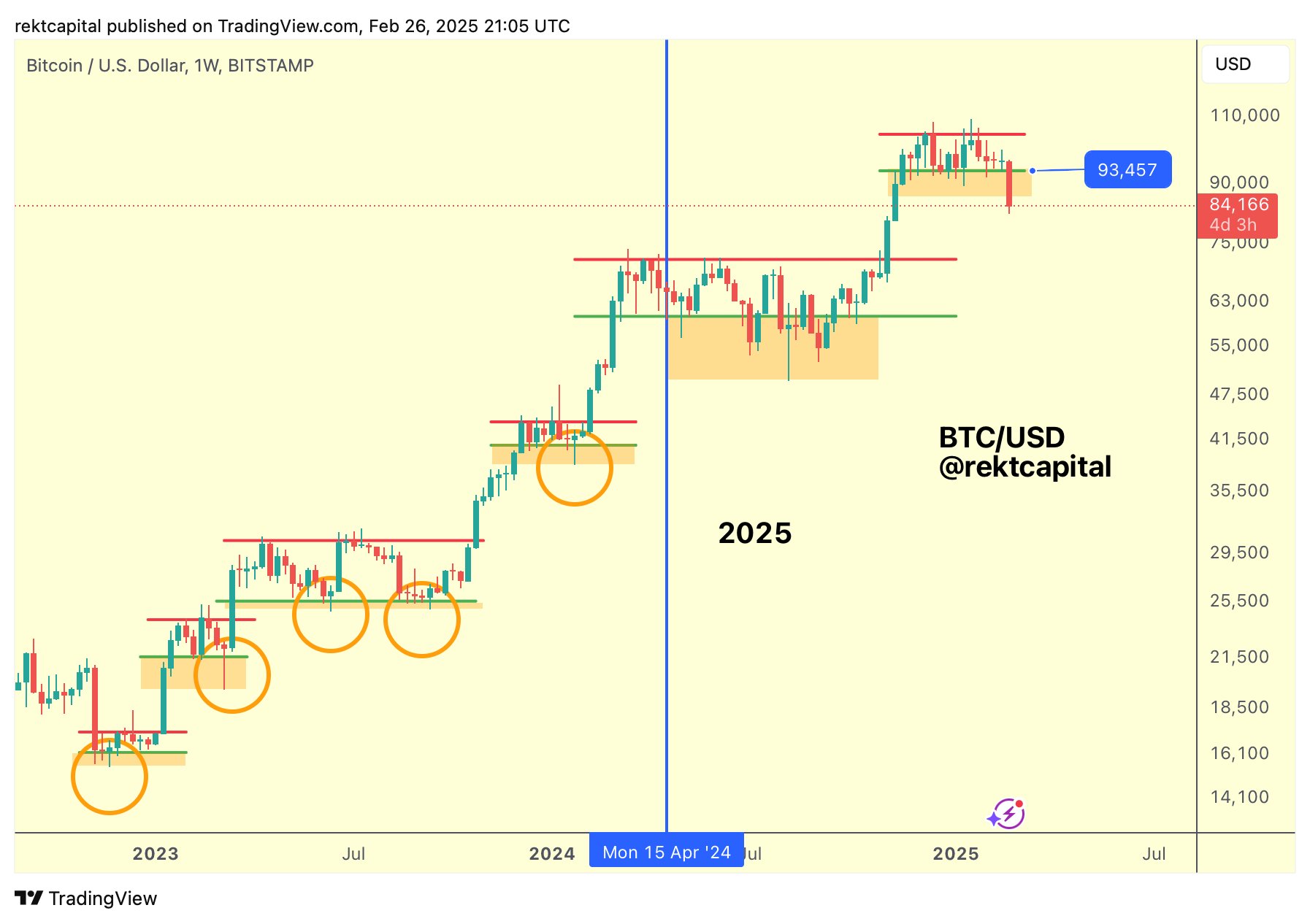

Although the last market shrinks, experts are still optimistic about Bitcoin’s long -term horizons. The analyst Rikt Capital notes that Bitcoin is closed to filling the CME gap that was created between $ 78,000 and $ 80,700 in November 2024. In addition, a new CME gap has formed between 92,700 dollars and $ 94,000, which may lead to a possible relief and decrease of a 93,500 dollar point.

Other experts, such as Rose Premium signals, expect more ambitious goals for BTC, at a long -term possible price of $ 130,000. With Bitcoin almost fills every CME gap since mid -March 2024, the price recovery may be on the horizon. Since the market is monitoring the signs of transformation, investors continue to hope to restore Bitcoin its upward momentum.

Responsibility: Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.

partner: