Bitcoin bears will be washed if this happens

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

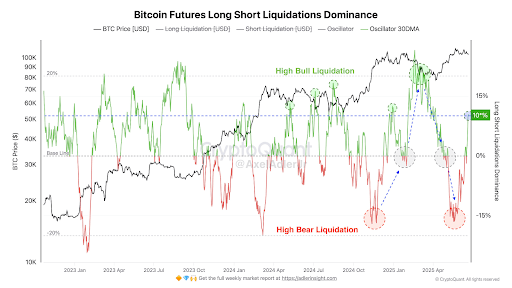

Bitcoin Tight price movement During the past week, it contradicts a very different development in the futures market. According to Axel Adler JR. And a Cryptoquant analyst on the series’s analysis platform, a sharp rise in the long liquidation domination scale can pave the way for a major transformation in feelings that may wash the bears completely from the market. Adler Share data In a modern post on X, Accompanied by a scheme that shows the previous points that resemble the current preparation.

A long rise to liquidation without collapsing the price

The long references dominated from 0 % to +10 % over the past seven days, a step that usually appears distress among the upscale merchants. However, what makes the current development of observation is the absence of an acute accident in the price of bitcoin. Instead, at the week that was just concluded, Bitcoin was often held within the range of $ 103,000 to $ 106,000 until a modern decrease, although the increasing pressure from long rank.

Related reading

Axel Adler Junior explained that this continuous liquidation of long sites without the collapse of the full price indicates the constant support of Jupiter. According to data from Cryptoquant, the long BTC qualifiers, the highest level last week. An increase in the long qualifiers usually indicates that merchants who were expecting a crowd of prices are removed from their positions under pressure.

The Cryptoquant chart below shows how the nails are in the dominance of long liquidation, especially in the range of 15 % to 20 %, has always preceded bullish repercussions. According to the analyst, if this scale increases by another 5-7 %, this may cause a highly used scenario where descending situations are washed and stir the bitcoin price movements In favor of bulls.

A large portfolio accumulates with the retail sale

Data appears from Santiment, which is another series of analyzes on the series, interesting dynamic Play between bitcoin holders. Over the past ten days, the governor with more than 10 BTC has increased by 231 titles, which is 0.15 %. Meanwhile, the smaller retail governor with between 0.001 and 10 BTC decreased by 37465 in the same time frame. This trend highlights the difference in feelings between large retailers.

Related reading

According to Santime, The shift where whales and sharks accumulate while retail sale is a bullish mixture for Bitcoin. The market value of Bitcoin hovers just less than 104,000 dollars during this accumulation, and there may be an upward outbreak in the end. Once the retail holders begin to re -enter.

Although Power inherent in the chain, The instant price of Bitcoin has achieved short -term success in the past 48 hours. During this time frame, bitcoin price Loving under support levels Between 106,000 dollars and 103,000 dollars. At the time of this report, Bitcoin is traded at $ 102,670, a decrease of 2.6 % in the past 24 hours.

The decline can be attributed to the recent American strikes on Iran. American military strikes caused Iranian nuclear facilities (21-22 June) to hate immediate risks across the markets. Bitcoin fell 3.2 % After the strike adsLike a 6 % decrease during Iranian 2020 tensions.

Distinctive image from Dall.e, Chart from TradingView.com