Says TRADER Bitcoin Alert says, BTC says higher than an embarrassing level to avoid a 30 % decrease

The encryption strategist warns that Bitcoin should carry one major level because support or BTC may have severe correction.

Ali Martinez merchant Recount His 121,300 followers on the social media platform X that if Bitcoin fails to get $ 91,700 in support, BTC may decrease by 30 % of its current value.

“Given these factors – high sale pressure, the lack of new capital and network activity – it is very important for Bitcoin to exceed 91,700 dollars. If this level fails, BTC can be suspended to $ 74,000.”

analyst Use Pricing ranges derived from the market value of Bitcoin to the achieved value (MVRV) to determine the main support levels. MVRV is the percentage of the market value of the encoding assets in relation to the achieved value or the value of all coins at the purchased price. When the value of MVRV decreases below zero, it indicates that the original has a front stadium as the traders who bought it in a specific time frame witnesses losses.

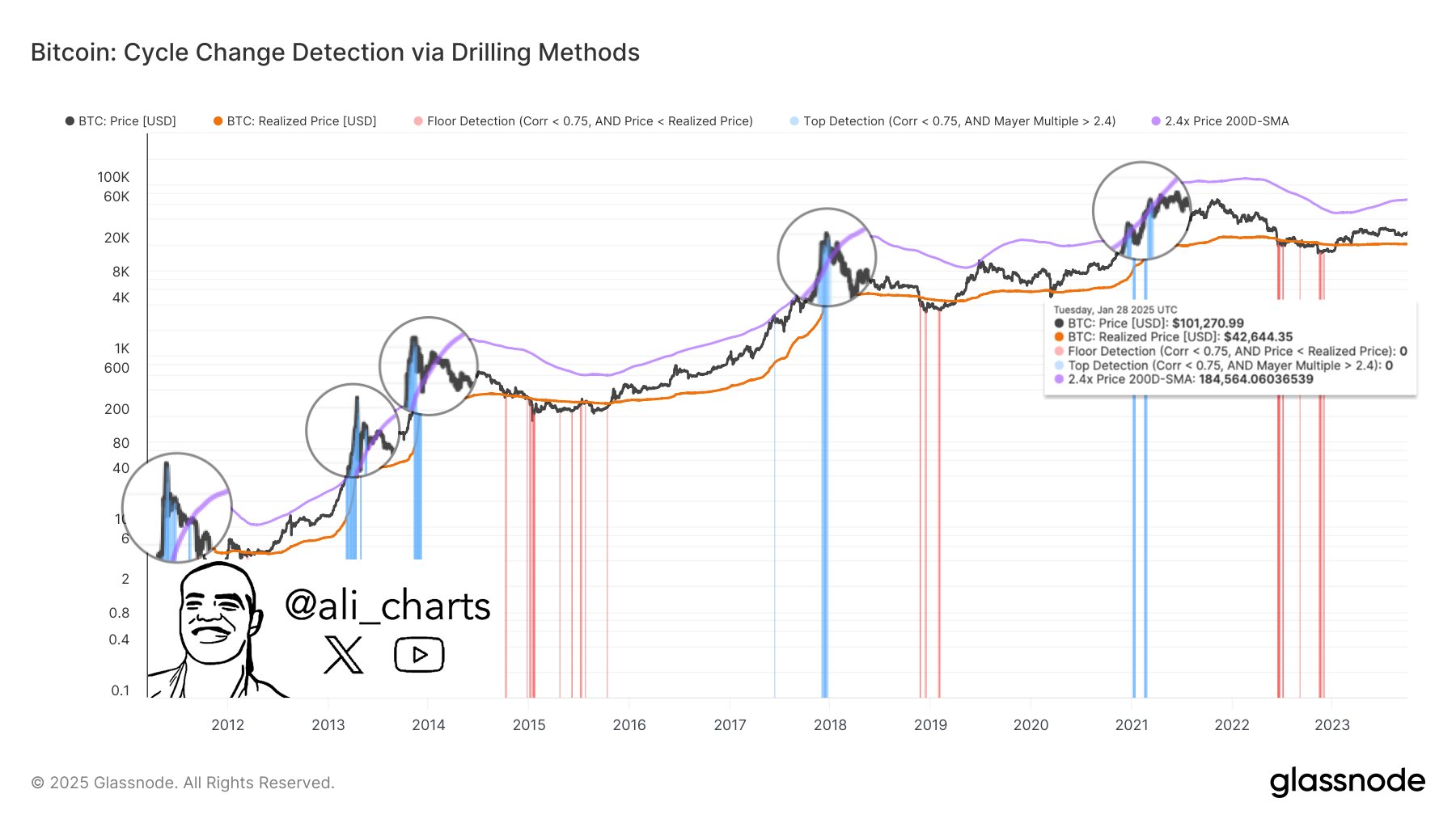

While the trader says that some of the scales are flashing to Bitcoin, he also says that Cycle Peak may not be present yet.

Based on previous sessions and price analysis using the moving average for 200 days, He says There is still a possibility to increase the main encryption assets more than 74 % of their current value.

“But despite these descending signals, multiple models indicate that Bitcoin still has a room to rise before reaching the market top. For example, the cycle transformations usually occur when BTC 2.4x SMA exceeds 200 days (simple average) average) , Which is currently sitting at $ 184,600.

It is too He says Mayer is multiple is a bullying ascending to Bitcoin. The Mayer Moleer is a technical tool that measures the difference between the current price of BTC and a 200 -day moving average to determine whether Bitcoin is his arm or an increase in a fillet.

Likewise, Mayer Moener indicates that Bitcoin has more upward trend, with the highest possible market about $ 182,000. “

Bitcoin is trading $ 105,757 at the time of writing this report, an increase of 3.7 % in the past 24 hours.

Don’t miss a rhythm – Subscribe to deliver email alerts directly to your inbox

Check the price procedure

Follow us xand Facebook and cable

Browse the daily Hodl Mix

& nbsp

Disclosure: The views expressed in Daily Hodl are not an investment advice. Investors must do due care before making any high -risk investments in bitcoin, cryptocurrency, or digital assets. Please note that your transfers and trading on your own responsibility, and any losses you may bear are your responsibility. Daily Hodl does not recommend buying or selling any encrypted currencies or digital assets, and Hodl Daily Andersor is an investment. Please note that the daily Hodl participates in dependent marketing.

Distinguished Image: Shutterstock/Slava Gerj