Jim Kramer calls Bitcoin a safe haven amid the growing concerns of the United States

The investor is afraid again after Moody’s classification of the US government debt classification, but Jim Kramer of CNBC advised a different response. He urged investors to manage their emotions instead of panic, indicating that digital assets such as bitcoin can serve as a preventive option at unconfirmed times.

Jim Kramer warns of the sale that is moved by fear

Jim Kramer, Host Crazy CNBC money, to treat Investors on Monday after MOODY decision to reduce American debt classification. This announcement, which was made after the market on Friday, sparked a volatile start for this week. The markets opened less, with Dow Jones decreased by 300 points and S&P 500 slide by 1 % in early trading.

Despite the initial decrease, the markets were recovered during the session. DOW was closed by 0.32 %, the Nasdaq Stock Exchange increased by 0.02 %, and it acquired S&P 500 0.09 %. Jim Kramer urged investors to resist fear, describing it as a frequent pattern after the previous discounts, such as those written by S&P in 2011 and Fitch in 2023.

“I got an early warning to invest more – not more aggressive – but more than you can provide,” said Jim Kramer. He added that the sale after reducing the classification was not a reliable strategy in the past.

Bitcoin and gold proposal as safety networks

Jim Kramer advised those who are interested in increasing national debt to consider assets outside the traditional markets. He mentioned in particular gold and bitcoin as alternatives in times of financial uncertainty. “Fear is what to tame if you want to be a good investor,” explained, stressing that panic often leads to bad decisions.

Bitcoin, in particular, has shown flexibility in recent days. After the discount news, the Bitcoin price showed fluctuation but continued to stick to more than the main support levels. Cramer noted that digital assets such as Bitcoin may provide a temporary store for those who warn of excessive government borrowing.

He also suggested that some of the fear novels are driven by individuals or entities with their financial interests.

Jim Kramer said: “The people who write these are fools who do not know anything or incredibly open sellers who really need to spread fear because of their business model,” said Jim Kramer.

Bitcoin’s open interest rate increases the price of $ 107,000

Bitcoin’s open interest in the futures market reached $ 74 billion, according to data from Coinglass. This represents one of the highest levels seen in recent weeks and proposes the increasing trading activity.

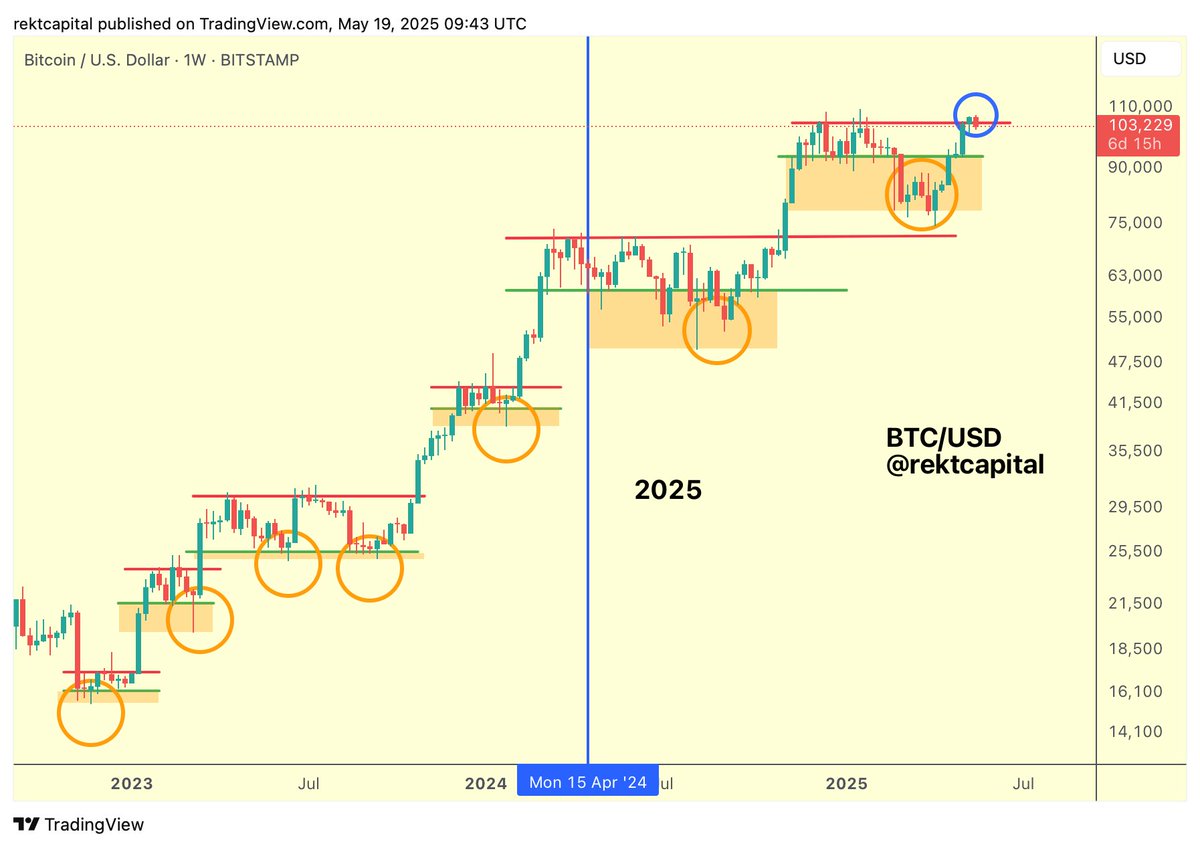

The Bitcoin price is currently trading about $ 105,000 after a short transition to $ 107,000. He rejected this level twice in modern sessions, indicating the resistance. Despite the fluctuations, the Crypto Rekt Capital expert said that the original closed the previous weekly candle of more than $ 103,000, which was a major resistance point.

Analysts attribute the activity to the feeling that interest rates will decrease and that inflation will be arrested, both of which are suitable for things like bitcoin. This increasing number of financial companies that occupy their exposure, such as Michael Sailor’s strategy, which is led by Michaelor, also indicates, as some of the reasons behind Bitcoin stability.

Responsibility: Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.

partner: