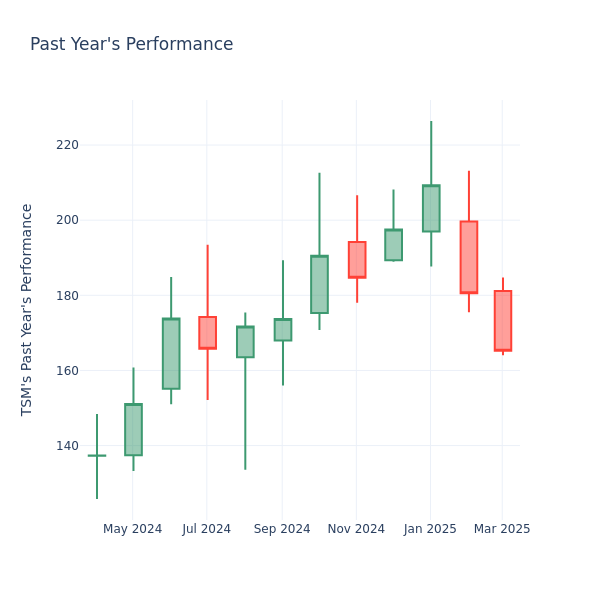

Look at the price of Taiwan semiconductors on profits – Taiwan semi -conductor (NYSE: TSM)

Consider the current session, Taiwan SemiDUCTOR Inc. TSM The shares are traded at $ 165.13, after a 1.85 % He falls. During the past month, the stock decreased 8.47 %But during the past year, it already rose 16.79 %. Through a short -term performance like this, and the great long -term performance, the long -term shareholders may want to start researching the rate of company prices to profits.

Taiwan semiconductor P/E compared to competitors

P/E measures the current share price to EPS for the company. It is used by the long -term investors to analyze the current performance of the company against its previous profits, historical data and the total market data of the industry or indicators, such as the S&P 500. The P/E is higher indicates that investors expect the company to work better in the future, and the stock may be exaggerated, but not necessarily. It can also indicate that investors are ready to pay a higher share price, because they expect the company to work better in the next seasons. This leads investors to remain optimistic about the high stock profits in the future.

Compared to the ratio P/E College 127.6 In the semiconductor industry and semiconductor buildings, Taiwan Semiductor Inc. P/E at less than 24.59. The shareholders may tend to believe that the arrow may perform worse than its peers in the industry. Inventory can also be less than its value.

In conclusion, the price ratio to profits is a beneficial measure for the company’s market performance analysis, but it has its restrictions. Although the less P/E can indicate that the company is emerging with less than its value, it can also indicate that shareholders do not expect future growth. In addition, the P/E ratio should not be used in isolation, because other factors such as industry trends and business courses can also affect the company’s share price. Therefore, investors must use the P/E in conjunction with other financial scales and qualitative analysis to make informed investment decisions.

batch79.22

growth82.32

quality97.61

value49.41

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.