Lloyds price forecast 2025, 20230, 2040

- summary:

- The price of Lloyds has struggled in the past few years, with fears continuing about Britain after Britain has left the European Union. The stock has collapsed by approximately 40 %

The price of LLOYDS (LON: LLOY) was a mixed start for this year alongside other major international banks. In the United States, bank shares like Bank of America, City Group and Goldman Sachs were in a declining direction as concerns about their financial affairs continued. They published weak financial results.

After the price increased by 18 % in the first few weeks of 2023, the Lloyds share price is currently trading without its annual opening. This translates into a decrease in price by approximately 15 % of YTD height. It should also be noted here that LLOYDS is not the only bank that displays such a volatile basic procedure. Other major British banks such as HSBC, NatWest Group and Barclays also show a similar price.

This article was initially published in September 2022. It is updated regularly to reflect the latest developments in the performance of Lloyds Bank

What is Lloyds Bank?

Lloyds was established in 1765 in Birmingham. Since then, a British company has become a leading company serving more than 27 million people in the country. Lloyds has a wide network of branches throughout England and Wales. Halifax, affiliated with the bank, serves its customers in Northern Ireland, while Scottish Bank serves the Scottish Bank. LLOYD Banking Group PLC is the parent of all these entities.

Bankds Bank is one of the four major banks in the United Kingdom. The history of the 320 -year -old bank makes it one of the most credible banking institutions in the United Kingdom. LLOYDS Banking Group PLC currently has more than 65,000 employees. However, due to the reduction in the demand for material branches, the bank will close some of its branches in the United Kingdom in the next few months.

Lloyds banking group companies provide different solutions. For example, Certaark offers retirement solutions to more than 350,000 people with more than 37 billion pounds in assets. Schrooders Personal Wealth is its joint project with Schrooders, a company worth more than 650 billion assets. Black Horse and Lex Autolese provides car rental solutions.

However, Lloyds Bank earns most of its money from its UK banking services. Unlike her peers like Barclays and HSBC, she has no main imprint abroad. Below is the LLO: Lloy:

Lloyds share price date

The Lloyd Bank group had a long and difficult period as a company in the United Kingdom. The company became public in 1998. At that time, the stock was trading 130 pixels. Shortly after that, the arrow rose to its highest level ever reached 548p during the Dot Com. Good times ended when Dot Com Bubble exploded, and the shares decreased by 72 % between 1999 and 2002.

During the 2008 global financial crisis, Lloyds’s share price achieved great success. In fact, the Lloyds Banking Group was about to bankruptcy but was rescued by the UK government. The bank received the rescue package £20.3 billion. However, Louis reached: Louis is absolutely low $ 16.38 in 2009.

Since then, Lloyd’s shares have shown a side price. In 2015, Lloyd’s share reached the level of 89p. However, the price has been immediately recovered and has been in a declining direction since then. Criticism of the price for the lowest level of 2014 of 23p in 2020 and got a strong recovery. The 23p area has become strong because the price has received many apostasy from this level.

The UK banks were flourishing in high interest rates until the failure of multiple regional banks in the United States seemed to warn the Atlantic Ocean. Consequently, the investor’s belief in the banking industry has reached the lowest new level, as banks reach a significant decrease in deposits during the first quarter of 2023.

LLOYDS Financial to stay strong in the short term

Lloyds has almost doubled its profits since the rates began to increase. In 2023, the bank’s profit is expected to remain strong. However, in the long run, the current high -profit numbers may not be sustainable. This must change with the start of the interest rate next year.

Recently, the Lloyds Banking Group PLC group has released the full results of 2022. The results show an increase of 2.6 billion pounds in profits. However, due to events such as the Ukraine war and Hurricane Ian, the bank had to bear an investment loss of 3.1 billion pounds. This led to a loss before the tax of 800 million pounds.

Another factor that contributes to the constant translation of the Lloyds share price is the problems in Credit Suisse. The Swiss lender is located in the news again amid rumors of obtaining funding from its best Saudi national investor (SNB). Although SNB indicated restrictions because she was unable to increase her share in Credit Suisse, the media report suggested otherwise. This led to a huge sale in LLOYDS (LON: LLOY) share price as the price fell to less than 46 pixels in March.

Lloyds share price today

The European Central Bank (ECB) and the American Federal Reserve raised interest rates with another 25 -bit per second in May 2023. The bank’s shares show a mixed reaction to the news. At one end, high interest rates increase from the operating profits of banks, and at the other end, they also increase the losses that are not achieved on their public budgets.

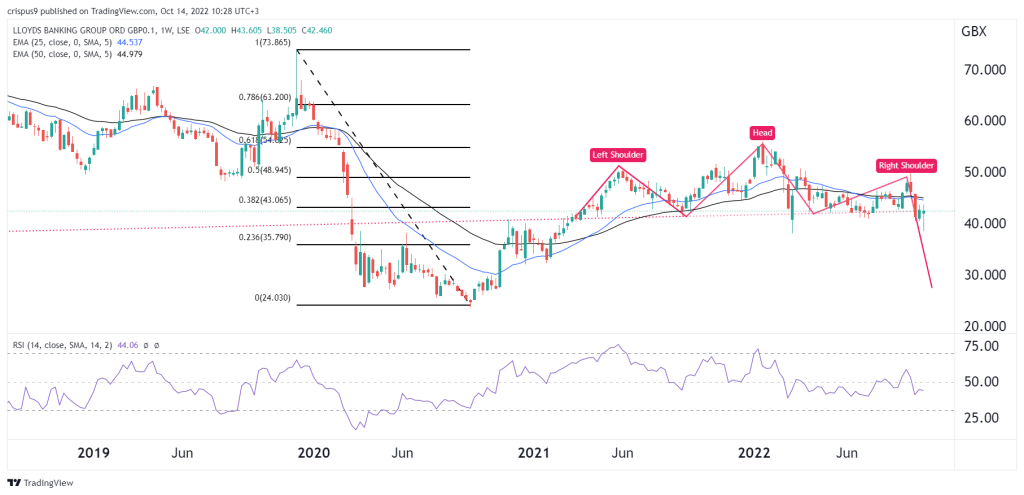

LON: Lloy Chart shows that the bank’s shares had a very good gathering until multiple banks failed in the United States. Since then, stocks have decreased to their lowest annual levels. The most common things in the beard are the formation of the head and shoulders style and the collapse less than 200 mA. Lloyds prices will become very declining if the price gains acceptance less than 44.6 pixels. In such a scenario, I expect stocks to drop to their support of 38.5 pixels.

Lloyds Bank participation news

Lloyds Banking Group PLC has recently investigated a significant investment in an advanced identity technology company. The investment of 10 million pounds in Uti will enable the bank to secure the personal data of its customers.

According to recent news, the Lloyd Banking group closes 40 additional branches throughout the country as the demand for material banking sites has decreased dramatically. This step is also seen as an initiative to reduce costs in the banking sector. Although the branches are closed, there will be no discounts related to jobs.

In other news, the bank issued a warning to its customers after a large number of its users recently fell due to romantic fraud. On average, these clients lost about 8,000 pounds.

Lloyd Bank reports week reports

Lloyds Bank’s reaction to the latest quarterly results. The company published weak financial results. Its profit decreased after the tax to 4 billion pounds, as it increased its provisions for non -existent debt. The net interest revenue increased by 15 %, as the Bank of England continued to walk in interest rates. The operating costs increased by 6 % to 6.4 billion pounds, while its basic profit increased before the value decreased by 26 % to 5.5 billion pounds.

The other important catalyst for Lloyds’s share was the final central bank’s decision by the Bank of England (BOE). As was widely expected, the bank decided to raise interest rates by 0.50 % in its battle against inflation. He also hinted that he would continue to walk in the coming months. However, analysts expect that the path for more prices is still limited.

Why Lloyds share price is very low?

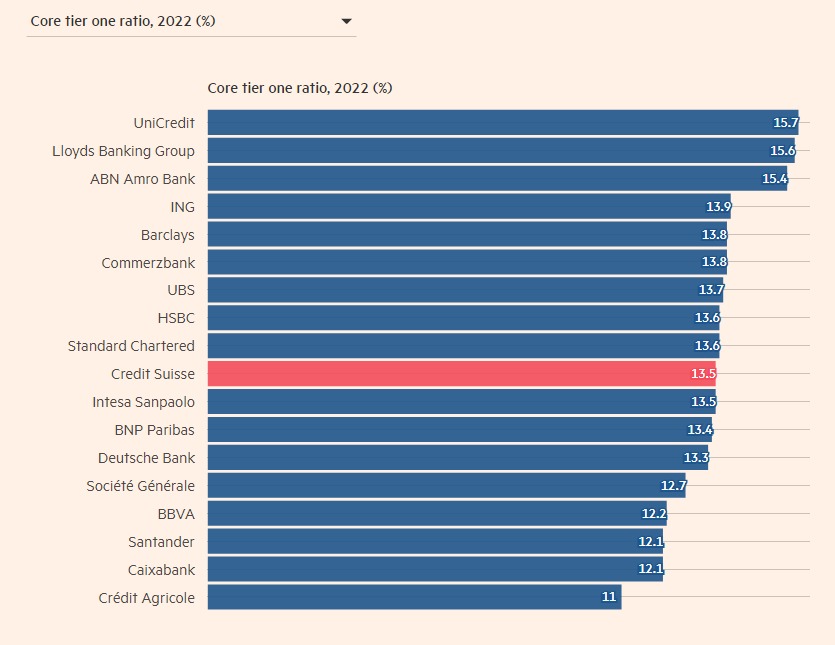

Lloyds share price is undoubtedly cheap. For one of them, a price ratio is 0.6, which makes it cheaper than other famous European banks such as Intesa Sanpaolo, HSBC, ing, BBVA and Caixabank. This is also noticeable because Lloyds has one of the best public budgets in Europe. As shown below, it contains the best basic degree in Europe after Unicredit.

Lloyds share price is cheap due to concerns about the British economy after Britain’s exit from the European Union, the British decline, and the general lack of growth in the banking sector. Also, low interest rates in the past decade have made relatively difficult to invest in.

When will the price of Lloyds share?

A closer look at the bank shares scheme shows that it struggled to move higher than the important resistance level at 60 pixels. Therefore, the common question is when the arrow will wear. It is difficult to know this due to the presence of continuous concerns about the British economy. Also, with global stocks in a generally declining direction, there is a possibility that they will remain in a period of unification for a period of time. However, given the current upward trend, it is very likely that the height of 2022 of 56 GBX will recover in 2023.

Lloyds 2023 price expectations

Since the beginning of this year, the Lloyds share price has failed to obtain a higher strength of the main psychological level of 50p despite the re -tests. LON: Lloy Chart also explains that the price has collapsed less than the rising trend line on the daily chart. Currently, the price is supported by the 200 -day moving average, which lies at $ 46.28.

The acceptance of less than 200 mAh on the daily chart will be a significant drop for LLOYDS because the next support will be the lowest level in October, which is located in 38.6 pixels. This will be a decrease of more than 21 % of the current share price.

Lloyds price forecast 2025

The next few years will be difficult for Lloyds and other UK banks like Natwst and Virgin Money. This is because analysts believe that the British economy will face in the coming years. A look at the weekly graph shows that the arrow is a shape similar to the head and shoulders style. In price action analysis, this style is usually a declining sign.

The arrow is also less than the 38.2 % Fibonacci tradition level and the bottom side of the Pitchfork Andrews. Therefore, there is a possibility that the arrow will decrease to less than 30 pixels by 2025.

Update the price of Lloyds – April 30, 2025: 72 pixels, but merchants are hesitating near the summit

LLOYDS Banking Group (LON: LLO) concludes April a little less than 72 pixels, and holds the gains but shows signs of exhaustion near the levels of the highest this month. The arrow touched 74.46p earlier in April before the decline, and now, the momentum looks flat. The bulls do not retreat completely – but they are not chasing either.

To date, 2025 was a strong Lloy. The stock has increased more than 20 % YTD, with the support of strong profits, the UK price environment, and a wider strength in the financial statements. But the assembly has recently cools. Traders closely monitor to see if 72 points of silence – or if the deeper withdrawal is coming.

Technical collapse: Can Lloyds break 74p?

- Resistance: 72.00p, 74.46p

- Support: 69.16p, then 67.32p and 64.84p

- RSI: Sitting around 55 – still is in the upward lands, but it fades

- MACD: positive but flat – there is no real sign now

The price structure has not yet collapsed. But unless LLOYDS 74.4pp wipes soon, it risks sliding towards a range of 69p. If this is broken, this step may extend to 64p.

What is behind Lloyds in 2025?

- The British economy retains better than expected. This helped in the performance loan and net interest margins.

- Distribution distributions are fixed. The shareholders are still in income, and the gossip has not disappeared.

- The mortgage activity slowed down a little, but Lloyds compensates for this with gains in other lending areas.

- The Bank of England stopped high interest rates – a mixed bag. It helps borrowers but can tighten the margins if the price cuts appear very early.

In short, the look is still decent. But investors want more than just stability – they want signs of growth, quickly.

April 2025 Recap: Uptrend Prephes, not reversed

April started with energy, but quietly ended. Lloyds wore between 69p and 74p for most of the month, and she refused a higher fracture but not to give up the ground. This is not a decline – but it is not exciting either.

If the stock can collapse and close over 74.46p, it may go to its highest level in 2025. If not, traders may start rotating and closing the gains from the past two months.

Lloyds 2030 price expenses

In order to be fair, it is relatively difficult to predict the location of the arrow in 2030. But given the monthly graph below, we see it in a declining direction in the past two decades. During this period, I moved to the bottom of the descending trend line shown in black. During this period, they were lower than all the moving averages. Therefore, we cannot exclude the position in which the stocks disrupted about 25 points by 2030.