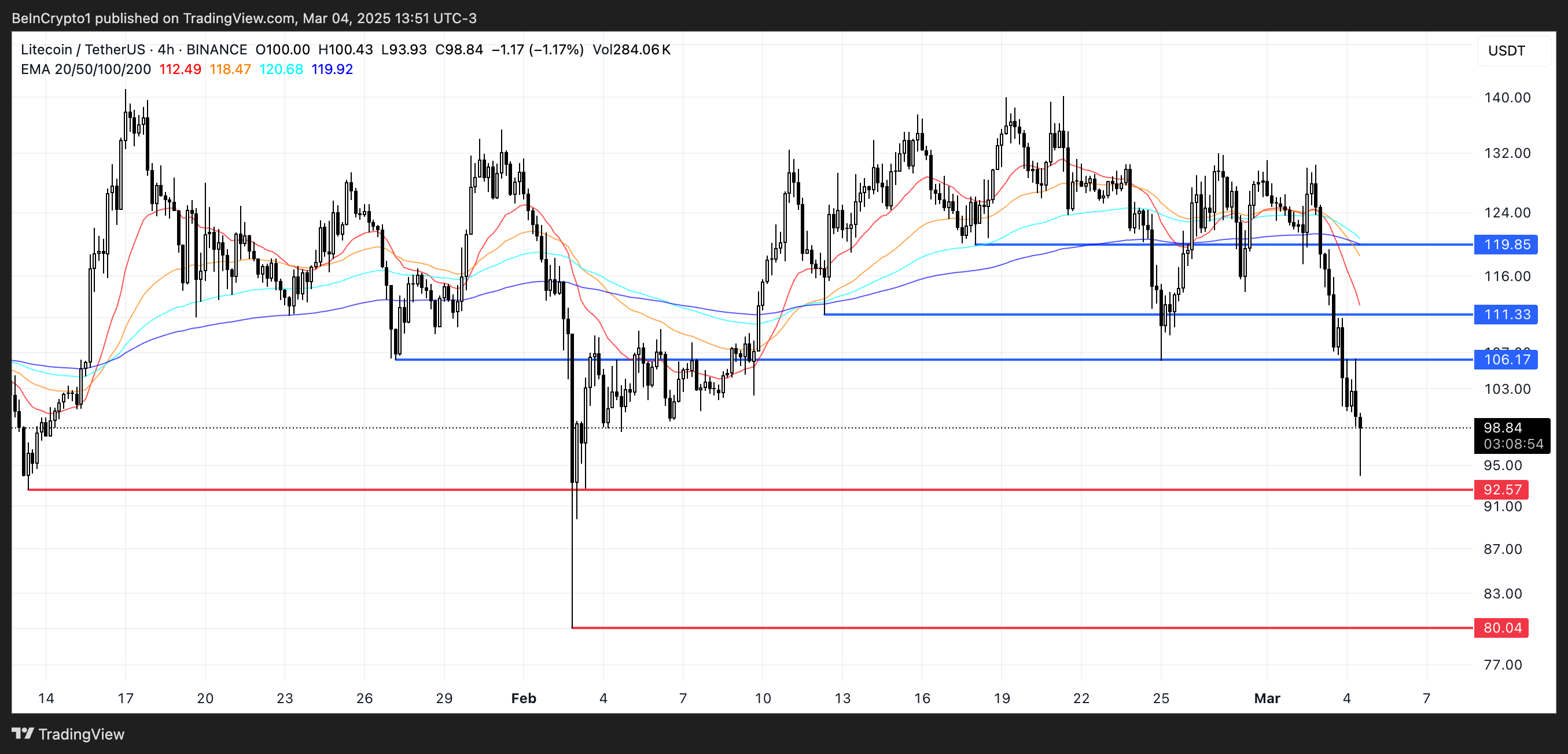

Litecoin falls 12 % in 24 hours

Litecoin (LTC) has decreased by more than 12 % in the past 24 hours, with a decrease in the price to about $ 100, and the maximum market decreased to $ 7.5 billion. The sharp decrease comes with the condensation of the sale pressure, pushing the RSI from LTC to excessive sales lands and the flow of Chaikin (CMF) is deeper in negative levels.

If the landmark continues, LTC can test the support 92.5 dollars and may decrease to $ 80, the lowest price for it since November 2024. However, if the momentum transformations, LTC may try to recover, retract $ 100 and target resistance levels at $ 106, $ 111, and perhaps $ 119.

LTC RSI is currently on excessive sale levels

Litecoin (RSI) has decreased to 26.7, a sharp decrease from 57.1 just two days ago. This sharp fall indicates that LTC has entered into the sale area, indicating intense sale of sale.

Such a rapid decrease often reflects the sale of panic or a strong declining direction, leaving LTC exhibition to more negative aspect unless buyers enter.

However, the relative power indicator also indicates that the original may approach a possible reflection on the short term, as excessive sale conditions often lead to altitudes.

RSI is an index of momentum from 0 to 100, and measures the strength of modern price movements. The above readings indicate excessive conditions in the peak, where the assets are likely to face the pressure pressure, while the readings of less than 30 excessive conditions indicate, as the opportunities for purchase may appear.

With RSI from LTC now in 26.7, it is deep in the sales lands, which increases the chances of short -term apostasy.

However, if the landfill continues and the RSI continues to decline, Litecoin may struggle to find support and expand its losses before any attempt to recover.

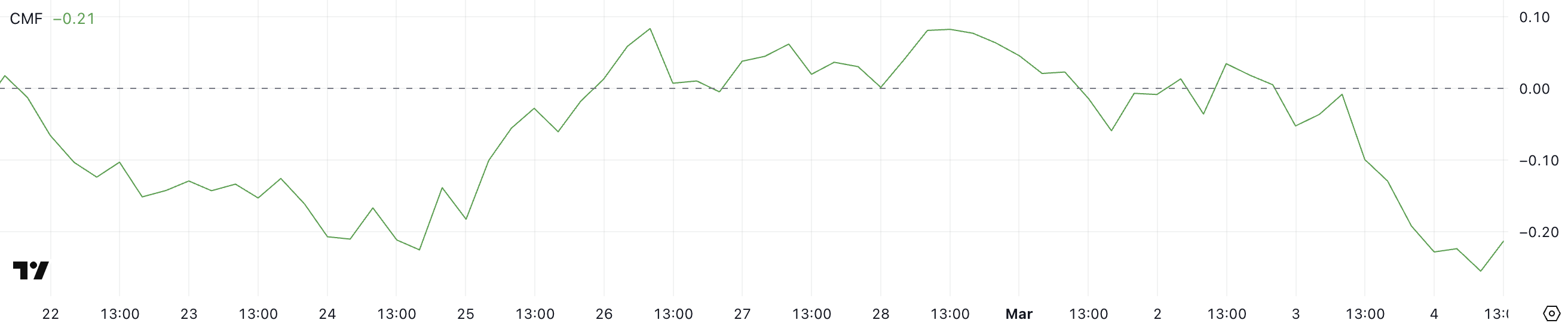

Litecoin CMF decreased below -0.20

Litecoin’s Chaikin Money Flow (CMF) is currently at -0.21, a decrease from 0.03 just two days ago, indicating a significant transformation of the capital flow. Earlier, CMF has briefly fell to -0.26, its lowest level since mid -February, which strengthens the emotional feelings.

Decreased CMF refers to the increase in the pressure pressure, as the capital flows more than LTC than it.

This trend indicates that investors are withdrawing liquidity from Litecoin, making it difficult for the price to keep any short -term counterattacks.

CMF evaluates the pressure and purchase of the sale by analyzing the size and prices ranging from -1 to 1. Positive values indicate accumulation, which means that more money flows to the original, while negative values indicate distribution and increased pressure pressure.

With CMF from LTC now at -0.21, sellers remain in control, unless the volume returns, LTC, are not able to find support.

The recent decline to -0.26 shows that the external flow of capital reaches extreme levels, which increases the risk of increasing the negative side unless morale transformations.

Will Litecoin decrease to less than $ 90 soon?

If Litecoin’s downward trend continues, the price can test the support level of $ 92.5, a major area previously held buyers. If this level is lost, LTC may decrease to $ 80, which represents its lowest price since November 2024.

While showing momentum indicators such as RSI and CMF downward pressure, there are other probability declines unless buyers intervene to defend support.

However, if LTC reverses its direction, it may restore momentum and pay more than $ 100, with $ 106 as the first main resistance level.

The collapse above this may lead to a test of $ 111, and if the bullish momentum strengthens, LTC may collect about $ 119.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.