The new American encryption bill changes everything – the best encryption for purchase now

Today, a new bill for cryptocurrency has been introduced in the United States, which aims to “keep America at the forefront of financial innovation and global competition, while protecting consumers from fraud.”

The new US encryption project is welcomed as the most comprehensive attempt to regulate digital assets yet – This time, it may actually work for Crypto.

The draft law cancels wealth and income restrictions for retailers and encourages decentralization through a complete transparency request from the holders of the large symbol.

It is seen as a big step towards the prevailing acceptance of encryption, which puts the way for some calling “a golden age of digital assets.”

Meanwhile, Michael Sailor, in Bitcoin, has returned with another bold stadium – this time Microsoft urges Bitcoin to buy Bitcoin instead of its own stock. region? Bitcoin outperformed the shares of Microsoft, which is the smartest play in the long run.

With the construction of momentum, it is not surprising that investors are to search for the best purchase now.

What does the new United States encryption bill mean?

Let’s divide this. The newly released draft of the US encryption project is not just more legal noise – it is a serious attempt to determine who is organizing what is in the encryption world.

For years, SEC and CFTC fought against the judicial jurisdiction. This draft law finally draws a clear line: goods go to CFTC, securities to SEC.

More importantly, it removes the old restrictions of retailers. There is no more having to have the wealthy to obtain the requirements of the investor and the appropriate suitability.

Now, ordinary persons can join legally pre -honor and early offers.

To keep the projects responsible, the draft law provides decentralization test that requires the disclosure of any 10 %+code holders. In short, it is a new rules book – green light for Web3.

Michael Silor clearly sees what will happen. in World 2025 strategyHe suggested that Microsoft purchase Bitcoin instead of rebuilding his own shares, noting that $ BTC has already outperformed Microsoft shares over the past five years.

While the United States tends to encrypt, voices like Silor clarify the matter – it is time to pay attention. Not only the coins that deserve to be seen. Reading for the next three symbols can go equivalent under the dispensation of the new encryption.

1.

BTC Bull Token ($ BTCBLL) It is the first Mimco currency under the title Bitcoin that is equivalent to real bitcoin holders.

At only $ 0.0025 and withdrawn more than $ 5.3 million in the previous one, $ BTCBLL was designed to allow investors

Here is the way it works: every time the Bitcoin crosses the features of the main prostate – such as 125 thousand dollars, 175 thousand dollars, or 2255 thousand dollars – the distinctive BTC Bull code scores a symbolic burning to reduce supply and increase scarcity.

But more importantly, it rewards my holders with Real $ BTC and $ BTCBULL AIDROPS in major landmarks – such as $ 150,000, 200 thousand dollars, and $ 250,000 – if you buy and bear your codes in Best portfolio.

This distinctive symbol that works in MEM also targets the market gap.

Although Bitcoin dominates, almost no metal coins are associated with the performance of $ BTC. BTC Bull Token fills this space with elegance and strategy.

With the opening of the American list, the doors of Crypto retail investments, BTC Bull Token provides a rare opportunity to ride Bitcoin increase and collect bonuses along the way.

If Bitcoin is on its way to a million dollars – as Michael Sailor argues – $ BTCBLL aims to be the missile that takes meme investors for sale in the length of the trip.

2. Best Code Code (Best $)

The best wallet code (best) It is a metal currency that operates an encryption wallet from the next generation that shakes the current situation.

At a price of $ 0.024985 and after already raised more than $ 12 million in what is before, the best $ in one in one in one is designed to simplify the encryption trade for all, from buyers for the first time to the old WEB3 warriors.

Think about the best wallet like Metamask 2.0-only more elegant, faster and full of value added features. The portfolio includes “upcoming symbols”, a powerful tool that allows you to join new symbolic releases directly in the application, safely and without the danger of mirror sites.

By keeping the best $, you can open the reduced transactions fees, early access to new encryption projects, juice iGaming privileges such as free courses, operating marks, and higher bonuses.

protection? Closed, thanks to Fireblocks MPC-CMP Tech. For the first adopts, exclusive representation is available exclusively through Best wallet app.

Analysts are optimistic about the best dollar. With a rise of $ 2025 of $ 0.072, a long-term goal of $ 0.82 by 2030, the upscale trend can be huge-especially for those who buy the best dollar before reaching the stock exchanges.

With American organizers moving to legitimacy to encryption with bold new legislation, distinctive symbols such as $ are the best major assets for investors looking to take advantage of the next wave of adopting the encryption portfolio.

3.

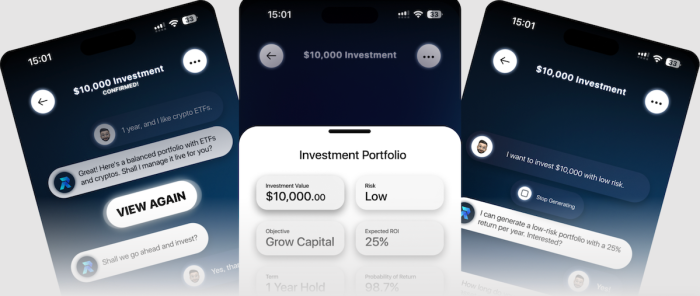

RCO Finance ($ RCOF) redefines decentralized financing by integrating artificial intelligence to make investment more intelligent, faster and easier.

Currently in the sixth preparatory stage, the price is $ 0.13, and has already raised $ 17.7 million.

At the core of the platform, there is an ROBO adviser who works for Amnesty International and creates dedicated investment strategies through encryption, traded investment funds, stocks and commodities.

This makes RCO Finance an ideal match for the new United States encryption project, which aims to cancel the barriers followed by retailers and allow smart investment tools for all.

$ RCOF also provides a full range of features, including Amnesty International Trading Deta, Experimental Trading, Instant Deposits, and Crushes – as well as an elegant interface directed towards both encrypted new arrivals and experienced professionals.

Smart nodes and No-Kyc on board the plane add an additional layer of safety and privacy.

With more than 285,000 users already on the trial version platform, it acquires a serious power.

Since the list shows the way to share retail, RCO Finance can be a bridge between artificial intelligence, Defi, and the next generation of the investors who have been enabled.

A new dawn for investors encryption

While the United States adopts a friendly organization for encryption and thought leaders such as Michael Saylor Champion Bitcoin, the perfect storm in the assembly.

For investors, projects such as BTC Bull Tokenand The best wallet iconRCO Finance provides new opportunities in an advanced scene quickly.

However, do not forget to do your own search (DYOR) before investing. This article is for media purposes only and does not constitute financial advice.

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.