Bitcoin warning signs? The long -term holders come out while the buyer is rushed

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

While Bitcoin (BTC) decreases from its highest level (ATH) of $ 111,814-which is currently circulating in the mid-100,000 dollar-data signals emerging on the series that may fade the coded currency momentum during the past month.

A deeper correction in front of bitcoin?

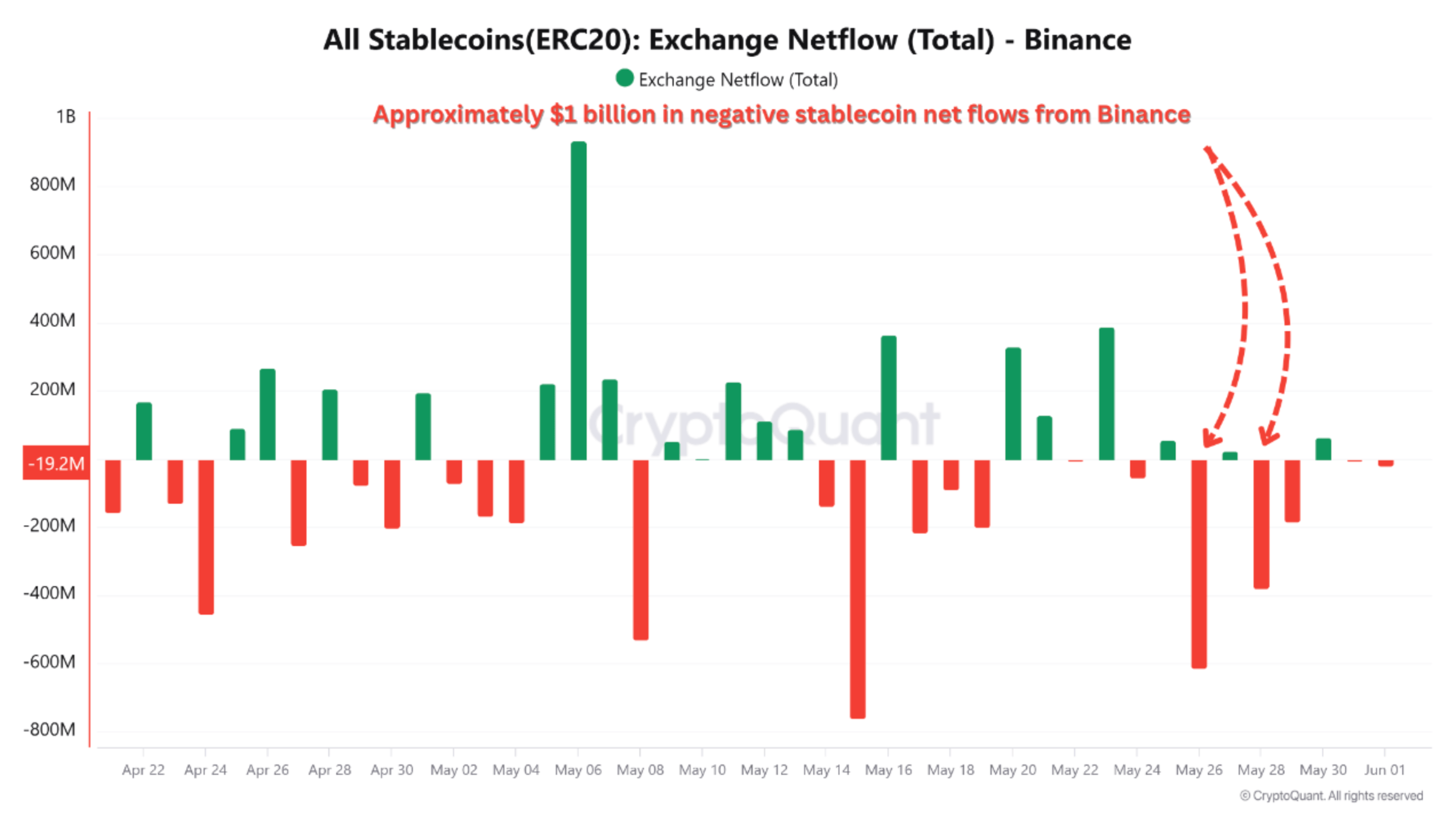

According to Cryptoquant Quicktake Post recently by the Amr Taha shareholder, the Bitcoin market is subject to many prominent transformations on the series. These external flows include large Stablecoin from Binance, a decrease in the participation of the long -term holder (LTH), and the accumulation patterns between the portfolio groups.

Related reading

One of the most striking indicators is the net flow of more than a billion dollars in Stablecoins from Binance. This indicates that merchants transfer money from the stock exchange and to private portfolios, and it is usually a sign of a decrease in risk appetite or the decrease in purchase of purchase in the near term.

Withdrawal processes often widely indicate a decrease in purchase power and can precede the loss of market momentum or a shift towards profit and caution. If this trend continues, BTC may slip more, which may lose the level of 100,000 dollars in a psychologically important terms.

In parallel, long -term holders (LTH) also declined. The pure position of the LTHS fell from $ 28 billion to only $ 2 billion by the end of May 2025 – indicating that these investors no longer increase their exposure despite the recent increase in prices.

Moreover, wallet behavior trends for 60 days indicate the difference in market morale. Their large owners of 1000 to 10,000 BTC have gradually cut their positions, while the smaller retail groups carrying 100 to 1000 BTC were accumulated strongly, and buying in the assembly. Taha commented:

A mixture of heavy stablecoin, low LTH accumulation, and the conversion of dust behaviors indicating a market that goes through a transitional stage. Whether this paves the stage for the cooling period, a healthy unification or renewed momentum will depend on how the new capital is inserted into the system and whether the retail buyer can maintain the current assembly without institutional reinforcement.

All hope is not lost

While the above data points indicate that prices are corrected on the horizon of the Apex digital assets, and other data on the series He appears BTC is likely to continue in its upward path, and perhaps on the new ATHS.

Related reading

Cryptoquant Crypto Dan recently High The Bitcoin (NRPL) profit/loss scale supports a continuous upward path, noting that current profit levels are modest compared to the peaks of the previous session.

In addition, BTC flow from central exchanges moreWith the last 7,883 BTC withdraw from Coinbase. This can indicate the renewal of institutional interests and accumulation in anticipation of another upward step. At the time of the press, BTC is trading at 103,854 dollars, a decrease of 0.2 % in the past 24 hours.

A distinctive image of Unsplash, plans from Cryptoquant and TradingView.com