Learn the reason for the revenue missed the expectations of analysts amounting to $ 2.1 billion

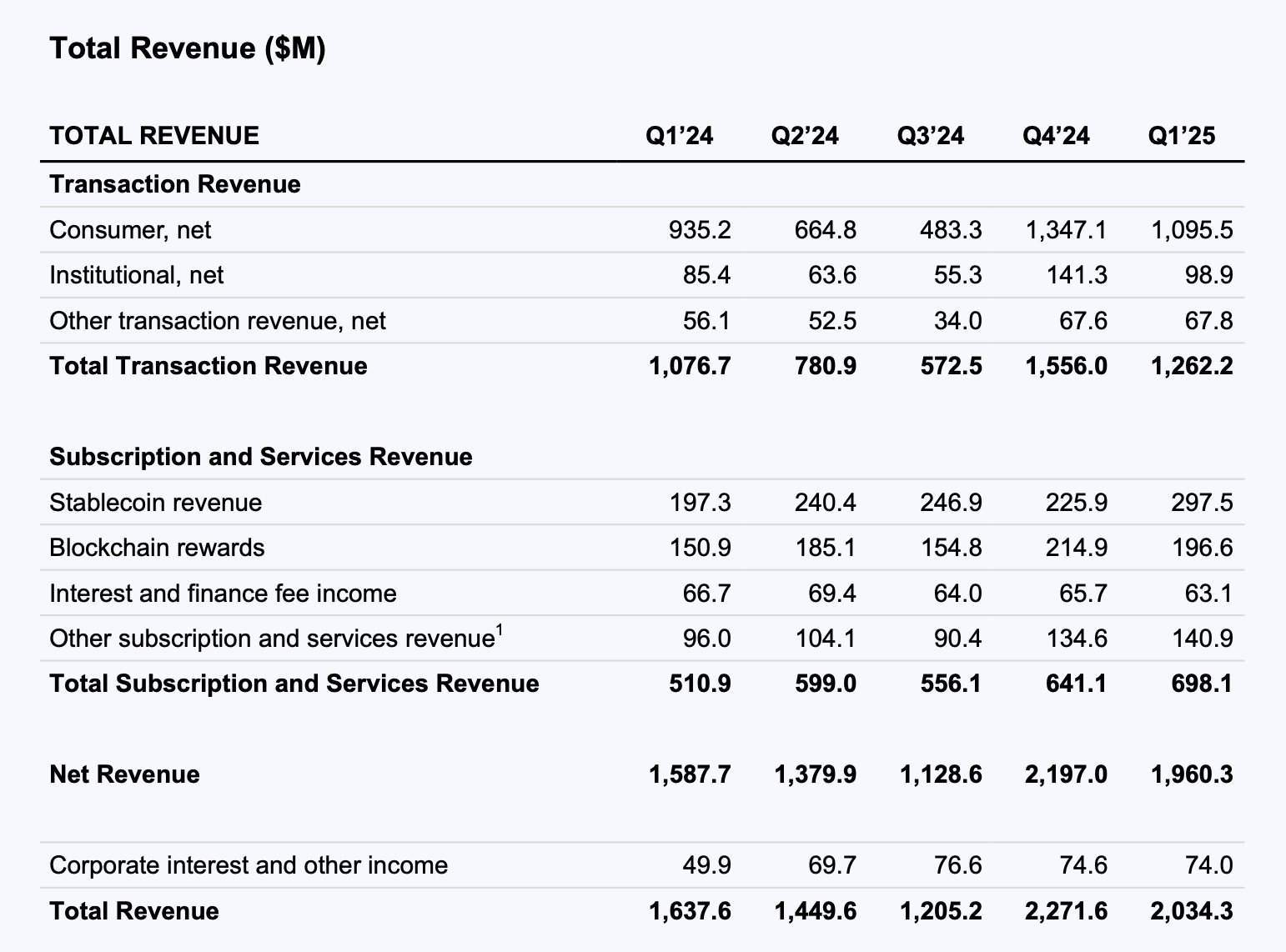

Coinbase Q1:- Crypto Excination Coinbase has released a quarterly report for Q1 2025. The total quarter revenues of $ 2.00 billion, the stock exchange witnessed an increase of 24 % on an annual basis.

However, on a quarter -quarter scale, revenues decreased by 10 %. Its revenues of transactions also decreased by 19 % Q/Q of $ 1.3 billion.

In general, the revenues were absent from the 2.1 billion dollars of Wall Street estimates. The subsequent disappointment in its stock on the Nasdaq-Loctecide (modified currency) was reflected in a decrease of about 4 %.

In the last quarter (Q4 2024), Coinbase defeated analysts’ revenue expectations by 22 %. I reported 2.27 billion dollars in revenues, an increase of 38 % on an annual basis.

Why did the revenues of the first quarter of the expectations of the analysts lost?

The Wall Street analysts expected Q1 2025’s Q1 2025 about $ 2.1 billion. They expected 28 % on year on an annual basis.

This estimate was driven by 1.39 billion dollars of transaction revenues and $ 702 million in subscription and services revenues.

According to the Coinbase Q1 report, the company announced the total economic uncertainty as a reason for a decrease.

This includes the shift in American trade policy and geopolitical tensions led by US President Donald Trump. These tensions, especially Trump’s tariff, served as a traction in market fluctuations and reduce consumer appetite for encryption trading.

This is already true. Bitcoin rose to the highest new level in January, but the gains proved that it did not advance shortly with the decrease in encryption prices alongside a wider market. By the end of the first quarter, the total maximum of the cryptocurrency market decreased by 19 % of the level of the end of the year, reaching 2.7 trillion dollars.

On this background, Coinbase’s Coinbase’s transaction revenues amounted to $ 1.3 billion – at 19 % of a quarter of a quarter.

The total immediate trading volume decreased by 10 % to 393.1 billion dollars, although this still exceeds the size of the global market by 13 % during the same period.

Interestingly, Stablecoin’s revenues increased by 9 % Q/Q, which reflects the increase in revenue from its partner and the StableCoin Assuer Circle USDC.

Also read: The encryption market in the first quarter

What is the next giant

In the second quarter of 2025, Coinbase expects the uncertainty in the macro, including the World Trade Policy, and continued to influence consumer morale.

This may contribute to the most soft encryption trading markets and reducing asset prices as the second quarter enter.

For Q2 2025, Coinbase expects to participate and services services from 600-680 million dollars and 215-315 million dollars in sales and marketing, including about $ 15 million in stock-based compensation.

According to Ryan Rasmussen, head of research at BitWise Invest, “Coinbase is a sleeping giant.” It highlights its hegemony as the guardian of the American Crypto ETF market with the most successful L2 network, base.

The WEB3 financing project that supports Coinbase Ventures-is making good progress.

Check the shareholders ’speech

Coinbase is a sleeping giant …

– A guardian of the US Cracking Market ETF

The most successful L2 (base)

Participation of profits with the circuit (USDC)

-Coinbase One subscriptions (Coinbase One)

Discrimination at the institutional level

– Deribit has been obtained to control the encryption … https://t.co/unnjthtmrcRasterlyrock May 9, 2025

The recent acquisition of Deribit to control encryption derivatives is an example of his dominant situation.

In the first quarter, she paid 803.6 billion dollars in the volume of global derivatives trading as it continues to develop its market share with the last acquisition.

Also read: Coinbase acquires deribit

Responsibility: The content may include the author’s personal opinion and subject to market conditions. Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.