JLR shock has decreased by 11 % of the highest in recent times

As of Tuesday morning, Tata Motors (NSE: Tatamotors) decreased to about $ 681 after losing about 11.5 % of the latest swing of $ 770. The decrease is a minimum profit for the 26th year of its excellent division, Jaguar Land Rover (JLR), which raised analysts and investors.

Tata Motors shares hit the JLR cutting a FY26 margin and directing the cash flow

Jaguar Land Rover reviewed her financial view of the 26th year, as she offered a decrease in operating margins to between 5 % and 7 %, compared to 8.5 % in the previous year. The company also expects the free cash flow to shrink significantly, from 1.5 billion pounds last year to nearly zero this year.

This is a sharp transformation of the most important business unit in Tata Motors, which contributed 71 % of the total revenue and more than 80 % of the total profits in the 25th fiscal year. While the average selling prices maintain a company more than 70,000 pounds, the company has not adhered to a clear time for recovery. The administration is now looking to improve the margins and generate money from the fiscal year 27 ascending.

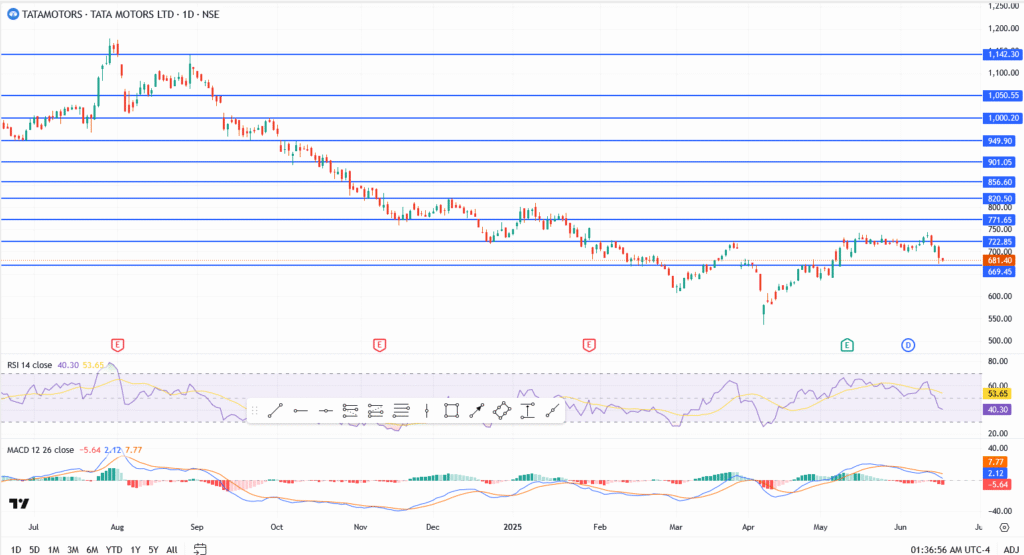

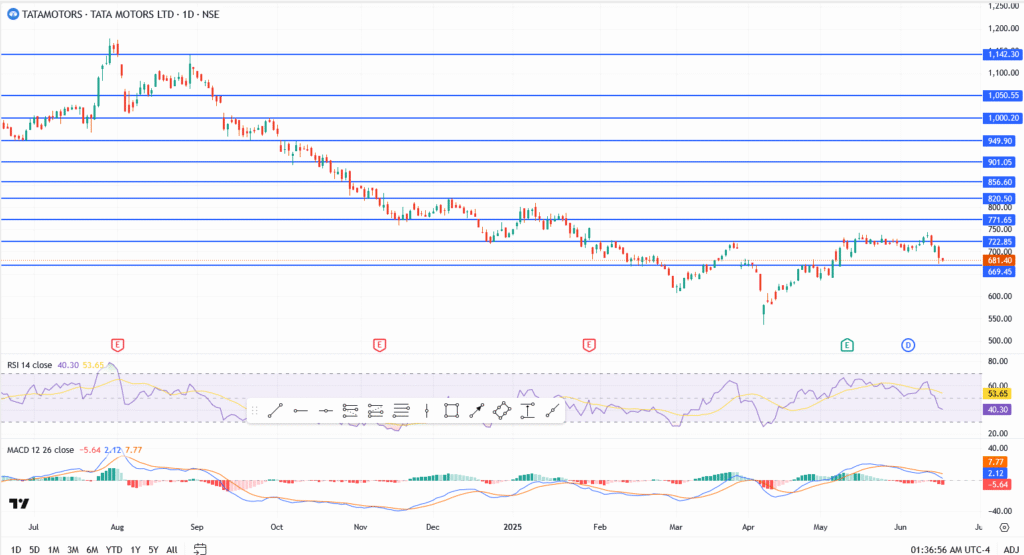

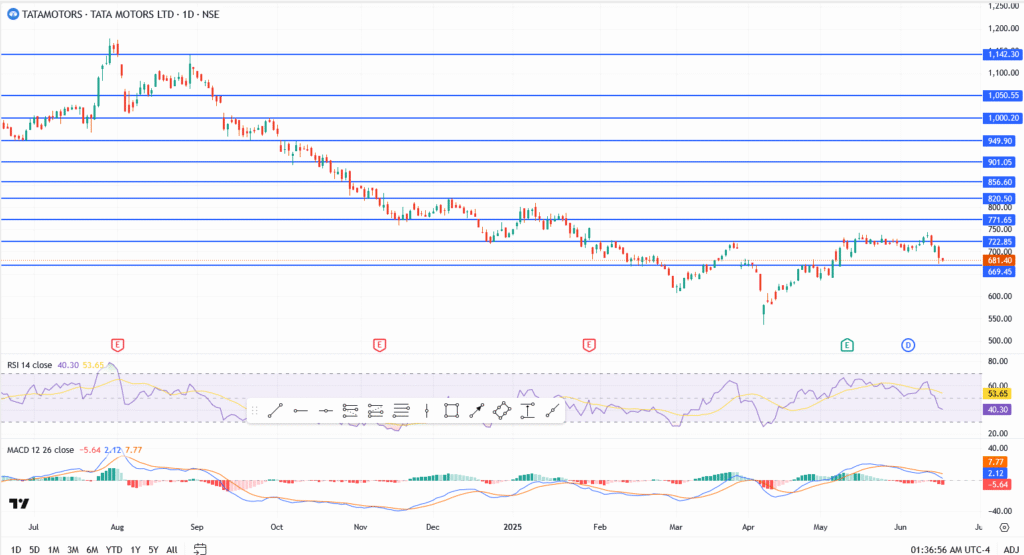

Tata Motors

- Current price: $ 681.40

- Resistance: $ 700 and $ 722

- Support areas: $ 669.45, then $ 640

What is the next for Tata Motors share?

This may be a sign of more decrease if the price of Tata Motors shares decreases to less than $ 669 this week. RSI and MACD momentum are still less, and the bulls have not defended $ 700 with condemnation yet.

The stock may remain under pressure in the near future unless JLR provides the market more powerful guidelines or new delivery victories. Investors currently respond to actual problems instead of just market noise. It will be important to monitor $ 669 as a major support.