5 I missed the red flags investors

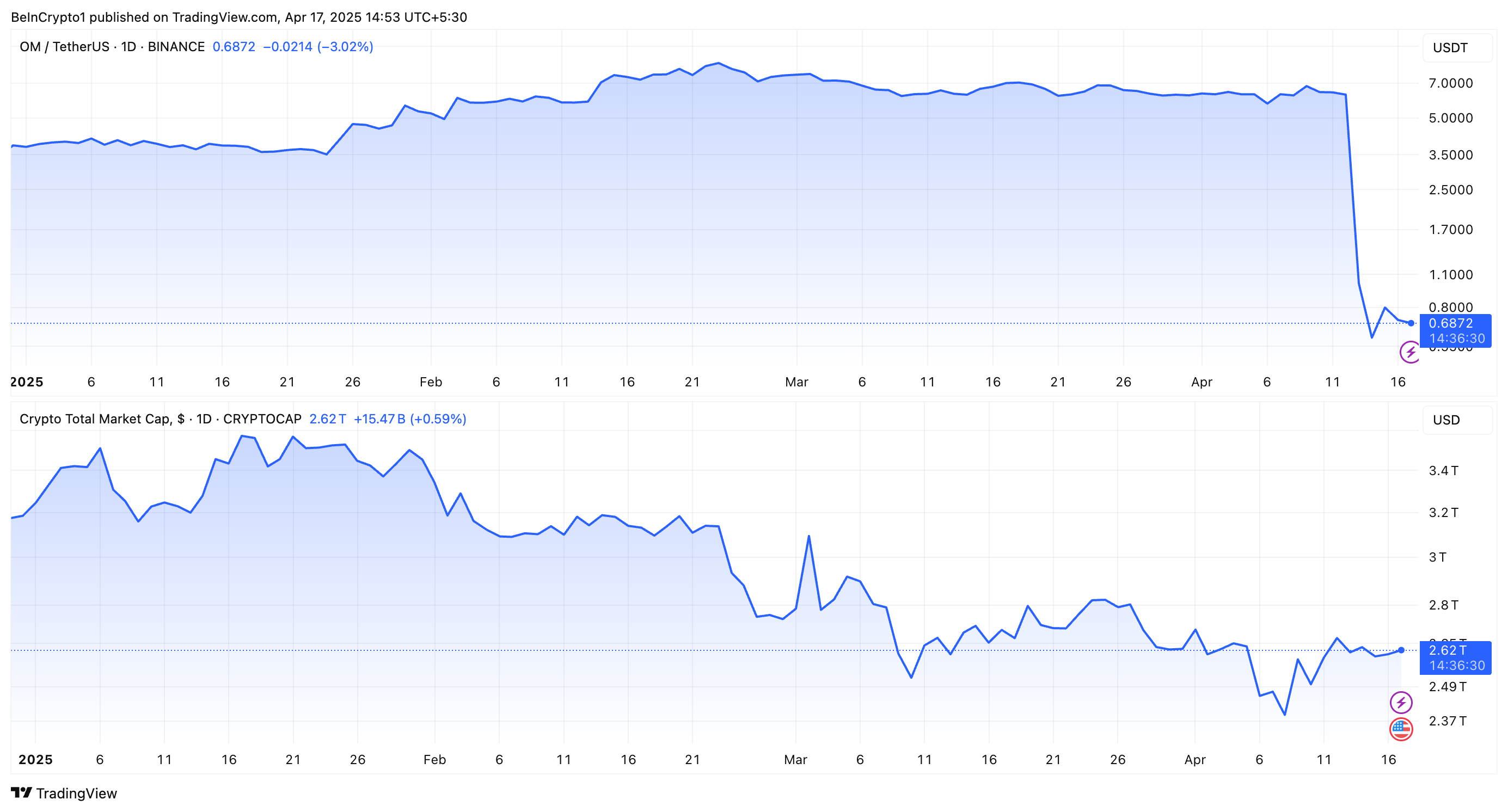

The collapse of the mantra symbol (om) has left investors to reel, as it faces many great losses. While analysts combed the causes of collapse, many questions remain.

Beincrypto experts have consulted industry experts to determine five critical red flags behind the fall of Mantra and detect strategies that investors can adopt to switch similar pitfalls in the future.

Talism (om) breaks: What investors have missed and how to avoid future losses

On April 13, beincrypto broke 90 % om destroying news. The collapse sparked many concerns, as investors accuse the pump and fragmentation planning team. Experts believe that there are many early signs of problems.

However, many ignored the risks associated with the project.

1.

In 2024, the team changed the distinguished symbol of OM after the community vote in October. The distinctive symbol from the ERC20 icon to the original Stoke L1 coin for the Mantra series.

In addition, the project adopted a symbolic model of inflation with an unexploited supply, to replace the previous steel cover. As part of this transition, the total supply of the distinctive symbol was increased to 1.7 billion.

However, this step was not without defects. According to the Rossis committees, co -founder of SMARDEX, Tokenomics was an anxious point in the collapse of om.

“The project doubled its symbolic supply to 1.77 billion in 2024 and moved to an inflationary model, which reduced its indigenous holders. It is preferred to be the most familiar with the informed, while the low -circulating supplies and the huge FDV fed and price treatment,” said Rausis Beincrypto.

Moreover, the team’s control over the offer also sparked central concerns. Experts believe this was also a factor that could have caused the alleged prices to manipulate.

“About 90 % of the om symbols have been kept by the team, indicating a high level of centralization that may lead to manipulation. The team also maintained control of governance, which led to the decentralized nature of the project,” said CORK’s co -founder.

Strategies to protect yourself

Phil Vogel has acknowledged that the supply of the distinctive concentrated symbol is not always a red sign. However, it is important for investors to know who holds large sums and conditions for their closure, and whether their participation is in line with the goals of decentralization in the project.

Moreover, Ming Wu, founder of RabbitX, argued that analyzing this data is necessary to detect any possible risks that can undermine the project in the long run.

“Tools like bubble maps can help deter potential risks related to the distribution of the distinctive symbol,” he advised Wu.

2.

The 2025 mark was placed as the year of large market fluctuations. The pressure of the wider macro economy was greatly affected on the market, as most coins offer sharp losses. However, the om prices were relatively stable until the last crash.

Jean -Rice revealed: “The largest red brand was simply the movement of the price.

He added that this was a clear sign of a possible problem or problem in the project. However, he pointed out that determining the discriminatory procedure in the price will require some technical analysis. Consequently, investors who lack knowledge would easily miss it.

Nevertheless, Rausis highlighted that even an unacceptable eye may find other signs that something might stop, which eventually led to the accident.

Strategies to protect yourself

While investors remained optimistic about om flexibility amid a shrinkage in the market, it ended with the cost of millions. Eric Ho, the LBANK community official, and a risk control advisor, stressed the importance of proactive risk management to avoid collapse similar to OM.

“First, diversification is essential-equal capital through projects can limit single exposure. Stopping catalysts (for example, 10-20 % over the purchase price) can lead to controlling damage to the volatile conditions,” Eric participated with Beincrypto.

Ming Wu had a similar perspective, focusing on the importance of avoiding excessive allocation of one symbol. The Executive Authority explained that the various investment strategy helps reduce risk and enhance the stability of the portfolio in general.

“Investors can use permanent future contracts as a risk management tool to hedge from potential low prices in their property,” Note Wu.

Meanwhile, Philo Vogel advised focus on the liquidity of the distinctive symbol. The main factors include the volume of float, the price sensitivity of sales orders, who can significantly affect the market.

3. The basics of the project

Experts also highlighted the major contradictions in TVL’s Mantra. Eric pointed out that there is a large gap between the fully diluted evaluation of the distinctive symbol (FDV) and TVL. FDV reached 9.5 billion dollars, while TVL was only $ 13 million, indicating a possible estimate.

“The evaluation of $ 9.5 billion for $ 13 million from TVL has been evaluated,” the screaming of instability. “

It is worth noting that many issues have also been raised regarding Airdrop. Jean Rossis called “chaos”. He referred to many issues, including delay, repeated changes in the rules of eligibility, and the abolition of eligibility for half of the participants. Meanwhile, suspected robots have not been removed.

“Airdrop preferred unpopularly with the exclusion of real supporters, reflecting the lack of fairness,” he repeated the Phil Vogel.

Criticism expanded more as Vogel referred to the alleged team associations with doubtful entities and relationships with questionable initial currency shows (ICOS), which raises doubts about the project’s credibility. Eric also suggested that the talisman was associated with gambling platforms in the past.

Strategies to protect yourself

Forest Bay stressed the importance of verifying the project’s accreditation data, reviewing the project road map, and monitoring the activity on the series to ensure transparency. Investors also advised to evaluate society’s participation and organizational compliance with the long -term feasibility measurement of the project.

Ming Woo also emphasized the feeding between real growth and artificially amplified.

“It is important to distinguish between real growth from the activity that is artificially amplified through incentives or weather drops, and irresponsible tactics such as” selling the dollar for 90 cents “may generate short -term measures but do not reflect actual participation.”

Finally, Wu recommended looking at the background of the project team members to reveal any date of fraudulent activity or participate in doubtful projects. This would ensure that investors are good knowledge before adhering to any project.

4. Pisces movements

As mentioned by Beincrypto earlier, before the collapse, it was reported that the whale portfolio was linked to a talisman team that deposited 3.9 million om icons on the OKX Stock Exchange. Experts highlighted that this was not an isolated accident.

“Large OM transfers (43.6 million symbols, about 227 million dollars) were for exchanges a few days before the large warnings of potential sales,” Forest Bay moved to Beincrypto.

Ming Wu also explained that investors should pay close attention to these major transfers, which often serve warning signals. Moreover, analysts at Cryptoquant also identified what investors should search for.

“OM’s transfer operations to stock exchanges amounted to 35 million dollars in just one hour. This represents an alert mark as follows: Transport to stock exchanges is less than $ 8 million in a typical hour (except for transfers to Binance, which is usually large given the exchange volume). Beincrypto.

Strategies to protect yourself

Cryptoquant reported that investors need to monitor the flows of any symbol in the stock exchanges, as it can indicate an increase in price fluctuations in the near future.

Meanwhile, IRIC Risk Advocate Adviser has identified four strategies to stay on a permanent knowledge when it comes to large transfers.

- ChainTools such as Arkham and Nansen allow investors to track large transfers and monitor wallet activity.

- Set alerts: Ethescan and Glassnode platforms notify investors with unusual market movements.

- Track exchange flowsUsers need to track large flows to a central exchange.

- Check the closure: Exalted dunes for investors helps determine whether the distinguished symbols of the team are released earlier than expected.

It also recommended focusing on the market structure.

“The depth of the market that has proven its collapse is not negotiable: Kaiko data showed the depth of the demand book by 1 % 74 % before the fall.

In addition, Phil Fogel emphasized the importance of monitoring platforms like X (previously Twitter) of any rumors or discussions about possible dumps. He stressed the need to analyze liquidity to assess whether the distinctive symbol can deal with the sale pressure without causing a significant decrease in prices.

5. Central exchange is involved

After the collapse, the CEO of Mantra JP Mullin was quickly blaming the central exchanges (CEXS). He said that the accident had led to a “reckless forced closure” during the hours of low hardness, claiming negligence or intentional location. However, Binance indicated the exchange of exchange.

Interestingly, experts are slightly divided on how CEXS contributed to om crash. Forest Bay claimed that CEX Qualifiers during the low -hard hours worsened by operating successive sales. Eric confirmed this feeling.

“CEX references have played a major role in om crash, as it was an accelerated. With kind liquidity – he was depth from $ 600,000 to $ 147,000 – consecutive closure operations performed. More than $ 74.7 million has been eliminated in 24 hours,” he said.

However, Ming Wu called the explanation of “Just an excuse.”

“An analysis of open interest in the OM Dermits market reveals that it was less than 0.1 % of the market value of OM. However, it is especially interesting that during the market collapse, the open interest in OM’s derivatives actually increased by 90 %,” Wu expressed Beincrypto.

According to the executive authority, this challenges the idea that liquidation or forced closure caused a decrease in prices. Instead, it indicates that merchants and investors have increased their short positions with a low price.

Strategies to protect yourself

While CEXS’s involvement is still discussed, experts are dealing with the main point for investor protection.

“Investors can reduce the leverage to avoid forced liquidation, choose transparent policies for risks, monitor open attention to the risk of filtering, and maintain symbols in the portfolios of self -needs to reduce CEX exposure,” Forest Bay recommended.

Eric also advised that investors must reduce risk by controlling the leverage based on fluctuations. If the tools such as ATR or Bollinger signal ranges, the exposure should be reduced.

It is also recommended to avoid trading during low hardness periods, such as UTC in the middle of the night, when the risk of slipping is higher.

The collapse of a talisman (om) is a strong reminder of the importance of due care and risk management in cryptocurrency investments. Investors can reduce the risk of causing similar traps by carefully evaluating the features, monitoring data on the chain, and diversifying investments.

With experts ’visions, these strategies will help direct investors towards more intelligent and safer decisions in the encryption market.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.