Ethereum Whales Empty 143,000 ETH in one week – more in the future?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

ETHEREUM is trading around the level of $ 1,600 after several days of failed attempts to restore high prices. Bulls show signs of life, but its momentum remains weak as the declining pressure continues to control the market. Although the recovery recovery lasts last week, the broader ETHEREUM structure still reflects a clear and clear direction.

Related reading

The encryption market remains under the shadow of the total economic uncertainty, as the ongoing tensions between the United States and China greatly provoke confidence in global financial morale. No decision or agreement has been announced between the economic giants, which leaves investors caution and risks.

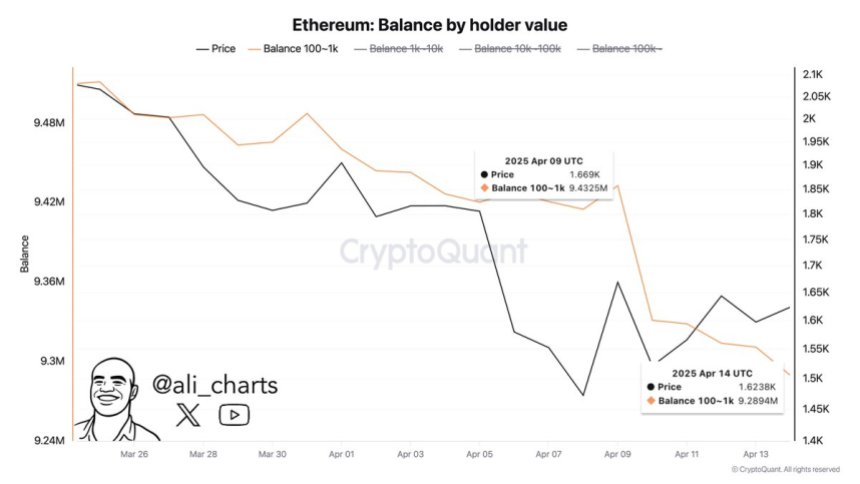

In addition to negative feelings, Cryptoquant data shows that Ethereum whales have emptied about 143,000 ETH during the past week. This distribution is widely enhanced by fears from the additional downside, as their holders choose in the long run and large portfolios reduce exposure instead of accumulation.

While some analysts still see the possibility of transformation if the main levels are reclaimed, the current market environment remains fragile. Unless Ethereum could restore and absorb short -term resistance levels, the threat of another leg is still very real. Traders are now watching the price procedures to get transformation signs – but for the time being, be careful in driving the road.

Ethereum faces pressure to sell with whales out

Ethereum faces a decisive test as there is no price work, and the support levels remain fragile. Despite the short attempts of the apostasy, the ETH failed to create a clear bottom, and the structure of the declining direction remains intact. It fights the market in order to determine a strong demand area, which makes it difficult for the bulls to maintain ascending momentum. Since the sale of pressure, analysts warn that Ethereum may continue to slip towards low demand levels in the absence of a strong purchase interest.

The wider macroeconomic conditions are still highly weighted on risk origins like Ethereum. Global trade tensions, especially the definition confrontation that has not been resolved between the United States and China, has caused uncertainty in the financial markets. In addition to fears of the slowdown in the global economy and the lack of coordinated financial support, the encryption markets remain under pressure.

In addition to the descending feelings, the best analyst Ali Martinez Share data on the series He revealed that the whales had emptied about 143,000 ETH during the past week. This distribution is widely led by influencers’ holders significantly weakened ETHEREUM expectations, enhancing fears that smart funds are preparing for a deeper side.

Since late December, ETH has been in a long -term direction, while fulfilling every attempt to recover through the renewal of sale. Unless bulls recover the main technical levels and market feelings, ETHEREUM may continue to slide more.

Related reading

ETH price stuck in the volatile term

ETHEREUM is currently trading at $ 1,600 after permanent days of massive fluctuations and ancient economics and certainty. Despite short heights, ETH is still closed in a declining structure, unable to generate continuous momentum. In order for bulls to regain control, restoring the resistance level is $ 1850. This level is in line with 4 hours 200 mA and EMA about $ 1,800, making it a major area to monitor the confirmation of a short -term reflection.

Keeping over these moving averages would indicate renewable power and may represent the beginning of the recovery gathering. However, the price continues to be under the struggle, and the failure to pay over these indicators will confirm the continuous weakness. In this case, ETHEREUM may re -test the level of $ 1500 or even a decrease in it in the event of intensification of the sale pressure.

Related reading

The current environment is formed by global tensions and uncertainty in macro, with no clear incentives to push out in either direction. As long as the ETH remains less than the average moving the key, the other leg risk to the bottom is still high. The bulls should quickly behave to turn the feelings and avoid a deeper correction towards the levels of demand for long -term.

Distinctive image from Dall-E, the tradingView graph