Intel 2023, 2025, 2030: Buy, sale, contract?

Intel (NASDAQ: INC) price was performed in the face in the hours on Thursday, after the chip maker published very weak results that endanger its profits. The shares were shattered by more than 10 % and settled at $ 27.17, which is the lowest level since January 4 this year. This decline saw that it erases some of the gains it achieved in the profit season.

Please note that this article was originally written on January 13 this year.

What is Intel?

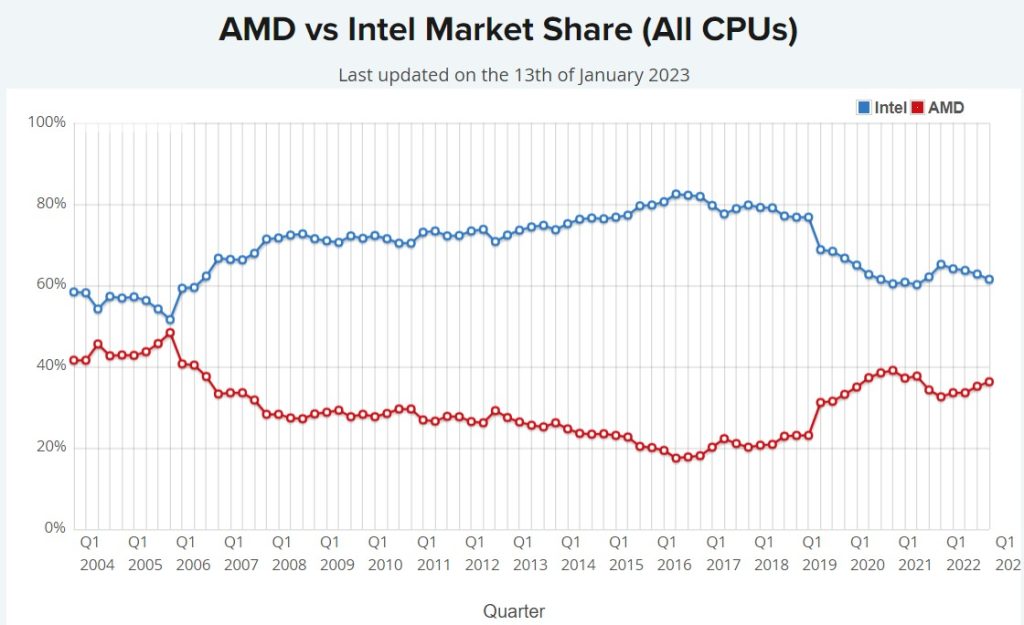

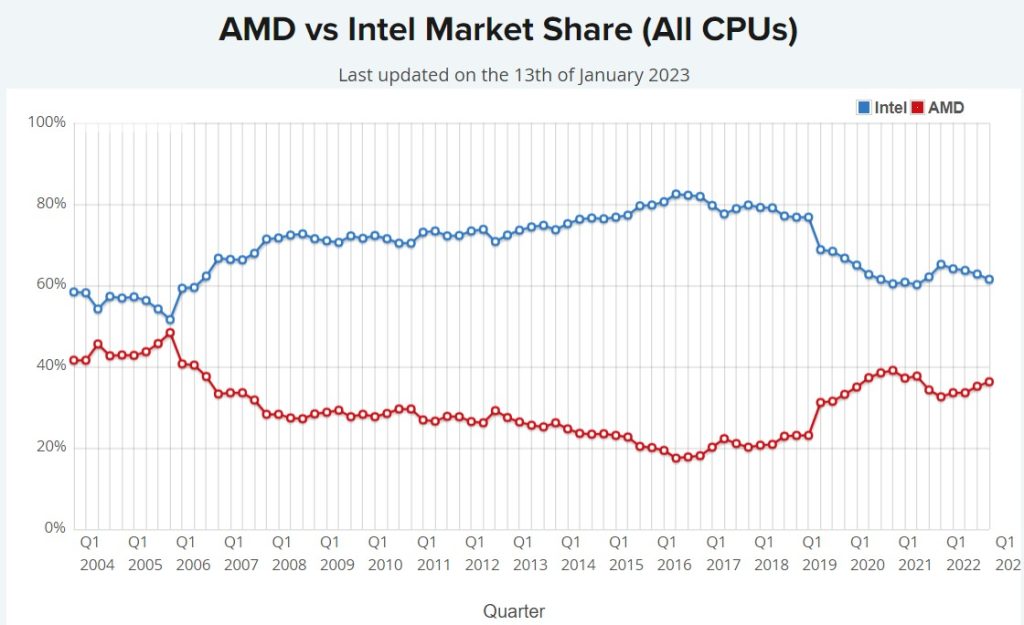

Intel is an American company that builds computer chips used in all industries. For a long time, the company got the largest share in the market in this industry, as companies such as HP, Dell, and Toshiba are available in their chips. However, recently, the company has witnessed that its market share is shrinking amid the increasing competition such as AMD and Nvidia. At the same time, companies like Apple and Microsoft build their chips internally.

Today, Intel provides its chips for companies in most industries. For example, OEMS still like Dell and HP buy Intel products. Likewise, companies in sectors such as cars, industrial and cloud computing use Intel chips in different ways. Intel has a large share in the market in the computing industries for institutions such as data centers.

The latest Intel news

There have been many Intel and Semipeductor news in the past few weeks. First, Taiwan has published semiconductors, the largest semiconductor manufacturer, mixed results. Its revenues for the fourth quarter increased by 19 % year on year to $ 19.3 billion. The company announced plans to reduce its spending in 2023 with weakening the demand for chips.

Second, the Intel shares reaction was moderate to reduce Bank of America analyst with a decrease in computers sales in 2023. The demand for computers was relatively weak in the past few months after it witnessed record growth during the epidemic. according to IDCThe volume of computers sales will decrease by 5.6 % in 2023 to more than 281 million units. This is a bad sign for Intel and other chips stocks.

Third, Intel recently launched a new processor selling it for $ 699. Core 19-13900ks is the first 6 GHz 320W CPU.

Finally, the most important Intel news was the profits of the company. The company’s revenues, which amount to 14 billion dollars, lost the expectations of the lost analysts badly, and decreased by more than 28 % of the same period in 2022. All parts of its business, including databases, weakened during the quarter.

Why the Intel share price declined

There are several reasons for the collapse of the Intel share in 2022. As mentioned above, PSacrifices c Strong downward direction In the past few months with high inflation. Moreover, computers buyers have already purchased their computers during the epidemic, which means they are still new.

Second, investors are concerned about Intel’s spending. Intel announced that it would do Investment $ 100 billion in Ohio. It also announced that it would spend $ 36 billion to make chips in Europe. The price of these investments of 136 billion dollars is much larger than the total maximum market for the company.

Third, the Intel share price decreased due to the increasing stocks between the chips companies. With the deterioration of the chain of supply chain in early 2022, companies strengthened their production. Unfortunately, this strong improvement came at a time when the demand was cooling. Moreover, like other companies, Intel shares have declined due to the correct Federal Reserve.

What is Intel’s profits?

Intel was loved for her profits, although some investors were concerned about their safety. It has 4.89 % profit revenue, which is larger than the S&P 500 average. Its annual profits are $ 1.46. The company has a 50 % profit payment rate, which means that it can handle the money belonging to investors.

Intel has constantly grown its profits in the past eight years. However, with the company’s presence in the loss area, there is an increasing risk of distributing profits in the coming years.

Intel revenues and public budget

Intel works at a difficult time with high competition. The company’s revenues increased from $ 62 billion in 2016 to more than 79 billion dollars in 2021. However, Intel’s revenues in the past four four billion dollars were only 69 billion dollars. The net Intel income was everywhere. It moved from 9.6 billion dollars in 2017 to more than $ 21 billion in 2019. It made a clear profit of $ 13.3 billion in the past four quarters.

Intel has a strong public budget with more than $ 22 billion in cash and short -term investments. The value of its assets is about $ 174 billion. However, the company has a mountain of debt. Its total debts in the long term are about 37 billion dollars. It does not have short -term loans.

Is Intel a good investment?

Some investors believe that Intel is a good share for purchase. Moreover, the company has a strong public budget and is a major player in industries that are witnessing rapid growth. Other investors believe that the company is a permanent backwards facing significant erosion in the market like AMD. As shown below, AMD gap with Intel.

Intel VS AMD: What is the best chip stock for 2023?

Intel evaluation

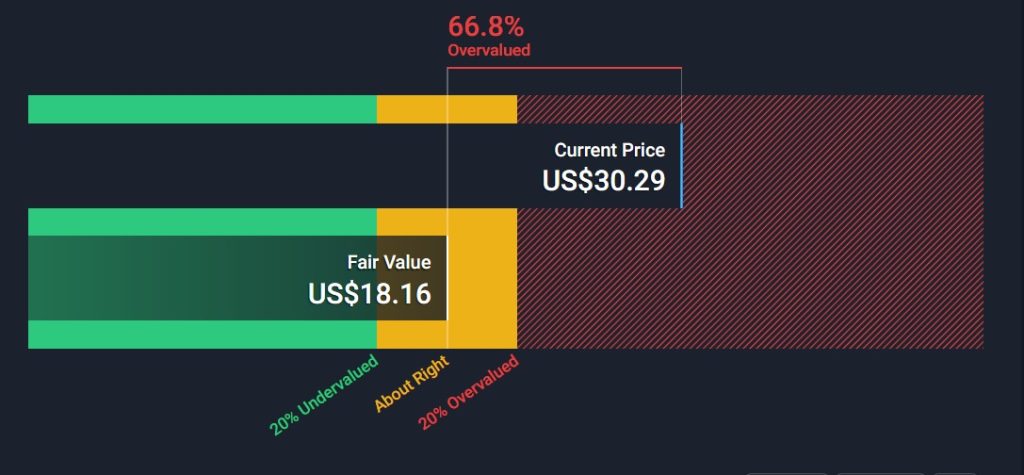

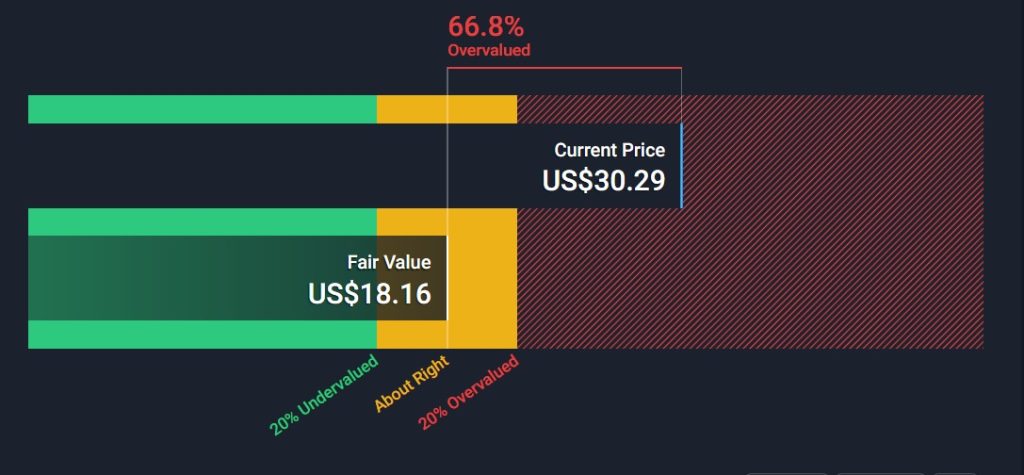

Intel has a market roof of more than $ 123 billion. It has an extra PE ratio of 9.38, which is less than S&P 500. PE ratio for one year is 15.50, which is also less than major peer companies such as AMD and NVIDIA. Therefore, based on PE complications, the company is relatively cheap. But cheap is often expensive because Intel lacks clear stimuli.

On the other hand, the DCF account shows that Intel is exaggerated. According to Simply Wall ST, the company must be traded at $ 18, which is less than $ 30.

Intel arrows expectations

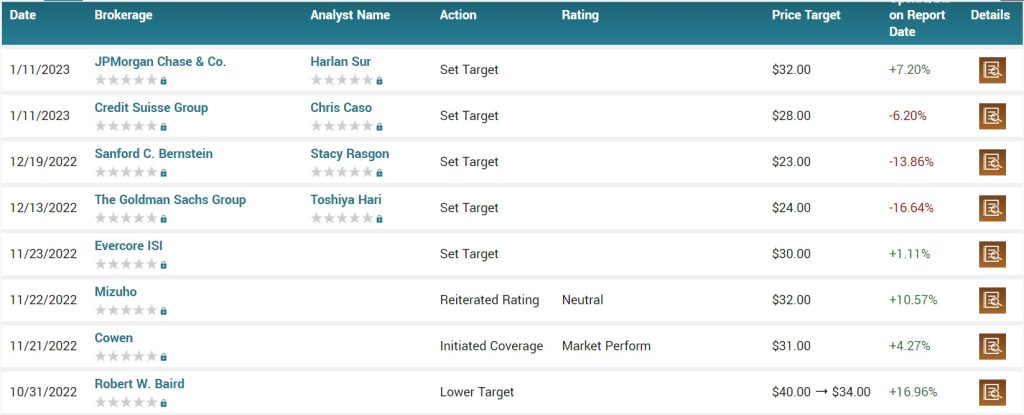

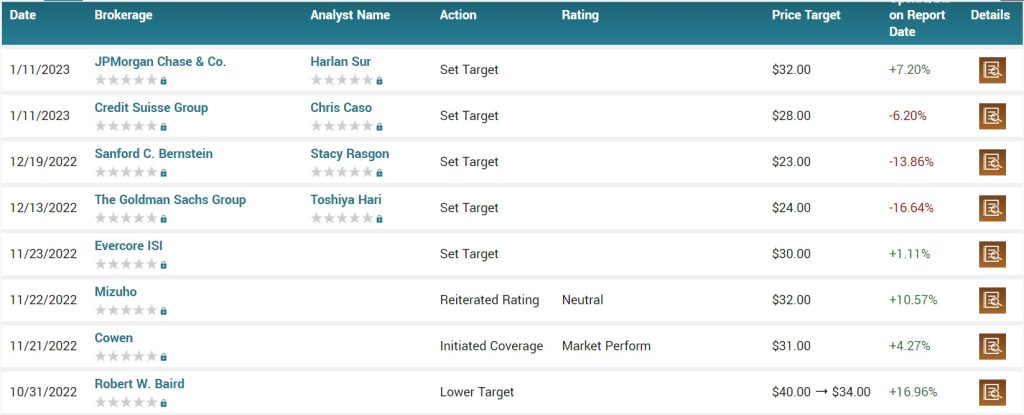

Analysts have a moderate look at the InTC share price. Harlan Sur of Jp Morgan has a goal of $ 32, the place where the arrow is located. On the other side, Analysts In Credit Suisse, Bernstein and Goldman Sachs have targets less than $ 30 as shown below. In total, the average goal per share is about 32 dollars, which means that there is no bullish direction for the share.

Intel 2023 share price expectations

The daily graph shows that the price of the intc share was in a declining direction in the past few months. Recently, it settled as the stock market has achieved a slow recovery. However, these weak profits are likely to reduce the classification of analysts and the transformation of the tone by investors and analysts.

Therefore, I think the stock will continue to decline in the coming months and reduce the psychological level of $ 20.

Intel 2025 share price expectations

It is difficult to predict the place of the Intel share in 2025. To do this prediction, we can use the weekly graph. In it, we see that Intel has been in general in general in the past few years. During this period, the arrow remained less than all moving averages. It is less than the important support level at $ 43.27, which is the neckline for the double style that consists between 2020 and 2021.

Therefore, the most likely scenario is where the arrow rises to $ 43 in the next few years and then resumes the declining direction. This is known as Break and Retest Pattern. As such, I think INTEL will be between $ 30 and $ 40 by 2025.

Intel 2030 share price expectations

It is difficult to predict the existence of the Intel share in 2030. Besides, the past three years have shown us how difficult a long -term prediction is. However, given the monthly graph indicates that the moving averages of 100 and 50 months are about to make a declining cross. This means that Intel can be in the pain by 2030. In this period, the arrow is likely to be less than $ 20.

Is Intel purchase, contract or sale?

As mentioned above, I think INTEL faces great challenges in the future with high competition and geopolitical tensions. As such, while I expect shares to recover modestly in 2023, the long -term expectations of the company are declining.