Bitcoin at a crossroads: 97,000 dollars based on cost

Bitcoin prices have returned to above $ 105,000 within the past 24 hours after a sharp drop in prices on Thursday caused by macroeconomic pressure. It is worth noting that US President Donald Trump and former political ally Elon Musk have been involved in a general disagreement that has already increased in the encryption market.

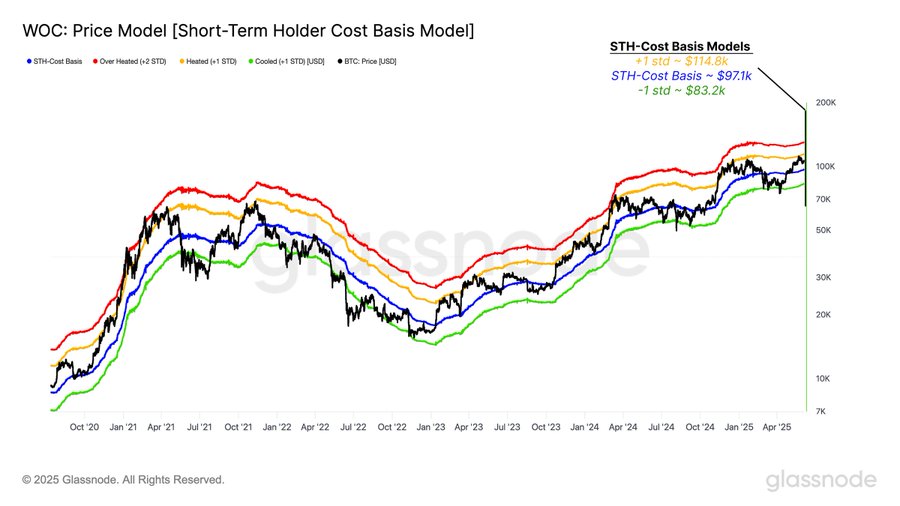

In the midst of a level of renewed stability in the last two days, the famous Glassnode company has now shared an important analysis of the series that highlights the main price levels currently in the Bitcoin Market.

Bitcoin is ready for Breakout as levels of $ 114,000 and 83 thousand dollars

in X post On June 7, Glassnode provides an insight into the potential bitcoin prices using the short -term holder standing model (STH), derived from the cost cost framework (WOC). As the name suggests, the basis for the STH cost is the average price of purchases for all coins that belong to their owners in the short term, that is, investors who have received Bitcoin over the past 155 days.

The basis for STH is an important scale in the market because it reflects the appetite of the risks for the new participants in the market who are usually the most interactive in changing prices. It is also a strong indication of market morale with the ability to work as resistance or support depending on the price direction.

According to Glassnode data, the current Bitcoin STH cost is estimated at $ 97,100. Using the standard deviation deviation in this WOC model, Glassnode also select the price level of $ 114,800 as a level +1std of this cost and the market that is likely to be heated.

Given the price of Bitcoin, the price area of $ 114,800 is the next main resistance, a lounge above which is expected to lead to a huge purchase pressure and pay the excellent cryptocurrency to an unavailable area.

The WOC model of Glassnode also determines the -1std level at $ 83,200 to represent the critical support zone in the current upper budget. The decisive price has decreased to less than this level that would indicate the market weakness, and it is likely to cause a series of qualifiers and correct more prices.

Bitcoin price overview

At the time of writing this report, Bitcoin is trading $ 105,745, which reflects a 1.07 % profit in the past 24 hours. Meanwhile, the daily trading volume decreased by 34.27 % and a value of $ 38.66 billion. Provided that Bitcoin continues to unify the highest cost STH at 97100 dollars, there is a good opportunity to bullish in the market towards the resistance at 114,800 dollars.

However, the loss of decisive support at $ 97,100 would indicate a re -test at $ 8,200 which carry strong consequences.