Does it have an area of $ 250,000 in bitcoin this year? This research manager believes that

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Tom Lee, head of Fundstrat Research, says, says Bitcoin It can reach $ 250,000 by the end of 2025. According to an interview on the Squawk box in CNBC today, Lee indicated that Bitcoin recently decreased from its highest level ever of $ 111,970 to about $ 104,000. He still believes that the market wanders around this level.

Related reading

A look at me for the short term

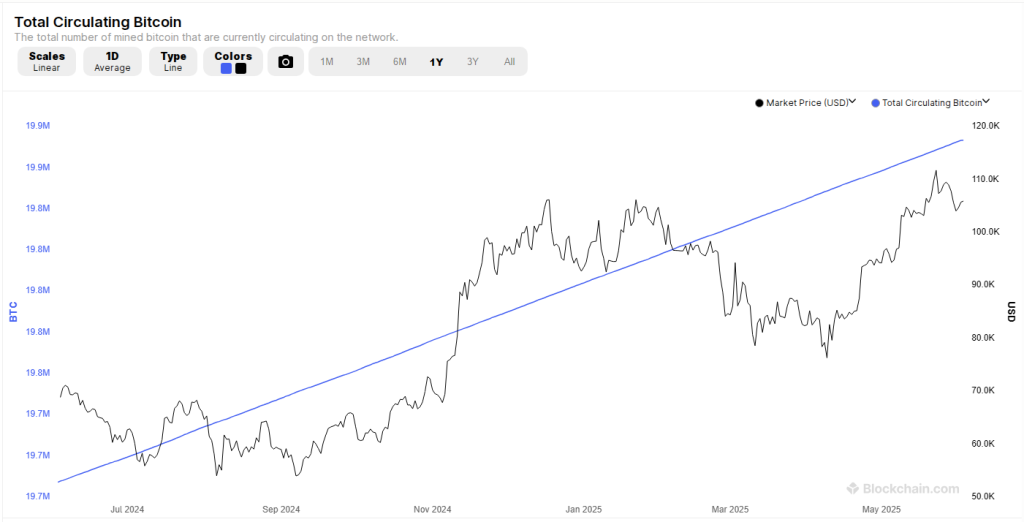

Squawk Box Joe Kernen told me that 95 % of all Bitcoin – 19.80 million coins – were already extracted from 21 million. This leaves approximately 1.13 million coins pending their production. He sees this narrow Preparing the offer.

He also indicated that although almost all Bitcoin coin is, 95 % of the world’s population does not have anything. Based on reports, this gap between the supply and potential buyers can push the high prices in the coming months.

To reach $ 250,000 from about 104,000 dollars now, Bitcoin will need to jump about 140 %. Lee still believes that it can reach $ 150,000 by December, and can extend between $ 200,000 to $ 250,000 if the demand for demand increases.

Offer and demand gap

I highlight the fact that most people in the world did not buy any bitcoin. He said this creates a defect. On one side you have almost fixed supplies. On the other hand, there may be millions of new buyers in the next ten years. He explained that even if part of these people decide to buy bitcoin, the price may move much higher.

https://www.youtube.com/watch?

Currently, there are still only about 5 % of all coins. This means that the new show slows down quickly. At the same time, more portfolios, applications and easy purchase methods may bring new money. It is believed that this mismatch is a large part of the reason why bitcoin continues to climb.

Long -term evaluation objectives

When asked about the peripheral value of Bitcoin – which is related to its price when all coins are extracted by 2140 – he told me that he is expected to match the maximum gold market of about $ 23 trillion. This amounts to at least $ 1.15 million per bitcoin if there are 20 million coins circulating.

He chose 20 million instead of 21 million because the assumed losses (lost keys, forgotten portfolios) means that each currency will not be spent at all. He went further, saying that he saw a bitcoin space to reach two million dollars or $ 3 million for the coin. This would put the average “bull issue” at $ 2.5 million, which is nearly 2,300 % over the levels of the day.

Related reading

Other analysts’ expectations

The head of the Fanf Digital Asset Research, Matthew Segel, also has long -term prediction. Based on what Signl told investors, Vaneck believes that Bitcoin reaches $ 3 million by 2050. This is expected to line up with the idea of Lee about Bitcoin matching or even overcoming gold over time. Both calls assume steady growth in demand, as well as the wider use by large institutions such as hedge funds or pension plans.

Distinctive image from Gemini, the tradingvief chart