The price of the liquid decreases by 11 % after the controversy of male manipulation

The price of HyperLELILIKUID, which is currently $ 14.43, has decreased by 11.1 % over the past 24 hours after the failure of Jelly Memecoin, who forced Dex HyperivRiber to delete the meme.

The Distinguished symbol of the male symbol did not showcase the weaknesses in the Hyperlelibly system, but also sparked sharp criticism of personalities such as Bitget CEO and Blockchain Sleute Zachxbt, which decentralized blood morals in a microscope.

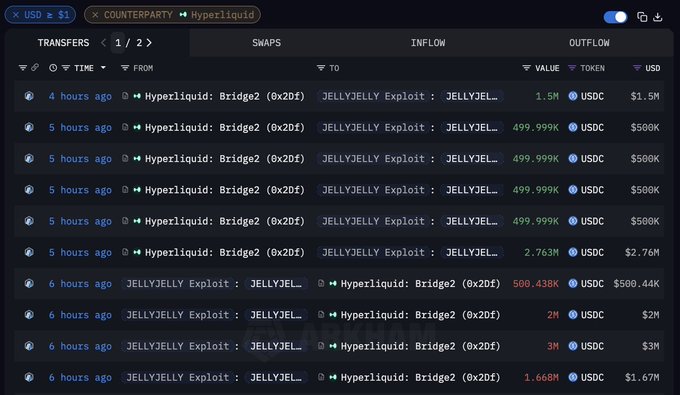

With excessive fluid to treat repercussions, the price of the distinctive symbol of noise continues, with large USDC flows indicating loss of confidence between users.

How to disintegrate gel tampering at the liquid height

The problem started when the excessive liquid whale, which is now called excessive liquid gel “exploitation”, “exploited”, Declaration of 7.167 million dollars on 3 separate excess accounts within 5 minutes From each other and then made the trained deals on Jelly Mimikoen.

Then the trader removed the margin guarantees needed to maintain positions, which led to the automatic automatic liquidation mechanism in the liquid.

This cunning step turned the burden on Vauult Hyperiquid Guid, putting the theater for the next theater for the exploiter.

As the trap prepared, the whale began to buy gel symbols strongly on the instant market, as the price of Jelly Geely sent about 500 %.

This sudden rise in a series of references caused the hyperlook vulnerable to the risk of losing $ 12 million.

To increase profits to the maximum, excessive liquid gel opened “exploitation” – using a second wallet – a huge long location, as it reached 8.2 million dollars as the price of the gel reached its climax.

However, Hyperleiid was quickly in behavior, as the exploit hunted on his paths.

The exploiter is now facing a million dollar losses, according to the arrows, which he cannot withdraw at the present time

In total, the exploiters deposited from 7.17 million dollars to 3 optical accounts and withdrawing $ 6.26 million, with a balance of about 900 thousand dollars on the height of the liquid through two accounts that were currently unable to withdraw. Assuming that he is able to withdraw this at some point in the future, his actions are at the height of the liquid

Analysts estimate that if the roof of the generation market rose to $ 150 million, Hyperlequid Dex could have faced insults.

The manipulation was a master’s blow to exploitation, as the platform leverage system and the distinctive symbol dynamics targeted the low lady.

A controversial controversial meter

In response to an esophaid dex, hyperliquid dex acted.

The platform audit group held a meeting of emergency and voted to the future factors of permanent jelly, which led to the closure of all related positions by force.

The auditors also reset the Jelly Jelly price to $ 0.0095 and filter 392 million gels, converting a possible disaster into $ 703,000 for the platform.

In addition, hyperliquid promised to pay the affected users, with the exception of those associated with manipulation, while the excessive basis for mitigating the losses interfered.

However, this rapid intervention came at a cost on the reputation of liquid height.

The CEO of Bitget, Grace Chen, dismantled the platform’s actions as “immoral” and “central”, on the pretext that the re -carcle price undermines excessive decentralization claims.

Chen warned that the height of the liquid had risked to become “FTX 2.0″, ” A sharp reprimand by the co -founder of Bitmex Arthur Hayes.

#Herliquid It may be on the right path to become #FTX 2.0. The way I dealt with Jelly $ The accident was immature, immoral, and unprofessional, which led to the losses of users and serious doubts about his integrity. Although he presented itself as an innovative decentralized exchange with a

Blockchain Zachxbt investigator accumulated, highlighting the contradictions in the Hyperleliquid governance.

Zachxbt noted that while the platform interfered in the Jelly Meecoin crisis, it had previously defended the deficit during greater incidents, which led to doubt its commitment to decentralization.

The CEO of Hyperleberber, Jeff Yan, who has once criticized Bitget because of the unethical practices, faced the bitter paradox now as his platform has charged similar accusations.

Critics also referred to the Small Audit group at HyperleliQuid, only two groups of four health, as evidence of central control, on the blatant contrast with networks such as Ethereum or Solana.

After the criticism that erupted how Hyperliquid responded to the catastrophe, the incident of the gel symbol turned from a financial exploitation to a referendum on the basic principles of events.

Market shock waves and the repercussions of the distinctive symbol of noise

The financial repercussions of Jelly Mimikoin’s interests were severely achieved.

The price of the liquid increased by approximately 11.1 %, as the total closed platform value decreased from 283 million dollars to 190 million dollars.

Within hours of liquidation of gel, Dex Hyperleliquid has seen more than $ 340 million in USDC external flowsA clear sign of the confidence of the investor shaking.

The decline in the distinctive symbol of the noise reflects the deepest market uncomfortable about the stability of Hyperleleliquid with the continuation of the gel gel gel jelly bite of manipulation.

The post -liquid price decreases by 11 % after the appearance of the controversy of gelatinous manipulation first on Invezz