Nakamoto Holdings and KidlyMd merged with $ 710 million to form a BTC locker

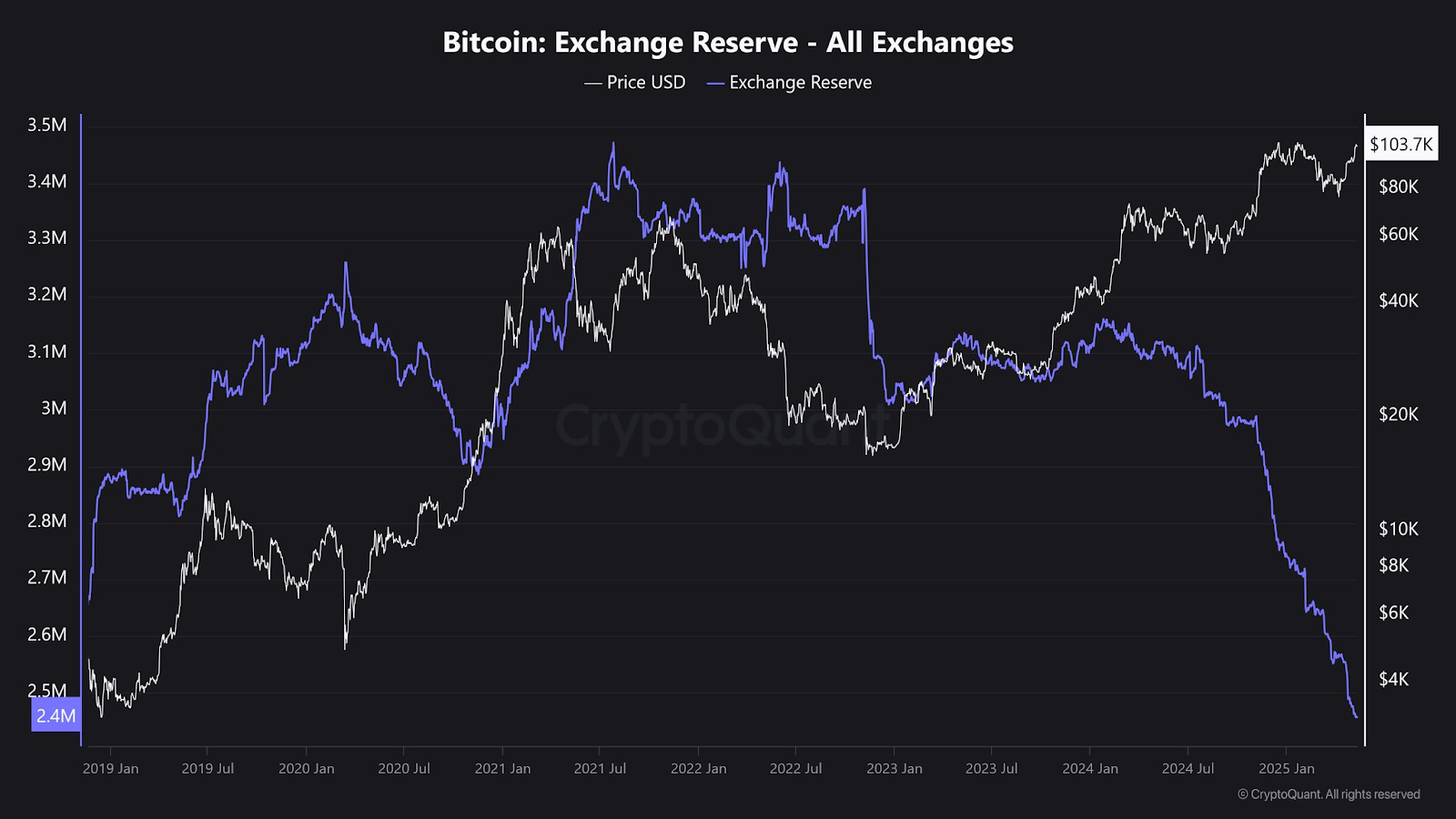

- Bitcoin supply has decreased on the central stock exchanges significantly in the past few years.

- Technical analysis indicates the emergence of an equivalent group in BTC prices in the next few months.

Bitcoin (BTC) has registered a significant cash flow in the past two years, most of them institutional investors. The greater demand will increase with the focus on national countries, led by El Salvador and the United States, on Bitcoin to face their debts and inflation.

According to data analysis on the series of Cryptoquant, Bitcoin supplies have decreased on the central stock exchanges by nearly one million to 2.4 million in the past two years. With the total Bitcoin supplies that were installed at 21 million, while long -term holders continue to accumulate strongly, it is clear that the shock of the offer is imminent.

Nakamoto Holdings and KidlyMd focus on Bitcoin

Earlier on Monday, Bidilymd, INC. announced. (NASDAQ: KDLY), a founding provider of integrated health care services, on a final integration with Nakamoto Holdings from David Bailey to form a bitcoin wardrobe that has been circulated publicly.

According to the announcement, the newly formed company received a total of $ 710 million to buy bitcoin coins for its wardrobe. As a result, the new company will join 193 other entities, led by the strategy and metaplanet, which currently owns more than 3.3 million BTCs in the cabinet.

“Nakamoto’s vision is to bring Bitcoin to the center of the global capital markets, filling them in stocks, debts, favorite stocks, and new hybrid structures that every investor can understand and own. Our mission is simple: listed these tools on every major stock exchange in the world”, Bailey, founder and CEO of Nakamoto, male.

BTC price enters a rewarding stage

In the four -year Bitcoin courses, it is clear that the price of BTC, against the US dollar, has started the joyful stage in the 2025 bull race. Given the theory of decreasing returns, the bitcoin price is in a good position to reach between 250 thousand dollars and 350 thousand dollars before the end of this year.

From the point of view of technical analysis, the monthly relative strength index of Bitcoin (RSI) tends to reach about 90 percent at the height of each macro bull cycle. Moreover, the monthly MACD line of Bitcoin is still higher than the signal line and zero line amid the upward upward graphs, indicating high cash flows.