NIFTY 50 slides less than 24,700 while Sensex drowns

The markets were not in a tolerant mood on Wednesday. NIFTY 50 gave up the ground to close less than 24,700, while Sensex threw more than 645 points, and today ends in the red color. The damage was widely, as Largecaps achieved great success while weakening the spirits of global risks and kept uncertainty in local policy on the edge of the abyss.

Indusind was a rare bright point, which was able to break the trend with 2 % profit. But for most sectors, it was a red sea.

NIFTY 50 Outlook Outlook: Resistance, Pressing Presse

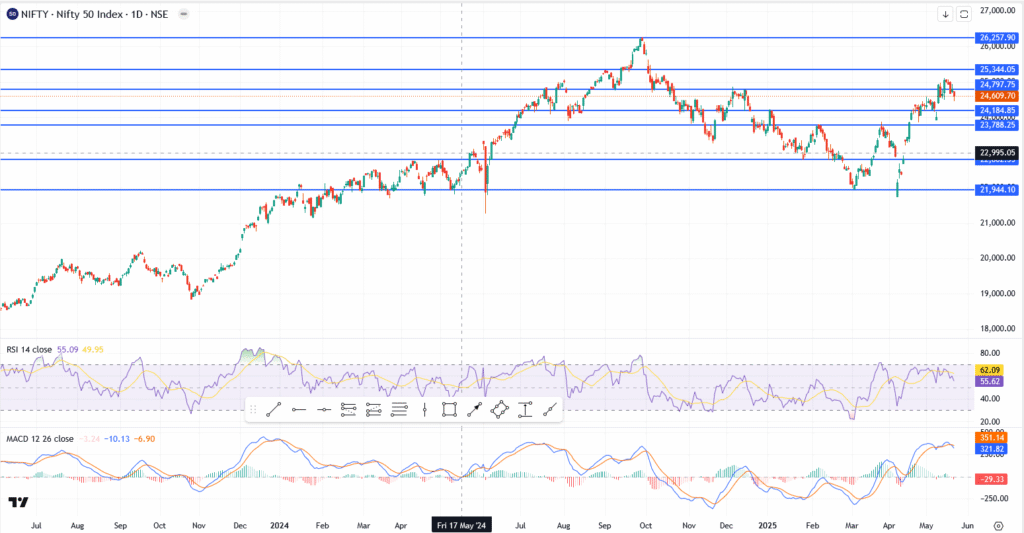

From a technical point of view, today’s step was not just noise, but rather a refusal. Nifty tried to stick to more than 24,797, but the sellers appeared directly on a braid.

- The price was closed at 24,609.70, and it decreased from the upper supply area at 25344

- RSI has been reduced to 55.09, a sign that buying momentum runs out of steam

- MACD loses the shape, with the graphic drawing to red and the intersection in playing

- The main short support is now on 24,184, followed by a more stable base of about 23,788

- If the bulls do not recover 24,800 soon, the door opens for a deeper step

The market did not disrupt, but the structure began to fluctuate. The bulls need to act quickly or support for more negative aspect.

NIFTY and Sensex find: destroy the reasons behind the market chip

It seems that many topics have decreased the market today, nothing enormously, but they assembled.

- Global sermon has turned over overnight, especially after the future of the United States decreased due to renewable inflation concerns. Traders are preparing to reduce fewer discounts in the federal reserve.

- Political fog has not been wiped. In India, concerns related to organizational deterioration and forward directions in the main sectors such as infrastructure and PSU banks add weight.

- Then there is a profit. After a strong gathering of the lowest levels of March, traders seem ready to lock.

It is the type of sale that does not scream with panic, but it is also not considered an easy recovery.

See too

Market feelings: Watch 24,184 and political pulse

This withdrawal does not change the medium -term direction, but it turns the tone in the short term. If 24,184 fails, the markets can escalate about 23,700 or less, especially with the election results and main macro data, just around the corner.

At this stage, confidence had erupted, and it was not broken. But if the volatility and the high political noise, investors may start asking the most obvious signals of both policymakers and central banks.

Currently, the message is simple: buyers are careful, and the plans turn brittle.