Bitcoin 7,883 BTC Outflow sees from Coinbase

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

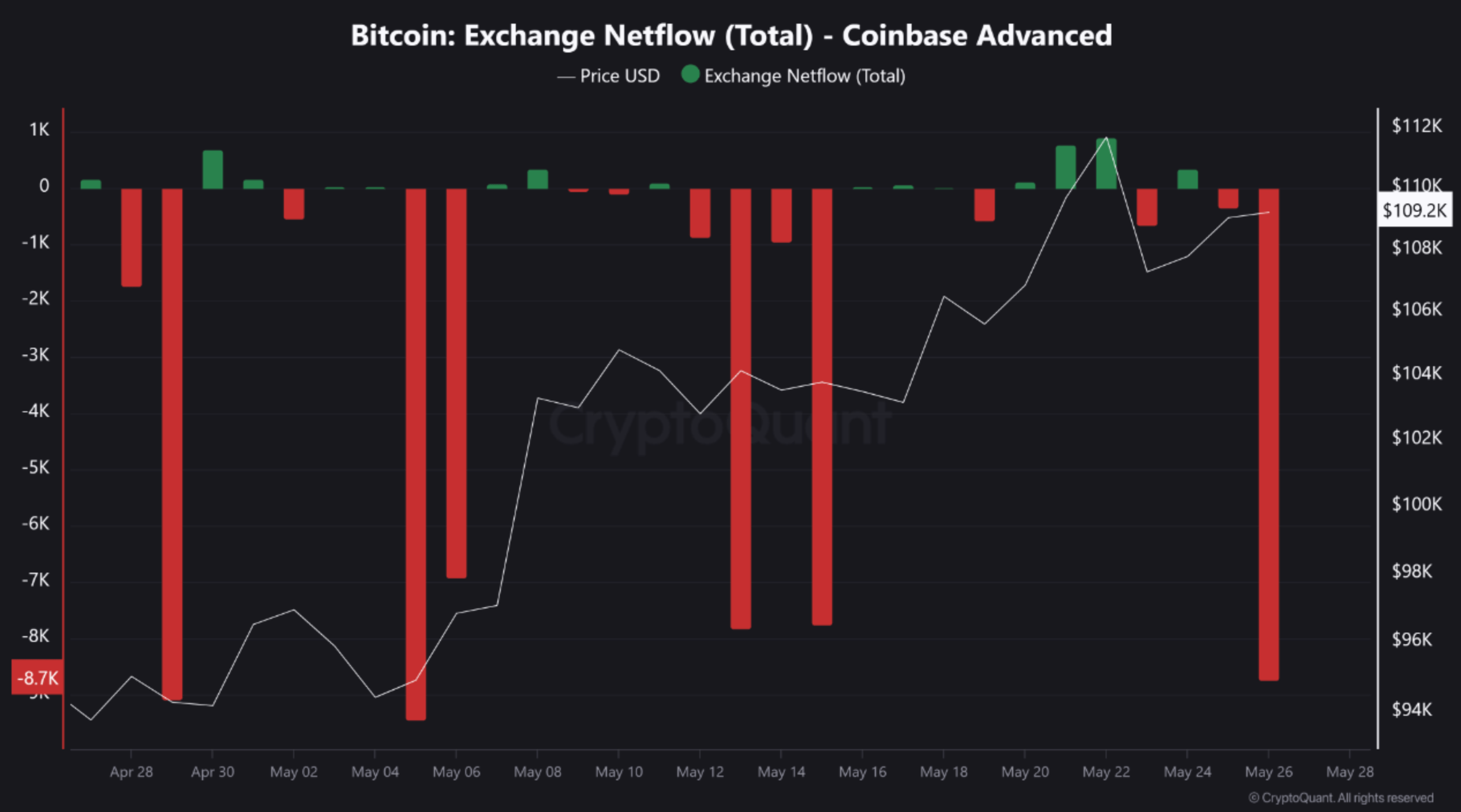

As Bitcoin (BTC) continues to trade near its highest level (ATH) of $ 111,980, the activity indicates that the main encryption exchange indicates that institutional investors may play their BTC holdings. It is worth noting that Coinbase- the leading stock exchange in the United States-has recorded a net flow of 7,883 BTC, which led to speculation about renewed institutional demand and a possible continuation of the gathering.

Coinbase 7,883 sees Bitcoin flow

According to Cryptoquant Quicktake Post recently by Brukkemeci shareholder, Coinbase saw a daily flow of 8,742 BTC on May 26. After the BTC deposits account, the net external flow reached 7,883 BTC- on the occasion of the third largest flow in one day of the stock exchange last month.

For a non -consumer, the daily flow of BTC refers to the total amount of bitcoin drawn from the stock market within one day, while the net flow is the difference between BTC withdrawn and deposited – which indicates the pure movement of the money. Positive pure flow means more BTC leaving the exchange more than input, and often the accumulation of signal.

Related reading

Historically, Coinbase external flows often follow institutional ads or instant Bitcoin exchange boxes (ETF). Since all investment funds circulated in the immediate Bitcoin listed in the United States-with the exception of Fidelity’s- BTC source from Coinbase, the scale of this deal indicates an ETF potential participation or the acquisition of companies.

One of the potential candidates is the strategy, led by Michael Silor. The company recently Detected Buy 7,390 BTC, raising its total possession to 576,230 BTC. Silor also has Glimpse In another large acquisition, although only time will determine whether the last Coinbase flows are connected to the company.

The support of this institutional narration is the Coinbase Premium, which has been constantly positive over the past month. This scale reflects the pressure of more powerful purchase than investors in the United States, and is often associated with institutional demand. The analyst concluded:

These external flows reflect the continuous demand of US -based institutions. If this appetite persists, you may lay the foundation for another leg in the price of bitcoin. Especially when ETF flows fed, such movements can lead to severe interruption periods and the highest new levels.

BTC ATH New soon?

At the time of this report, Bitcoin is traded at $ 109,589, that is, only 1.9 % less than its highest level ever. However, multiple indicators indicate the chain and technology that BTC can soon break into an unknown area.

Related reading

Cryptoquant recently male This bitcoin may target a mark of $ 112,000 after forming a double bottom pattern on the watch chart. Meanwhile, CVD Bitcoin Spot Taker (DeTa Delta) Turn Return to positive, which indicates the bullish momentum.

Moreover, standards appear on the series that my bearer Do not hurry For sale, even while sitting on large, not achieved gains, indicating faith in more prices. At the time of the press, BTC is trading at 109,589 dollars, a decrease of 0.3 % in the past 24 hours.

A distinctive image of Unsplash, plans from Cryptoquant and TradingView.com