How DEFI surpassed CEFI to recover encryption lending

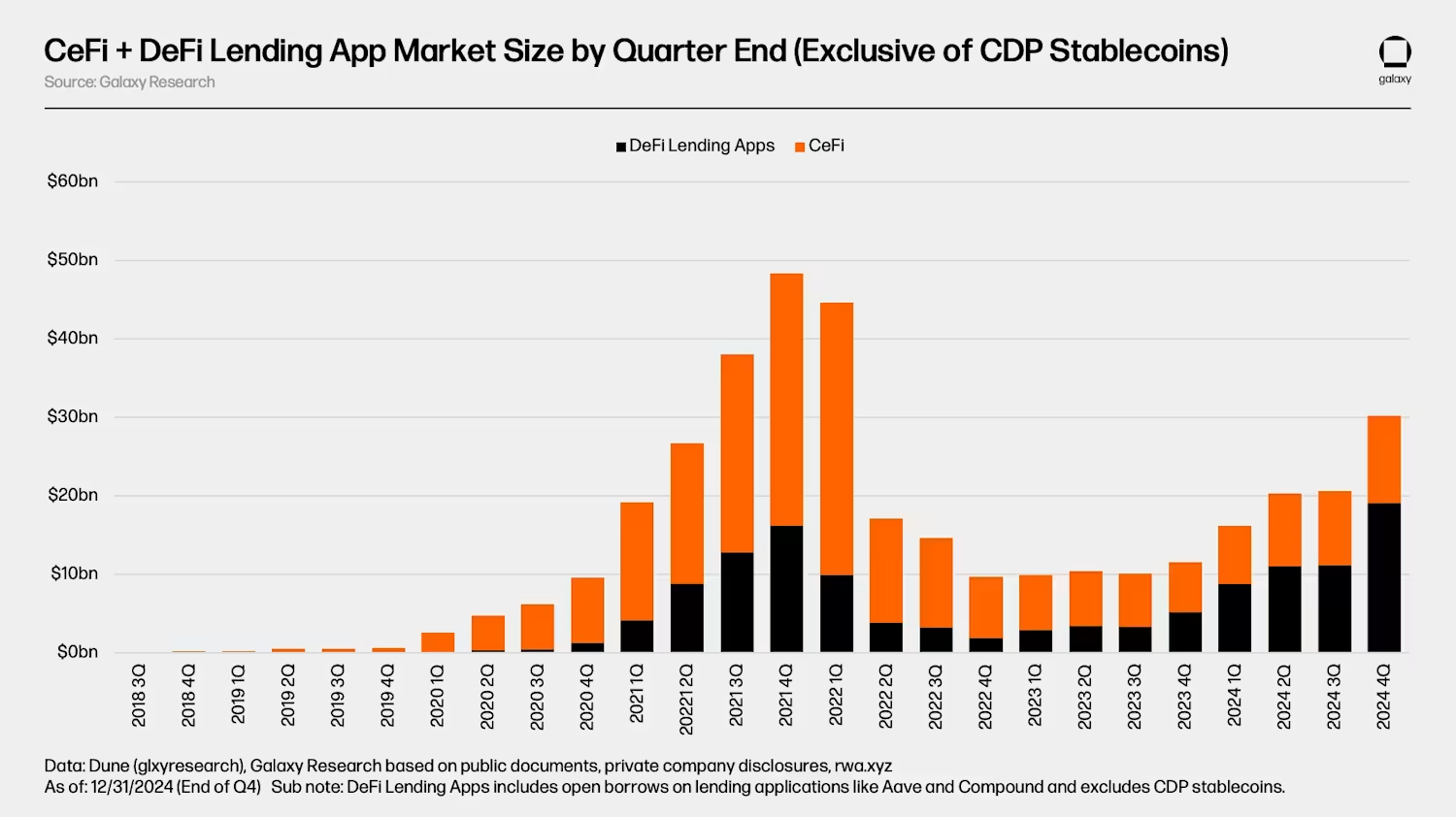

The coding lending market displays the signs of life again. Central financing platforms (CEFI) and decentralized financing (Defi) witness a return, with the last leadership.

This height follows a devastating collapse that witnessed major players such as Celsius, Genesis and Blockfi Grumble. Let this investors reel and strike confidence in the sector.

According to a recent report issued by the Galaxy Digital, the total size of the CEFI borrowed was suspended as of Q4 2024 $ 11.2 billion. This is 73 % increase from its lowest level in the bear market when it reached $ 6.4 billion.

Despite this positive growth, the CEFI lending market is still much lower than its previous highest levels.

“This is largely due to the lack of recovery in CEFI lending after the 2022 bear market and destroying the largest lenders and borrowers in the market,” as stated in the report.

The total market volume decreased by 68 % of its peak of $ 34.8 billion. The collapse of the main lending platforms is the primary factor behind this sharp decline, which has led to a significant loss of confidence and a decrease in return in loan sizes.

It is worth noting that the recovery in CEFI lending is also characterized by the unification of the market share. The first three lenders-Tether, Galaxy, and LEDN-89 % of the market as of Q4 2024. Previously, in 2022, there were three lenders at the time, including Genesis, Blockfi, and CELSIUS, 75 % of the market share.

Together, these players lead the CEFI recovery, although they are facing increasing competition from the Defi protocols. Galaxy Digital confirmed that Defi lending has seen a much stronger recovery. In running bull from 2020 to 2021, only Defi lending applications formed 34 % of the market. However, by Q4 2024, it represented 63 %.

“Most CEFI companies have not offers returning products to US customers since 2022. Defi platforms often do not comply with these regulations and do not require KYC, which may be a factor.” to publish.

Growth is also evident by the fact that the DEFI borrowing has reached a new peak, by 18 % of the peak of the previous rising market. Defi lending applications such as AAVE (AAVE) and the compound (Comp) survived the bear market without collapse, and benefit from its decentralized nature and strong risk management. In fact, Defi lending increased to 959 % of quarter 4 2022 to Q4 2024.

“AAVE and Compound have witnessed a strong growth from the bottom of the bear market of $ 1.8 billion of open borrowers. There was $ 19.1 billion in open borrowers via 20 requests for lending and 12 blocks at the conclusion of Q4 2024,” Galaxy.

The rise has significantly contributed to the overall improvement in the encryption lending market. With the exception of CDP Stablecoins, the Crypto lending market has seen a rating of 214 % of Q4 2022 to Q4 2024.

“The total market has expanded to $ 30.2 billion, most of which are driven by the DEFI LENDING application,” the report indicated.

With the continued stability of Cefi Linding under the control of some big players, Defi platforms appeared as real leaders in recovery. Its decentralization and treatment provides permission is a strong basis for growth in the market that still recovers from the previous turmoil. Despite the challenges, it has witnessed great growth, while highlighting the elasticity of the coding area in the face of adversity.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.