Hit Coinbase with a collective lawsuit after breaking the data

Cryptocurrency Exchang Coinbase is the subject of a newly submitted collective lawsuit. The lawsuit accuses the company and senior executives, including CEO, Brian Armstrong and financial manager Alicia Haas, of delaying the disclosure of the main data breach that includes misconduct from the inside and a failure to reveal serious organizational violations in the company’s operations in the United Kingdom.

It is claimed that Coinbase’s lack of transparency about these incidents led to major financial losses to the shareholders and seeks to compensate for the inconsistent damage.

Coinbase faces a lawsuit after the share price decreases

Investor Brady Nisler filed the lawsuit at the US District Court of the Eastern Region in Pennsylvania. The lawsuit is the shareholders who bought Coinbase shares (currency) between April 14, 2021 and May 14, 2025.

The complaint claims that Coinbase has hidden cash information about data breach. Beincrypto previously stated that Coinbase faced a $ 20 million extortion attempt by Internet criminals who stole sensitive customer data, including names, addresses and identity details. The criminals broke the support of support agents abroad to steal this data.

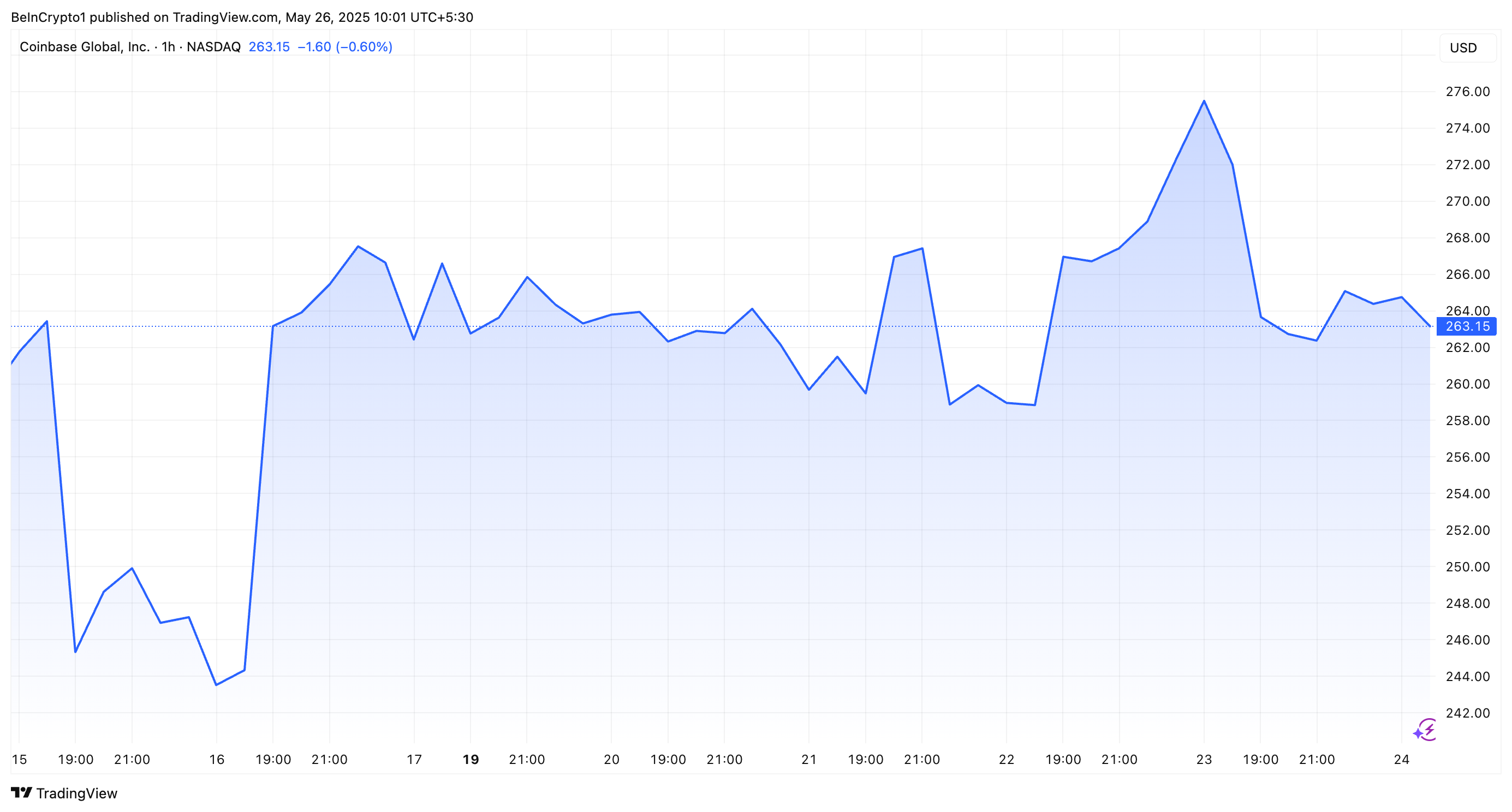

However, the company confirmed that the breach affected “less than 1 %” of its active monthly users. According to court documents, the breach, which was discovered months ago, was not discovered until May 15, 2025, after an attempt to blackmail. Because of this revelation, the currency decreased by 7.2 %, closed at $ 244 on the same day.

“As a result of the actions of the illegal defendants and negligence, and the prevailing decrease in the market value of the company’s common shares, the plaintiff and other members of the group offer great losses and damage,” Claim.

The lawsuit also highlights another incident that negatively affected stock prices. On July 25, 2024, the UK’s Financial Conduct (FCA) was publicly fined, CB Payments Ltd.

FCA revealed that CBL allowed 13,416 users of great risk to reach its services, allowing approximately $ 226 million of encryption transactions despite its explicit restriction. The lawsuit argues that Coinbase’s failure to reveal these regulatory issues has misled investors about the company’s operational safety.

“In this news, the price of Coinbase’s shared shares decreased by $ 13.52 per share, or 5.52 %, to close at $ 231.52 on July 25, 2024,” I read the lawsuit.

The prosecutor is now requesting a certificate of dismissal and seeking financial compensation, payment of legal fees, and the trial of the jury. Coinbase has not yet released a public statement on Nesler’s suit.

Meanwhile, Coin managed to recover slightly from its lowest level on May 15. However, Yahoo financing Data It showed that on May 23, Coinbase 3.23 % of its value was shared when the market is closed. This translates into a decrease of $ 8.79, which leads to a decrease in the share price to $ 263.1.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.