Higher encryption price expectations: Brarachain, XRP, Ethfi and PI network

The encryption market was fixed on Wednesday morning, when the fear and greed index rose to 75 years. Bitcoin kept stabilizing above 104,000 dollars, while Ethereum jumped over $ 2600. This article provides some higher encryption price expectations such as berachain (BERA), XRP, Ether Finance (Ethfi) and PI Network (PI).

Peruchane prices analysis

The price of berachain wore even after the network continued to face major challenges. For example, the total closed value (TVL) on the berachain network decreased by 40 % at the last 30 days to more than $ 3.37 billion. The stablecoin market ceiling lasted, as it moved from an increase of $ 1.34 billion in March to less than $ 300 million.

The eight -hour graph shows that the price of BERA had reached $ 2.68 earlier this month, then rose by 77 % to $ 4.75. The important resistance crossed at $ 3.87, the highest swing on April 25. Then re -support the support at $ 3.8, break and re -reinstall, and a common continuity mark.

The price of Bera on the graph for eight hours reached $ 2.68 earlier this month before it increased by 77 % to $ 4.75. The main resistance level exceeded $ 3.87, which was the highest point on April 25. Next, the price was returned to the $ 3.8 support test, which is a break and re -often referring to the continuation of the upward trend.

The price of the BERA has moved higher than the moving average 50 periods and hovers at the RECTING level 23.6 % Fibonacci. Therefore, the symbol is likely to continue to standardize, after which it will return to the 50 % decline point at $ 5.95. The decrease without support at $ 3.7 will nullify the upcoming expectations.

Ethics prices analysis

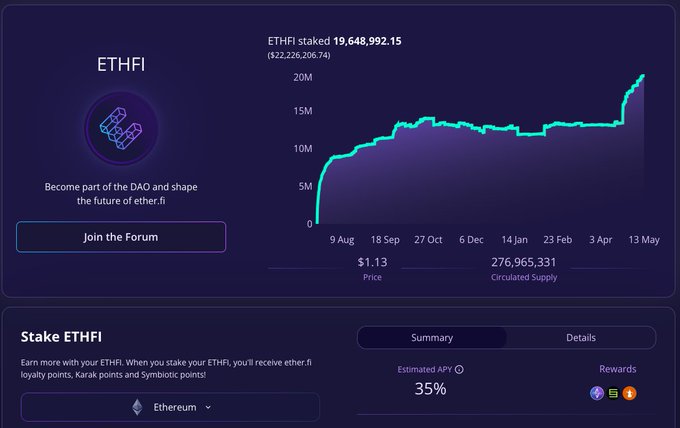

Ether.fi, is one of the best players in the decentralized financing industry. It is a liquid network and relax with it 7.24 billion dollars In assets, which makes it the fourth largest Defi company after AAVE, Lido and Eignlayer. EthFi, the distinctive symbol, has risen, as TVL jumped by more than 56 % in the last 30 days,

The Daily Chart explains that the distinctive ethfi symbol rose from $ 0.40 on April 7 to $ 1.517 this week, making it one of the best coins. This gathering happened with the closed total value jumping, and after the developers announced strong revenues and measuring a code re -purchasing.

The EthFi price moves higher than the main resistance level at $ 1.255, which is the highest swing in February and the upper side of the cup and processing style, which is a common continuity sign. The depth of this pattern is about 70 %, which means that the upscale collapse will push it to $ 2.1.

Technical analysis of XRP price

The price of XRP has increased in the last two weeks in a row, reaching the highest level at $ 2.65, its highest point since March 10. He jumped approximately 60 % of its lowest point in April this year.

The price of XRP has a bullish technical classification. He has now moved to the fifth stage of Elliot wave. In most periods, this stage is usually very upward. He remained over the moving average for 50 weeks and formed a pattern between the upholial flag.

This flag consists of a tall vertical line that resembles the mast of science and a triangle. This often leads to a strong upward outbreak, in this case, most likely to the highest level from a year to $ 3.4. The step above this level will indicate more gains, and perhaps to $ 5.

Pi

The price of the PI network has risen in the past few days, as it moved from a decrease of $ 0.5572 last week to $ 1.6638 on Monday. This recovery occurred after the main team disturbed a major news event on May 14.

The Pi Ecosystem advertisement will be released on May 14. Comment what will happen next!

Analysts expect the team to announce either a change in tokeenomics, an environmental system or an exemplary list. Hope is that the symbol will rise after the news.

A look at the graph for eight hours appears that it has moved to the third stage of the Elliott wave style. I also moved over the 50 -moving average (EMA).

Therefore, the distinctive symbol is likely to continue to rise as Bulls targets its highest level this week, which is $ 1.6638, followed by the psychological point at $ 2.

However, the danger is that it may go through a situation known as “buying rumors and selling news.” This is the position in which investors buy one of the assets before a major news event and then sell it when it happens.

Read more: The price of the PI network is approaching $ 1: Did the Coin PI train the station?

The Paragraphs of Supreme Prices for Supreme Prices of