High demand can lead

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Dogecoin is traded around the main demand area where the entire coding market battles are renewed. Among the most difficult parts affected by coins, which have seen a sharp decline in recent days. Dogecoin continues, the original and most famous symbol, follow a continuous declining direction – may not be reflected unless the current levels retain.

Related reading

Investors’ morale around space is still cautious, with total economic uncertainty and weakening of momentum clouds. For Dogecoin, this moment is especially important, as her work now hovers over the lower boundaries of a long -term parallel canal.

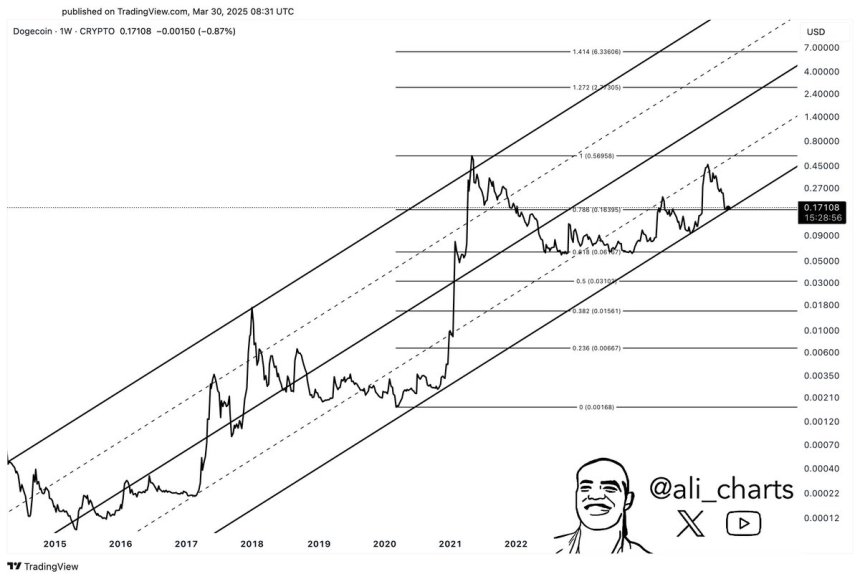

The encryption analyst Ali Martinez has shared technical visions that reveal that Dukwin still maintains this decisive level of support. According to Martinez, there can be a height of demand from this area as a launch platform in a middle-a-middle or upper range of the channel-which is likely to offer a comfort that affects the need for Doge holders.

Although the wider market conditions remain fragile, the Dogecoin structure indicates that it still has a room for apostasy – but only if buyers enter soon. Since the pricing impression near the support, the next step can determine the short -term trend of the code in a market full of uncertainty.

Dogecoin by 66 % with the investment of uncertainty in the market on feelings

Dogecoin is currently trading under severe pressure, as it decreased by approximately 66 % of its multi -year height near $ 0.48. Despite the short recovery attempts, the amazing movement of the vocal price continues to withdraw less, as the bulls are struggling to find momentum in an increasingly increasingly market. The wider total economic background also does not help-high interest rates, geopolitical instability, and trade war tensions, all contributed to a high-risk environment across global financial markets.

This disorder has a significant effect on speculative assets, and coins such as Dogecoin remain some of the most vulnerable. Current circumstances indicate that the increasing fluctuations may become the new standard for the foreseeable future, which increases the risk of increasing the negative side of DOGE unless strong support is supported.

Technical expectations for Martinez In X it is noted that the level of $ 0.15 is now necessary for Dogoin Bathing. According to his analysis, DOGE continues to trade above the lower boundaries of a long-term bullish channel-a structure that a company has held through multiple market courses.

Martinez emphasizes that the rise in demand at this level can lead to a sharp crowd, which may push Dog towards the medium or upper range of the channel, between 4 dollars and 7 dollars. Although this may seem ambitious given the current feelings, the long-term setting is still technically sound-but the bulls must intervene now to avoid a complete collapse.

Related reading

Dog Pirz pushes the bulls to the edge

Dogecoin is trading at $ 0.16 after facing intense sale pressure over the past few days, as more than 20 % decreased in less than a week. The sharp decline has put the bulls in a difficult position, as momentum clearly preferred the bears. The price structure remains decisive, and if DOGE fails to keep the critical support level of $ 0.15, a major collapse may continue – he may send Meme to low -order areas that have not been seen for months.

The 0.15 dollar brand now stands as the last defense line of the bulls, as it corresponds to the main support level in the long term within a broader upward channel. Its loss will probably sell panic and confirm a breakdown in the market structure.

However, if Dogecoin is able to maintain support above $ 0.16 and attract the renewed purchase attention, there is still a possibility for short -term recovery. The reversal of the current levels can lead to a crowd towards 0.20 – 0.25 dollars – an area that was previously operating with a strong resistance and may advance the first real test of any upward momentum.

Related reading

As market fluctuations and a feeling of vibration, Dog’s ability to retain current levels will be a key to determining whether this is just another decline – or the beginning of something worse.

Distinctive image from Dall-E, the tradingView graph