Two levels to support Bitcoin to watch where the price turns up

Bitcoin (BTC) recently ended a two -week fall, which witnessed a decrease in the price to $ 100200 before decline. Despite recovery, Bitcoin still faces pressure from LTHS in the long run, which may make it vulnerable to potential price correction.

The encryption market is still volatile, and the following price movement of Bitcoin will rely on these factors.

Bitcoin sale brings anxiety

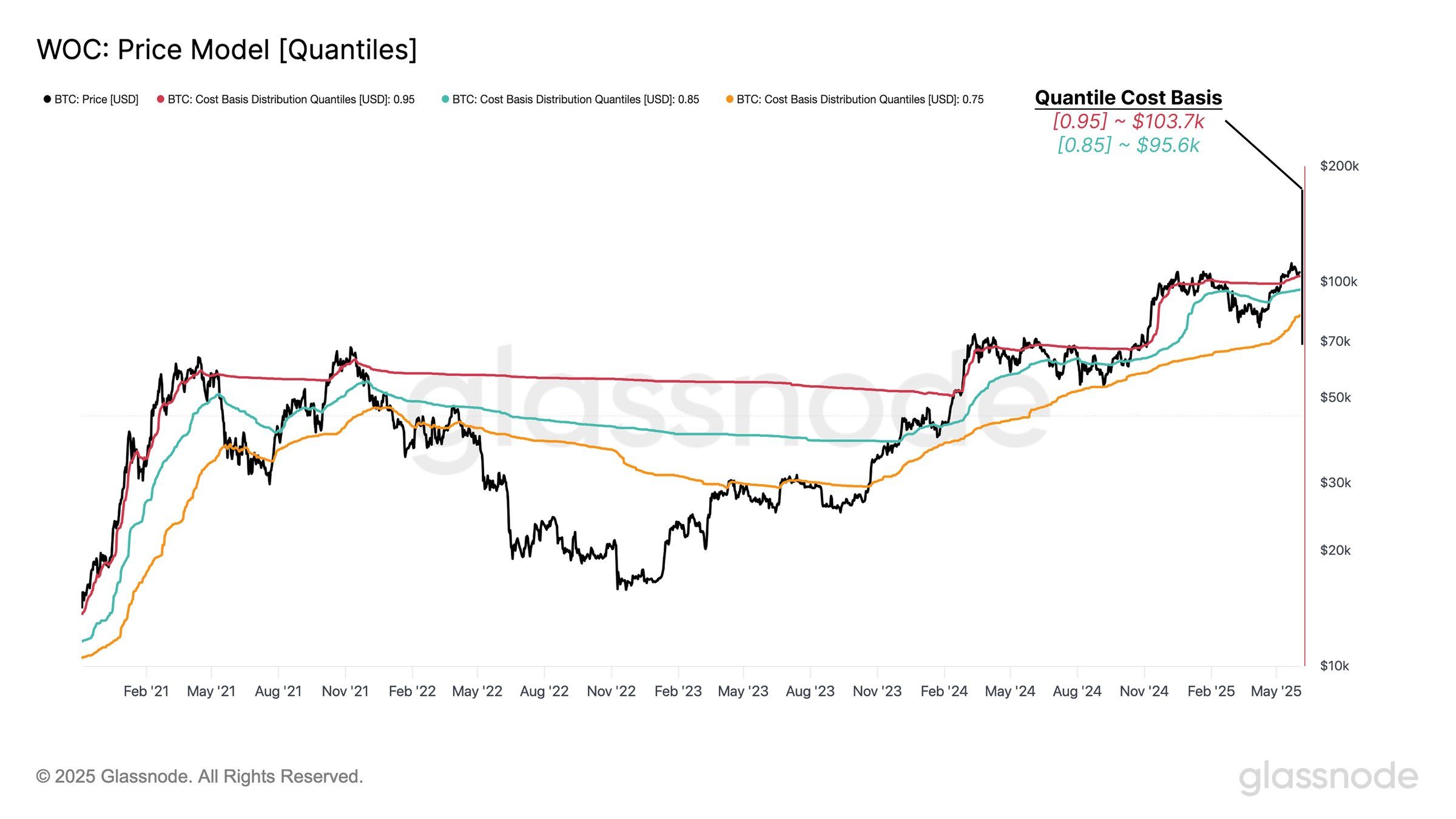

Highlighting the basis of the basis of the Bitcoin cost of the main support levels that may be decisive in the short term. 0.95 SSD (spending supply distribution) indicates that 95 % of the circulating bitcoin supplies have been purchased less than $ 10,700.

This indicates that only 5 % of Bitcoin has been obtained above this level, making $ 103,700 a strong support zone.

In addition, the other critical support level sits at $ 95,600, as it coincides with 0.85 SSD. This level represents a point where 85 % of bitcoin is a lower price, which makes it another possible stronghold for the Bitcoin price.

If Bitcoin faces more sale pressure, these levels may serve as strong barriers to a deeper decrease.

Despite the pressure of the sale of LTHS, the total bitcoin momentum indicates positive expectations in the long run.

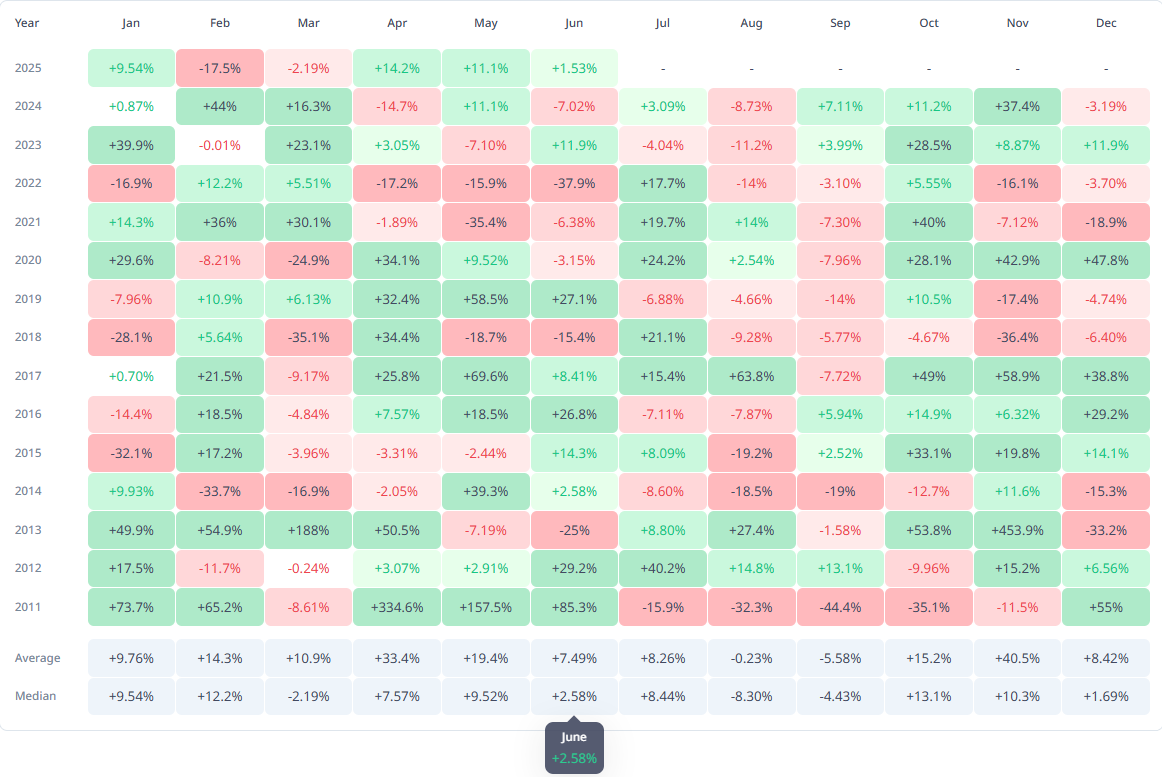

Bitcoin’s historical return data shows that June was usually a positive month of the original, with an average increase of 2.58 %. This indicates that although Bitcoin may face short -term corrections due to the sale, the wider market trend may support price recovery.

The historical trend indicates that any correction facing Bitcoin because of the LTH sale will be temporary. With the Bitcoin price showing the possibility of long -term growth, the market can soon turn into upward morale, especially if the wider market conditions improved.

BTC price has support

The Bitcoin price has recently increased by 4.7 % over the past three days, as it has been trading at 106,263 dollars. However, the cryptocurrency is still slightly lower than the resistance level 106,265 dollars.

Given the current market morale and the main support levels, the factors in playing indicate that Bitcoin may have a short -term decrease.

If Bitcoin fails to maintain $ 106,265 and face more sales pressure, it may decrease through subsidies of $ 105,000 and move about $ 10,700.

This level, as specified in the basis of the cost of quantities, can provide great support. In a more landing scenario, Bitcoin can slip to the next support at $ 102,734.

On the other hand, if the broader market turns to climb and oppose the effect of LTH, Bitcoin can exceed the resistance level of $ 106,265.

A successful breach of this level can lead to Bitcoin about 108,000 dollars or higher, which nullifies the current dropping thesis and indicating a potential price gathering.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.