Here is the reason that HyperLeeliquid hit ATH NEW with $ 39 and why it can continue

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Hyperlequid soon became a key personality in the encryption space after the financial stock exchange (Defi) has become a PERP trading. With its popularity growth, as well as the price of the original noise code. He saw this even at the time of the declining difference in the encryption market, as it rose by more than 50 % in one week to reach its highest levels ever.

Factors that lead the liquid price

The main driver behind the liquid price to the highest level ever was the high interest in the platform. Since the encryption investors are heading towards more decentralized platforms for their permanent trading activities, Hype’s Mindshare has grown significantly over the past few months.

Related reading

This increased interest has been translated into a significant increase in the trading volume of the platform during the past few weeks. The most prominent A billion dollar bets put by James WayneWhich raised quickly to become the most popular encryption dealer at the height of the liquid. Its circulation got the attention of thousands, and put more holidays on the platforms, as the spectators stood to see the results of his trading.

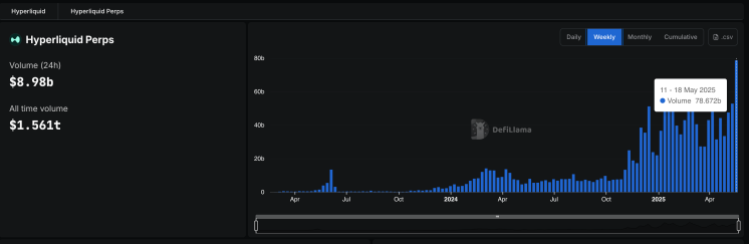

In particular, during the past week, the platform recorded for it The highest weekly volume since its launchIt reaches 78.672 billion dollars in the trading volume between May 11 and May 18, 2025. The daily trading volumes have also been excluded, as they constantly cross the brand of $ 2 billion per day.

The highest trading volume was recorded daily on May 21, 2025, with a trade of $ 17.731 billion on the platform. Cutting, the liquid height platform reached 1.156 trillion dollars in three years of operation, Devilia Data He appears.

Other major developments in the platform are the rise in open attention. Platform Celebrate The highest new level ever after the open interest exceeded a sign of $ 10.1 billion on the platform. The USDC lock on the platform also increased to $ 3.5 billion, with $ 5.6 million fee created in a period of 24 hours. In one week, the platform managed to generate more than $ 22 million as fees alone.

Related reading

On its own, the noise price still shows a lot of upscale momentum despite its already 50 % rise in one week. Daily trading volumes crossed $ 460 million on May 26, according to data from Coinmarketca. The encrypted whales were especially active during this time, as Lookonchain I mentioned Three whales spend $ 5.33 million to buy noise on Monday.

With high storage and prices, it indicates that a lot of size is actually buyers. If this purchase pressure continues, it is possible that the price is likely to see more bullish direction before a correction.

Distinctive image from Rigzone, Chart from TradingView.com