“Here is his view that the bottom is formed.

Jimmy Cutz, chief digital asset analyst at Real Vision, says the bottom may be formed in the encryption market after it decreases for weeks.

Cots Recount His 33,800 followers on the X social media platform, which is based on metric, tracks the performance of coding assets over 365 days, the market is preparing to reflect the rise.

“The encryption flow for this month resulted in the highest low reading of 365 days (NL) since mid -2014. Although it is not a final bottom, it indicates that the bottom is formed. Focus on the assets that outperformed performance over the past year and during this decline The latter.

It also participates Total2 Chart – the maximum market limit for all encryption assets except Bitcoin (BTC) and Stablecoins – which indicates a possible reflection on the daily time frame after declining tension.

A total value of 2 1.24 trillion dollars at the time of writing this report.

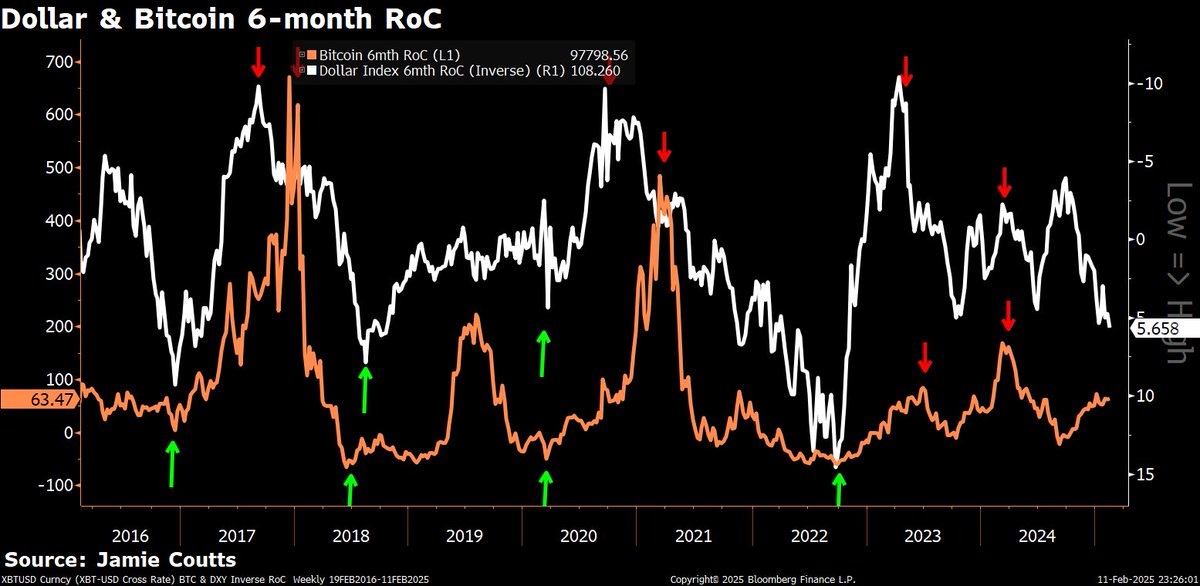

Next, coutus He says Bitcoin may break its historical reverse association with the US dollar index (DXY), which motivates the dollar for a basket of other major foreign currencies, as more investors may treat the leading encryption assets as a safe gold.

“The opposite relationship of Bitcoin with the broken dollar? Since the lowest level in September, BTC has risen from $ 70,000 to $ 110,000 while DXY rose from 104 to 110. Are it the traded investment boxes (traded boxes on the stock exchange), MSTR (Microstrategy) Kings?

It is too He says The adoption of Blockchain technology rises based on the DAAS scale (DAAS) on smart contract platforms (SCPS).

“Liquidity pushes the activity on the chain-always. But since 2022, that relationship has weakened. Blockchain’s adoption is more flexible and less link to liquidity sessions. Over the past year, the active headlines have multiplied three times while the markets themselves remain the usual schizophrenia, where they discuss the place that Its liquidity is directed.

Finally, it is Expected 2025 explosion of Blockchain technology will be witnessed across many sectors.

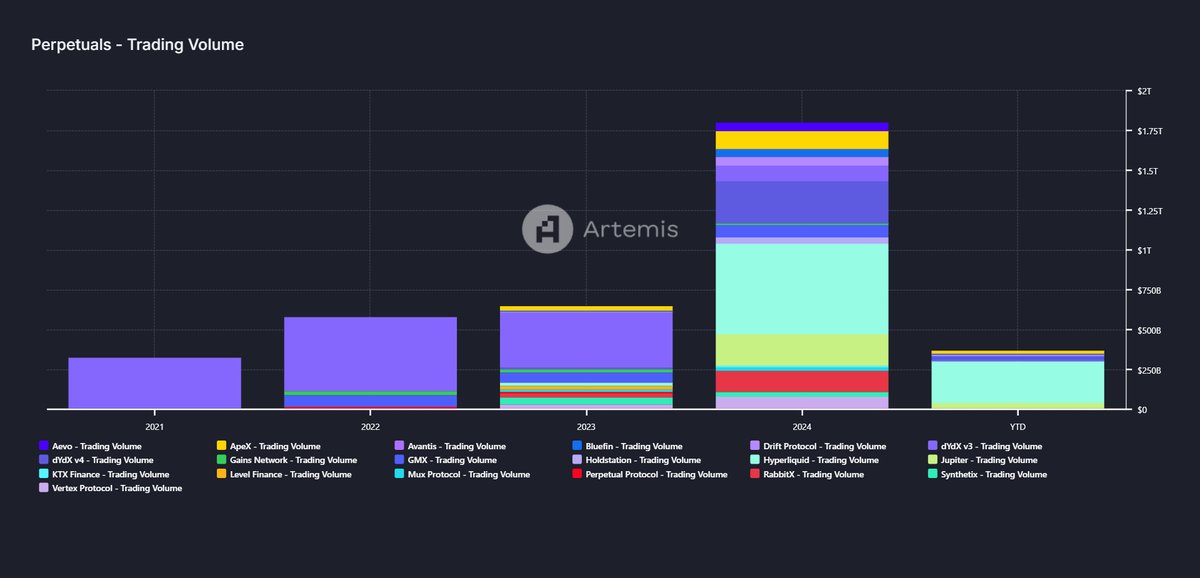

“In 2025, we will likely see butter sizes on the chain exceeding 4 trillion dollars. Even RWAS (assets in the real world) collectively, collectively, stocks, goods, bonds, and kyc solutions (customer knowledge) so that institutions can participate. They are chains and protocols that you think will benefit more than what will happen?

Don’t miss a rhythm – Subscribe to deliver email alerts directly to your inbox

Check the price procedure

Follow us xand Facebook and cable

Browse the daily Hodl Mix

& nbsp

Disclosure: The views expressed in Daily Hodl are not an investment advice. Investors must do due care before making any high -risk investments in bitcoin, cryptocurrency, or digital assets. Please note that your transfers and trading on your own responsibility, and any losses you may bear are your responsibility. Daily Hodl does not recommend buying or selling any encrypted currencies or digital assets, and Hodl Daily Andersor is an investment. Please note that the daily Hodl participates in dependent marketing.

Created Image: Midjourney