HEDERA (HBAR) slides to less than $ 0.20 in the direction of a continuous drop

HEDERA (HBAR) has decreased by 37 % in the last 30 days, with a trading of less than $ 0.30 for about a month now. Technical indicators continue to show the Hubudian view, as DMI reveals the lack of a clear trend and the strength of the weak direction.

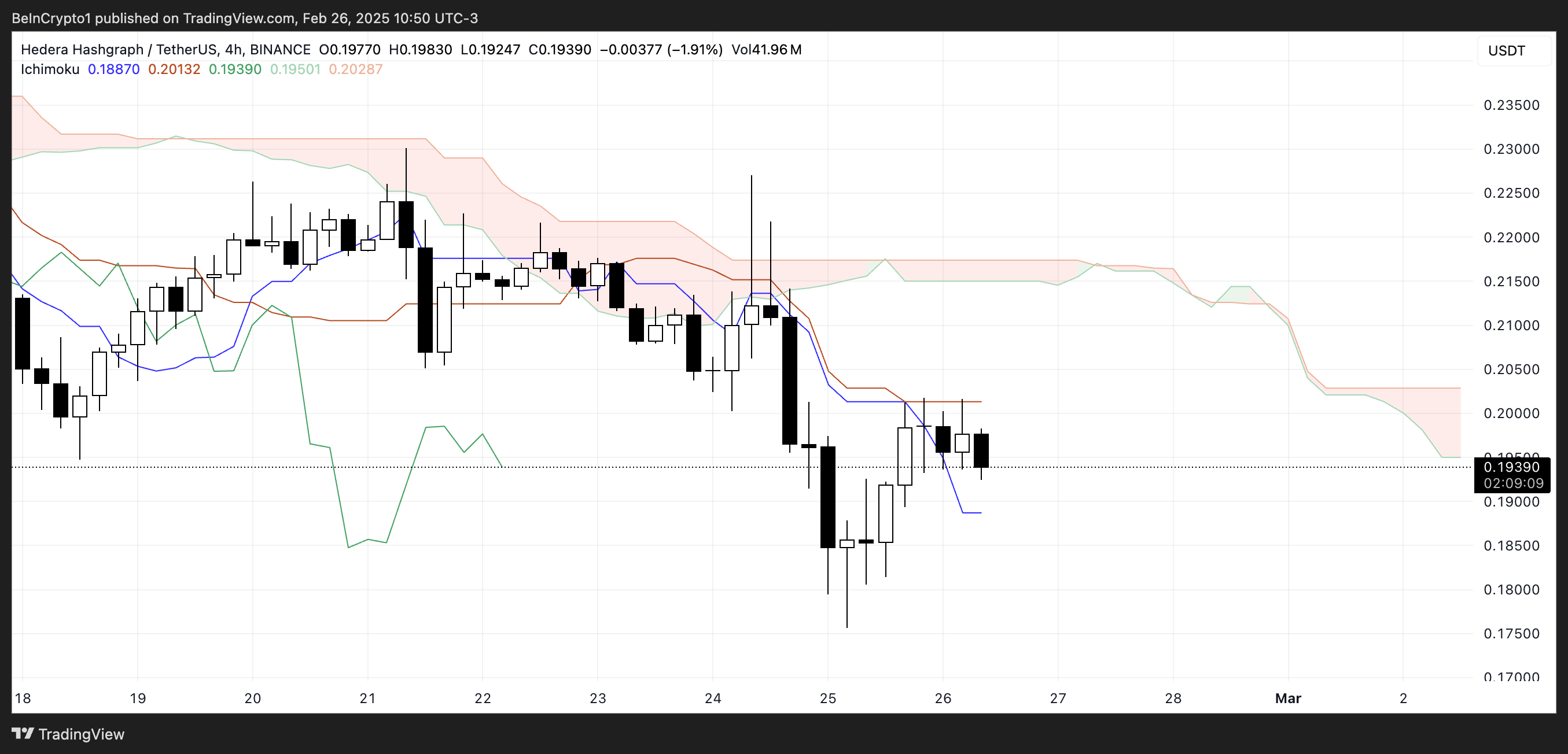

The Ichimoku cloud also indicates the continuation of the downward pressure as HBAR is struggling to break the main resistance levels. With EMA lines that maintain a declining alignment, HBAR may face an additional decrease unless the momentum returns are bought.

HEDERA DMI shows that there is no clear direction

The trend movement index of HBAR (DMI) ADX is currently at 13.5, a decrease from 17.4 yesterday. The average trend index (ADX) measures the strength of the trend, regardless of the direction, as values that are less than 20 indicate a weak or uncommon market.

In this case, the Hedra Delsing AdX suggests that the downward trend loses momentum. This can indicate a period of monotheism or side movement, as the trend lacks strength to continue below strongly.

Meanwhile, Di +in 18.2, a decrease from 28.2 two days ago, while -Di is 20 years old, a decrease from 31 days ago. It measures +di bullish momentum, and measure -di dumping momentum. Both the falling tensions indicate that the pressure pressure is decreasing, but buying interest is still weak.

Since the -Di is still higher than Di +, Hedra remains in the direction of a decline, although the decreasing gap between the two can indicate that the pressure pressure is reduced.

If +Di starts to rise above -DI in the coming days, it may indicate the beginning of the reflection or at least stop in the current declining direction. However, until this happens, the HBAR procedure is likely to remain a declined or associated with the extent.

Hbar Ichimoku Cloud draws a negative picture

The HBAR’s Ichimoku Cloud scheme currently displays an enormous look. The price is traded under the Red Cloud (Kumo), indicating the continuation of the declining direction.

Tenkan-Sen (blue line) is located below the Kijun-Sen (Red Line), which enhances the homosexuality. In addition, the price is struggling to break above the Kijun-Sen, which works as a resistance, indicating that buying momentum is still weak.

Senkou SPAN A is located (the leading green line) below the Senkou Span B (Leading Red Line), with a drop cloud width. This indicates that the declining pressure is likely to continue in the near future.

Moreover, the distance between the current price and the cloud shows that HEDERA is still in a strong declining direction. Unless the price is able to collapse over Kijun-Sen and move towards the cloud, the hypothalation look is likely to continue.

Will Hedra drop to $ 0.12 soon?

HBAR’s EMA lines currently indicate a declining direction, with EMAS mode in the short term under the long -term lines. This alignment indicates that the declining momentum prevails, and the sale of dominant pressure remains.

Recently, HBAR tested the support at $ 0.177, and although this level is preserved, the risk of re -testing continues. If the support is tested at $ 0.177 again and fails to keep it, HBAR may decrease to $ 0.125, which represents a continuation of the declining direction.

The location of the current EMA indicates that the downward trend remains the most likely scenario unless the benefit purchase is picked up significantly.

However, if the landmark fades and the direction is reflected, HBAR may rise to test the resistance at $ 0.24. The fracture of this level indicates a shift in feelings, which is likely to pay the price to $ 0.32.

If the upward trend has gained more power, HEDERA can gather to $ 0.40, an unprecedented level since 2021. For this bullish scenario to achieve it, Emas will need in the short term to cross in the long run, indicating a reflection.

Until this happens, the HBAR procedure is likely to remain under pressure, as the support level is $ 0.177 decisively to determine the next directional step.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.