HBAR is struggling with less than 0.25 dollars as the bears dominates

The HEDERA price (HBAR) was struggling to break more than $ 0.25, which enhances the constant declining momentum. Its market hat is now 8.7 billion dollars, as technical indicators indicate continuous negative risks.

ADX emphasizes that the current downward trend is still strong, while Ichimoku and EMA cloud structures indicate more weakness. Unless the main resistance levels are broken, HBAR remains in a weak position, with the possibility of deeper corrections.

Hedra DMI It suggests selling pressure reduces

HEDERA ADX is currently at 41.1, after it has remained above 40 in the past three days, and a climax at 44.1 on February 3. The average trend (ADX) measures the strength of the trend, with readings above 25 indicating a strong direction and less values indicating twice.

Although it does not indicate the direction, the ADX High from HBAR confirms that its continuous declining direction was strong in the last days.

+Di rose to 12.8 from 3.9 three days ago, settled between 11 and 14, while -Di decreased to 28 out of 44.7, hovering between 28 and 33.

This shift indicates that the sale of pressure is slightly diluted, but the Hedera buyer did not gain enough power to reversal. With no ADX above 40, the downward trend remains intact, although slow momentum can indicate a possible unification stage before the next step.

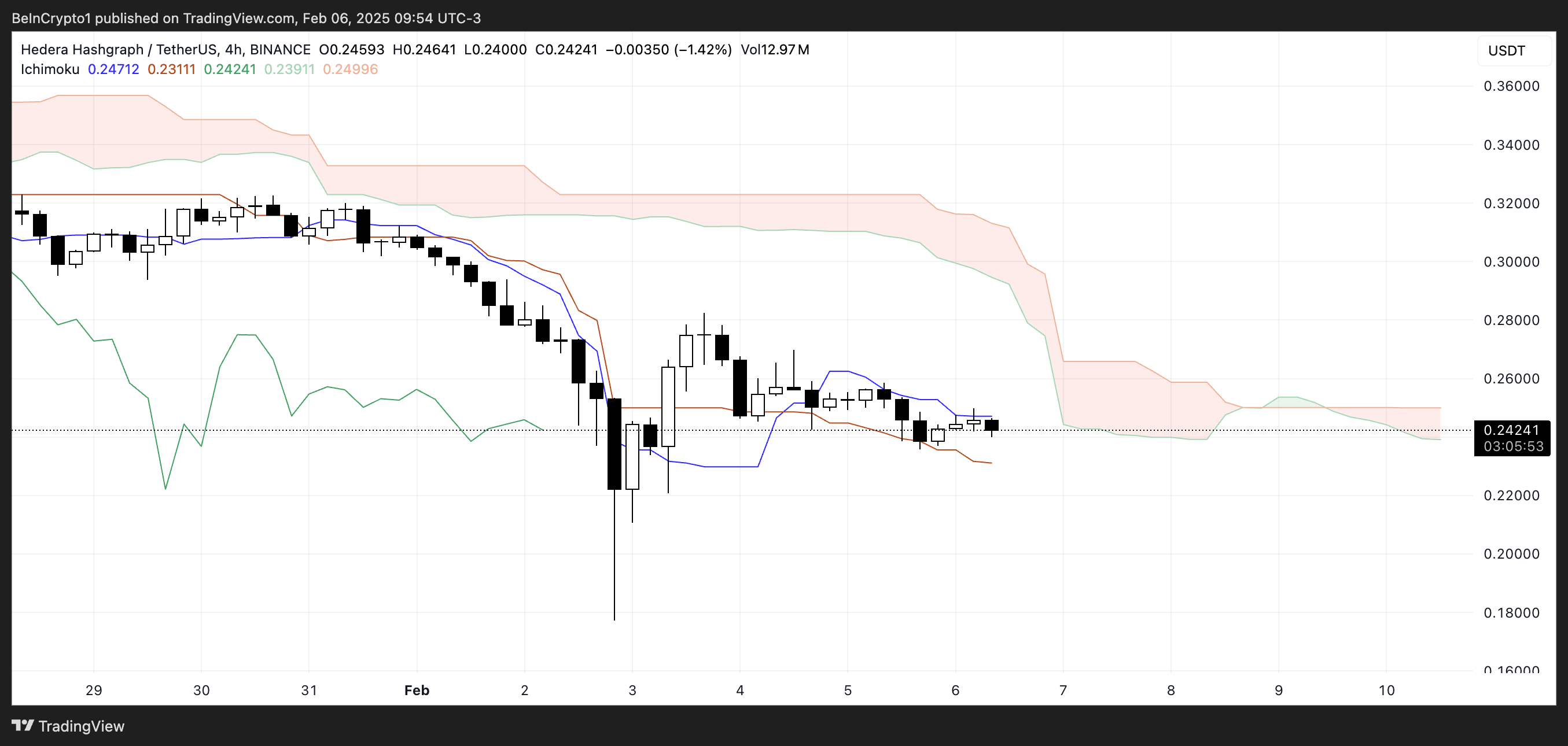

HBAR Ichimoku Cloud offers a declining preparation

The Ichimoku Cloud chart shows HBAR downly a declining look, while trading prices under the cloud. The red cloud indicates forward the continued decline pressure, as it indicates that future resistance is still strong.

The (blue) conversion line is slightly lower than the (red) foundation line, which enhances the short -term weakness and indicating that the declining momentum is still in control.

In addition, the delay period (green) is placed without the price, which confirms that the downward trend is still intact. The price was also moving side by a narrow range, struggling to get ascending momentum.

If the cloud continues to expand down, it may indicate more landmark continuity, while the consistent foundation can indicate a possible slowdown in the current direction.

Hbar prediction price: Can HEDERA correct 78 % in February?

Hedra EMA lines show a clear drop. Four days ago, the death cross remained as an Emas in the short term less than that long -term. This indicates that the declining trend is still in play, and if it continues, the HEDERA price can test $ 0.17.

The collapse below this level can open the door for more declines to 0.12 dollars, and if the declining momentum continues, this may decrease to $ 0.05, which represents a 78 % correction and its lowest level since November 12.

On the other hand, if the trend is reflected, the HBAR price can test $ 0.29, which will be the first sign of a possible recovery.

The collapse above this level can pay about $ 0.35. If the upscale momentum strengthens, HBAR may rise to $ 0.40, which is 65 % chest. However, until Emas turns into a more upward alignment, the prevailing trend remains declining.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.