Can Bitcoin rise harm companies?

After an example of the strategy, companies are increasingly investing in Bitcoin, a trend that is reinforced by the high price of encoded currency. However, these massive acquisitions raise concerns about the collapse of the market if companies are forced to sell and questions about decentralized bitcoin spirit.

Representatives of the BitWise, Komodo and Sentora platform states that the benefits greatly outweigh the risks. Although small companies have escaped, their impact on the market will be minimal. They do not expect any imminent risks, because successful companies such as Microstrategy do not show any signs of asset liquidation.

The increasing trend for bitcoin adoption for companies

The number of companies that join the direction of bitcoin purchases for companies is increasing. While Standard Chartered recently stated that at least 61 companies traded to the public bought Crypto, Bitcoin Rensuries indicates that the number has reached 130.

As the former Microstrategy strategy in the accumulation of billions in unrealized gains from the aggressive Bitcoin acquisitions, which are enhanced by the increasing price of bitcoin, are likely to follow more companies.

“The Wilshire 5000 Al -Shames Index literally includes 5,000 companies listed in the United States alone. It is very likely that we will witness a great acceleration in the adoption of the corporate treasury from Bitcoins this year and in 2026 as well,”

The reasons for his belief multiple.

How to compare bitcoin fluctuations to other assets?

Although it is volatile, Bitcoin historically showed exceptionally high returns compared to traditional asset categories such as arrows and gold.

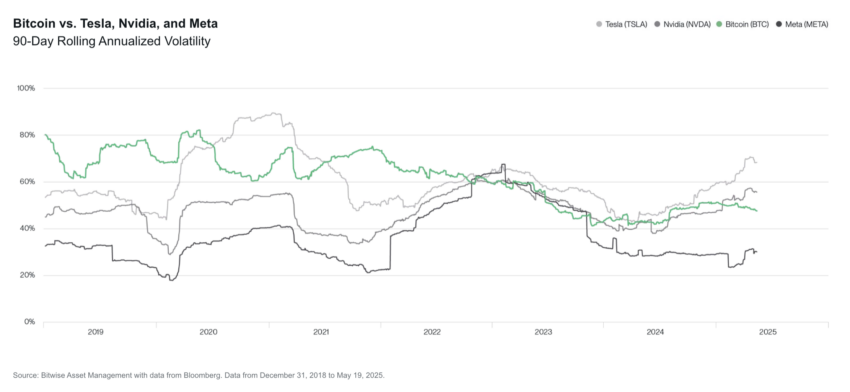

“One of the interesting data points in particular is bitcoin volatility compared to leading technology stocks, such as Tesla and Nvidia. Many investors say:“ I will never invest in something volatile like Bitcoin, Ryan Rasmussen, head of research at BitWise, added, adding, ”at the same time, most investors have Tesla and Nvidia (either through it through it through it Solds Solds directly, and P. Nasdaq-100).

Although the previous performance does not guarantee future returns, the current Bitcoin performance, which was particularly stable, may stimulate more companies to buy the original.

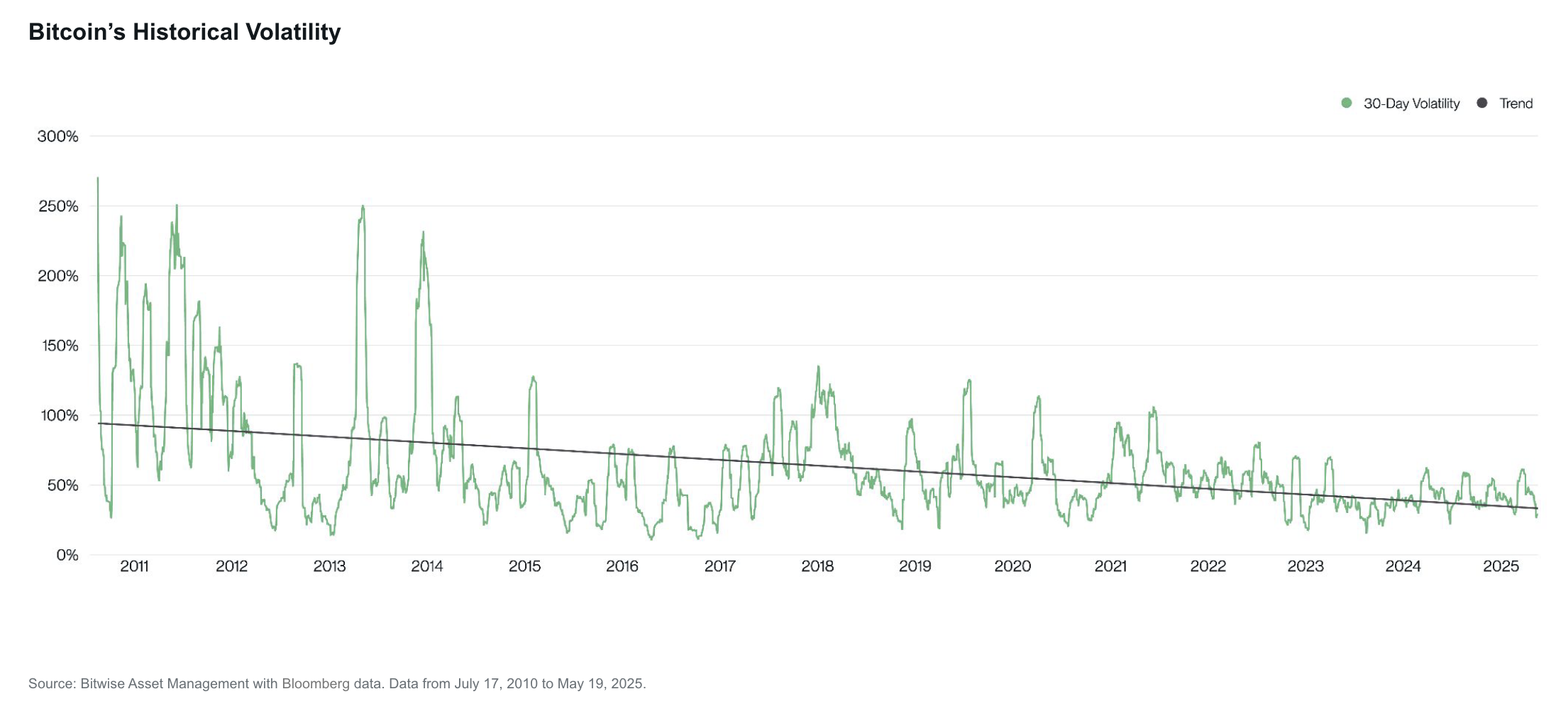

“Bitcoin fluctuations decreased over time-a direction that will be preserved in the foreseeable future. With Bitcoin discovered its real price, the fluctuation will shrink to nearly zero, and this is the point where the demand can slow down. Comodo platform, told Beincrypto.

Meanwhile, as global markets wrestle with economic challenges, Bitcoin can become an attractive option to improve weak financial budgets.

Will Bitcoin outperform traditional safe havens?

The United States and the largest global economy have suffered from geopolitical tensions, high inflation rates, and a worrying financial deficit. “Digital Gold” and a neutral and sovereign store are seen, and Bitcoin has caused the attention of different shareholders, especially after the victory of the strategy.

“The pressure from the current shareholders will increase over time with the adoption of more companies’ policy, especially if inflation rates should begin to accelerate due to the high geopolitical risks and increase the liquefaction of financial debts by central banks. Many companies are also working to unify them in the field of low growth, where adoption can rely on custody returns. “

And he expected that the Bitcoin Day be superior to traditional safe havens such as US Treasury and gold will come in the end. With the high adoption, Bitcoin fluctuations will decrease, making it one of the comprehensive competitive assets.

“Bitcoin fluctuations in a declining structural direction were from the beginning. The main reasons behind this structural decline were increased scarcity due to vanishing and increasing adoption, which tend to reduce fluctuations. We expected that Bitcoin fluctuation ultimately converge into the clarification of gold and become a major competitor for alternative storage.”

Meanwhile, Bitcoin technological background will also give it a competitive advantage over other asset categories.

“Due to its artistic excellence for gold, we believe that there is a high possibility that Bitcoin can disrupt gold and other stores such as US Treasury Links in the long run. This will become increasingly related to [the] Dragosh added: “A face of the high risk of sovereign debt worldwide,” Dragosh added.

However, not all companies are created equally. While some benefit, others do not.

Distinguish between bitcoin strategies for companies

According to Hassemen, there are two types of bitcoin locker companies.

They are either profitable companies that invest backup money, such as Coinbase or Square, or companies that secure debts or stocks to buy Bitcoin. Regardless of the type, its accumulation enhances the demand for bitcoin, which leads to a high price in the short term.

The profitable companies that buy bitcoin using excessive criticism are uncommon and do not pose any systematic risks. Rasmussen expects these companies to continue to accumulate Bitcoin in the long run.

Companies that resort to debts or stocks may face a different fate.

“There are not only Bitcoin financing companies because public markets are ready to pay more than one dollar for $ 1 of bitcoin exposure. This is something that cannot be affected in the long run unless these companies can increase bitcoin per share. The shares of the purchase of Bitcoin does not increase the bitcoin per share. “.

The success rates of these companies depend on the amount of profit they have to pay their debts.

Reducing bitcoin risk for companies

The largest companies and the drawing always have more resources than the smallest to manage their debts.

“The companies of the large cabinet, known in Bitcoin, such as the strategy, Metilantan, and Gamestop, should be able to re -financing their debts or issue shareholders’ rights to collect money to pay their debts in a relative ease. The smaller and less known companies that do not have profitable business are more vulnerable to the risk of selling Bitcoins to meet their obligations. ”

According to Dragosch, the key to avoiding such a scenario for smaller companies is to prevent overcoming. In other words, borrow what you can bear.

“It is a major component often that breaks any kind of work strategy that is excessive amount … potential risks instead lies in other companies that copy the MSTR bitcoin strategy and start at the highest cost. This increases the risk of forced references and bankruptcy in the next bear market, especially if these companies accumulate a lot in the process and overcome them.”

However, this liquidation will have the minimum market effects.

“This will create short -term fluctuations for Bitcoin and be harmful to the prices of these companies, but they are not the risk of bombing on the wider ecosystems system. This will be likely to be the relatively small number of companies that have to sell a relatively informed amount of bitcoin.

The real problem appears when the major players decide to sell their property.

Are the big holdings systematic risks?

More companies that add Bitcoin to their public budgets create decentralization, at least at the market level. The strategy is no longer the only company that employs this strategy.

However, the strategy’s possessions are enormous. Today, approximately 600,000 bitcoin – 3 % of the total offer. This type of centralization already comes with the risk of filtering.

“More than 10 % of all Bitcoin is now being held in ETF CUSTODIAL and corporate cabinets; a large share of the total of the offer. This focus offers a systematic risk: if any of these managed governorates is central to risk or abuse, the repercussions can fall through the entire market,”

Some experts believe that such a scenario is unlikely. If this happens, Stadelmann expects the initial negative results to stabilize.

“If Microstrategy will sell a large part of its bitcoin currencies, you will develop a plan to do this without affecting the market in the beginning. In the end, people will realize what is happening, and this will lead to a wider sale of bitcoin depression.

However, the large amount of bitcoin kept by a few large companies raises renewed concerns about the centrality of the same origin rather than competition.

Central as a preference for adoption

The accumulation of large companies raises concerns about the concentrated ownership of the limited Bitcoin display. This challenges the basic Defi principle and generates concern about disrupting its founding structure.

According to Dragosch, this is not the case. No one can change the bitcoin bases by owning most of the offer.

“Beauty about the Bitcoin consensus algorithm in the work is that you cannot change the bitcoin rules by owning the majority of the offer that is different from other encryptions like Ethereum. In the case of Bitcoin, the majority of Bitcoin needs to play Bitcoin.

In turn, Pellicer sees some truth in these concerns. However, they are seen as a preference for other benefits of adoption on a large scale.

“While this centralization contradicts the spirit of bitcoin for individual and self -ownership, the institutional nursery may remain the most practical way to adopt on a large scale, provide organizational clarity, liquidity, and ease of use that many new participants expect,” he said.

With companies increasingly benefiting from Bitcoin to obtain strategic financial benefits, their way to become widespread backup assets are accelerating. Currently, the risk of market collapse seems to be present.

Disintegration

With the guidance of the confidence project, this article displays the views and views of industry or individuals experts. Beincrypto is devoted to transparent reports, but the opinions expressed in this article do not necessarily reflect the views of Beincrypto or their employees. Readers must independently verify information and consult with a professional before making decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.