Gold price drops $ 180 from the high record with risk appetite returns – will you keep $ 3200?

- summary:

- Gold slides to less than $ 3,300, raising optimism between the United States and China, risk morale. Here’s what drives prices down and the main support levels to see the following.

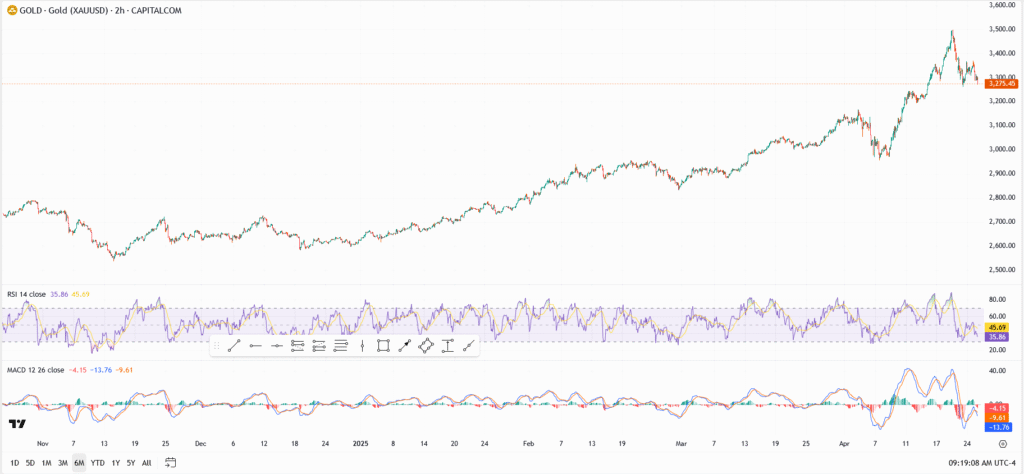

Gold withdrew (Xau/USD) below 3,280 dollars on Thursday, where it took its upward line, as the US dollar regained the ground and the dangers of feelings witnessed a brief rise after renewed talks between the United States and China. The metal is now trading approximately $ 200 from its highest level ever, as merchants revolve from safe armed assets and re -evaluate the possibility of price discounts this summer.

Despite the withdrawal, gold is still one of the higher assets in 2025, supported by sticky inflation, the purchase of the central bank, and geopolitical hedging. Since the markets are still ready about commercial risks and tensions in the Middle East, it seems that the floor of gold prices rises – but it is clear that the upscale momentum takes a break.

Golden Technical Analysis: The main levels of viewing

- Resistance levels:

- $ 3,320-previous height in the middle of the week, gathering

- $ 3,385-higher in short term in the short term

- $ 3,450-the highest level at all times (ATH)

- Support areas:

- 3,210 dollars – the main fiber level and demand highlights

- $ 3,100 – March unification base

- 2,970 dollars-Support the direction line from February March

Gold loses steam, but it is still above cash support. The preparation indicates a cooling stage, not a breakdown, unless $ 3,100 is decisively broken.

What is behind the price of gold today?

The withdrawal comes when the US dollar was recovered a little and I hope a diplomatic breakthrough between the United States and China is weak with the weakness of some safe havens. The strongest green back usually weighs gold, which is priced in dollars and becomes less attractive to foreign buyers when the currency collects.

However, the total background is still friendly: Central banks continue to accumulate reserves, and real tables decline again, and inflation remains higher than many G20 goals. For long -term bulls, this correction may be a re -calibration, not the opposite of the direction.

Is gold to buy in 2025?

The Gold’s 25 % has re -gathered this year the classic discussion: Is this the beginning of something larger, or will the metal really issue it? Historically, the equivalent movements do not maintain such without stopping, and this is exactly what we see now. Currently, smart money appears to be cautious in the short term, but while maintaining long -term exposure.