Are you preparing Pi Network (PI) for the main price movement?

Pi Network (PI) witnessed a 5 % modest increase during the past week, although it decreased more than 17 % in the last 30 days. This apostasy has brought some relief, but it has not yet been translated into a clear shocking reflection.

The price is currently uniformly between the main levels, with technical indicators such as Ichimoku Cloud, RSI and EMA lines that indicate everything. Whether this monotheism leads to the outbreak or another aspect that can depend on how PI interacts resistance at $ 0.68 and supported at $ 0.617 in the next sessions.

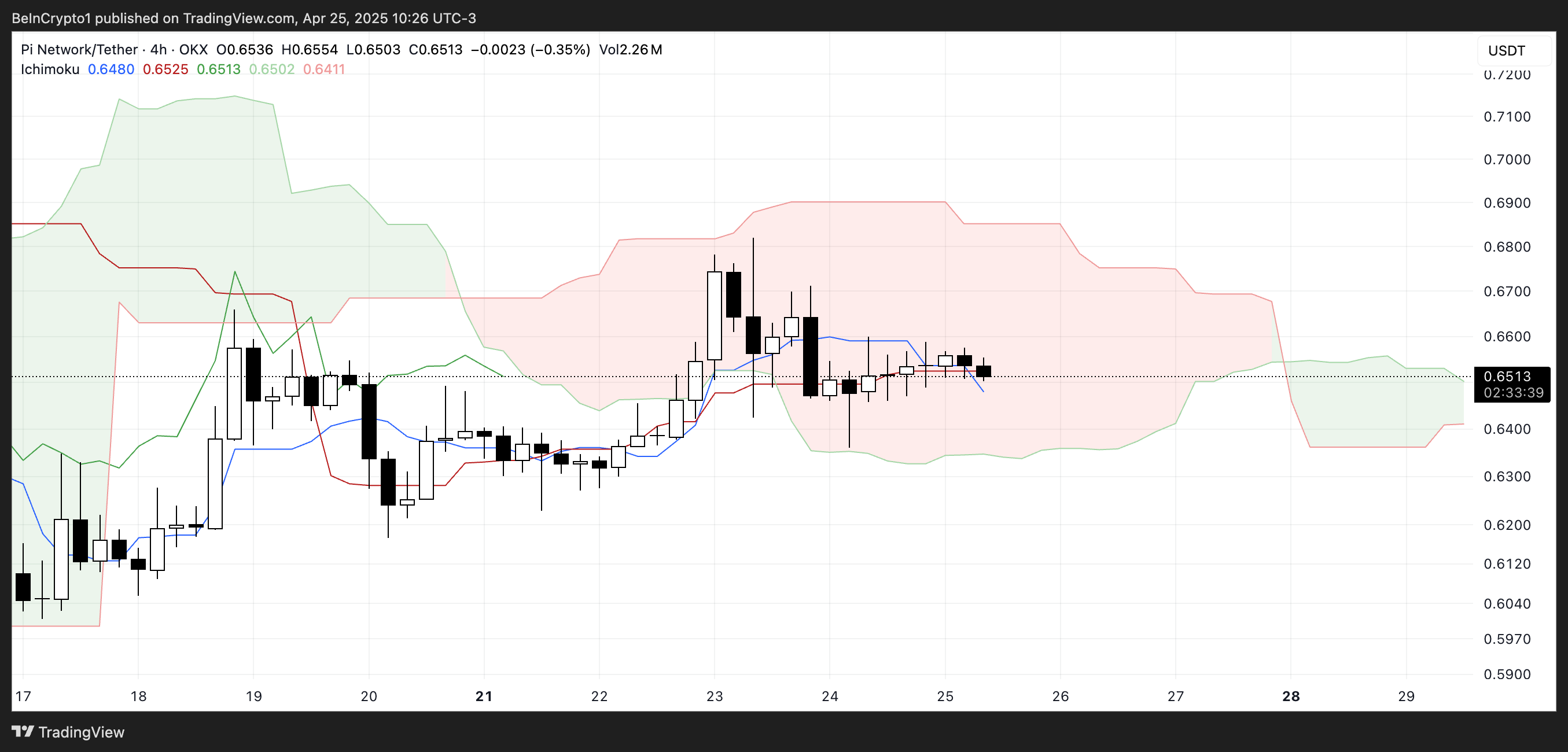

Ichimoku refers to the uncertainty in PI

The PI network is trading inside the Red Ichimoku cloud, which reflects the frequency and the lack of strong directional bias.

The price sits between the Red Foundation (Kijun-Sen) and above the Blue Transformation Line, which indicates twice the short-term momentum but there is no clear collapse.

The presence of the red cloud shows that the prevailing trend is still slightly declining, and the procedures for prices within the cloud generally indicate unification or neutrality.

However, looking forward, the cloud turns green, indicating that feelings may begin to shift.

The green cloud in the future indicates a potential upward transition, but only if the price can break the cloud with strong follow -up.

The crucial step over the cloud will support the reflection of the direction, while rejection and movement below Tenkan-Sen and Kijun-Sen enhances the declining pressure.

PI Rsi Cold: What comes after that?

The RSI (RSI) is currently sitting at 51.41, as it decreased from a height of 70 only two days ago.

This decrease reflects a remarkable cooling of momentum, as the original has moved from the land near the week to more neutral levels.

The relative strength index measures the speed and size of the recent prices to assess excessive conditions in peak or sale. The values that exceed 70 generally are at the height of purchase, and they are considered to be less than 30 years.

RSI at 51.41 put PI in the middle of the range, indicating that no buyers or sellers have a clear advantage currently.

This neutral reading often coincides with the standardization stage, as the price stabilizes before determining its next direction. If the RSI trends are again, it may indicate the regeneration of the bullish momentum.

On the other hand, the continuous decrease of about 40 or below may indicate increased twice and open the door for a deeper decline.

PI merge – is it coming?

The price of the PI network has been combined over the past few days, as it is currently being traded within a specific scope of resistance at $ 0.68 and support at $ 0.61.

This side movement is reflected in EMA lines, which are closely assembled together – a classic sign of low volatility and lack of strong directional momentum.

The market appears to be waiting for a decisive batch of buyers or sellers before adhering to a new direction. Until then, the PI remains in a knot style, with a besieged procedure between the main levels.

In the event of the return of the bullish momentum, the outbreak can indicate above $ 0.68 to the beginning of a new gathering.

In this case, the next resistance levels are to watch $ 0.789 and $ 0.85. If the upward trend is strengthened, the PI may target $ 1.04 – as its first step is over one dollar since March 23.

However, a lower collapse of $ 0.617 can regenerate the declining pressure, with $ 0.59 and $ 0.54 as the following negative goals.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.