Gary Black says that the consensus of Wall Street is outdated on Tesla Q1: The price of the arrow depends on affordable car comments, Doug Elon Musk’s movements – Tesla (NASDAQ: TSLA)

on monday, Gary BlackAdministrative partner in Future Fund LLCHe said he believes Tesla Inc.’s Timing The share price will stop after the first -quarter profit report on Tuesday more on the company’s expectations and main management comments.

What happened: Black took to xpreviously twitterHe said: “The price of Tesla’s share after tomorrow’s profits depends more on what the administration says about the most affordable car, the timing of the unaccounted self -testing market, the future participation of Elon with Doug, and the directives of the growth of the fiscal year 25, from the actual results.”

He also presented his predictions in the first quarter of Tesla and Kamel in 2025, and compared it to what Wall Street expected:

| metric | Ground Black appreciation | Wall Street estimate |

|---|---|---|

| Q1 Ep3 modification | 0.37 dollars | 0.44 dollars |

| Q1 Auto Gross Margin (EX-Reg credits) | 12.6 % | 12.3 % |

| Q1 revenue | 20.0 billion dollars | 21.4 billion dollars |

| 2025 delivery operations | 1.7 million (-5 % year) | 1.809 million (+1.1 % on an annual basis) |

| 2025 EPS modification | $ 2.60 | $ 2.64 |

See also: Ford remembers what

It indicates that the consensus of the Wall Street may be old because analysts usually do not update their models after the quarter ends until the actual results come. This makes these numbers very optimistic.

Instead, he says the Tesla Investor (IR) relations poll is more realistic.

| metric | Tesla Ir-Complized | Wall Street consensus |

| Q1 Ep3 modification | 0.38 dollars | 0.44 dollars |

| 2025 delivery operations | 1.731 million (-3 % on year) | 1.809 million (+1.1 % on an annual basis) |

| 2025 EPS modification | $ 2.29 | $ 2.64 |

Why is this important: Last week, it was reported that Tesla was delayed in the United States’s launch of a more affordable SUV. The “E41” car was determined internally, originally for the first time in the first half of the year.

Musk’s EV GIANT was also hinted at the launch of the independent Cybercab service to ride in Austin, Texas-but the plan drew doubts from industry experts.

Moreover, Musk faces increasing criticism from investors because of fears that it loses the focus on the company, as its attention appears to be increasingly directed towards his role in the president Donald Trump The Ministry of Governmental efficiency (Doge).

Since the situation took over after Trump’s opening, Musk’s political participation has sparked protests at the country level in the showrooms and facilities in Tesla, from peaceful demonstrations to sabotage.

His controversial statements to foreign affairs also drew a violent reaction in Europe, where attacks were reported on the characteristics of Tesla and retreat sales.

Price work: Tesla share fell by 5.96 % on Monday, and continued a wider decrease that witnessed the decrease of the shares by 40.04 % on an annual basis, according to Benzinga Pro.

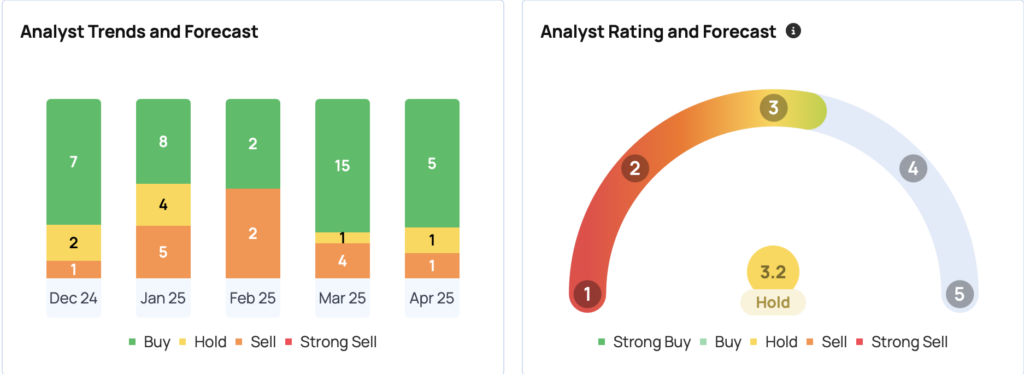

29 analysts tracked Benzinga at a targeted price of the consensus on Tesla at $ 298.14. The last three categories of PIPER SANDLER, UBS and Mizuho indicate the average price of $ 321.67, indicating a possible increase of 41.17 % based on these updated assessments.

The company currently has a growth degree of 67.59 % based on the Benzinga Edge shares rating.

Photo courtesy: Ti Vla on Shutterstock.com

Read the following:

Disintegration: This content was partially produced with the help of artificial intelligence tools and was reviewed and published by Beenzinga editors.

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.