Tesla’s share price decreased by 8 % after Trump criticizes Elon Musk due to EV tax credits

Tesla’s shares fell sharply on Thursday, losing 8 % in one session, as it rocked the war of increasing words between CEO Elon Musk and US President Donald Trump’s confidence in the investor. The general engagement, which focuses on differences on taxes and political loyalty, has eliminated an estimated $ 150 billion in the market value in Tesla.

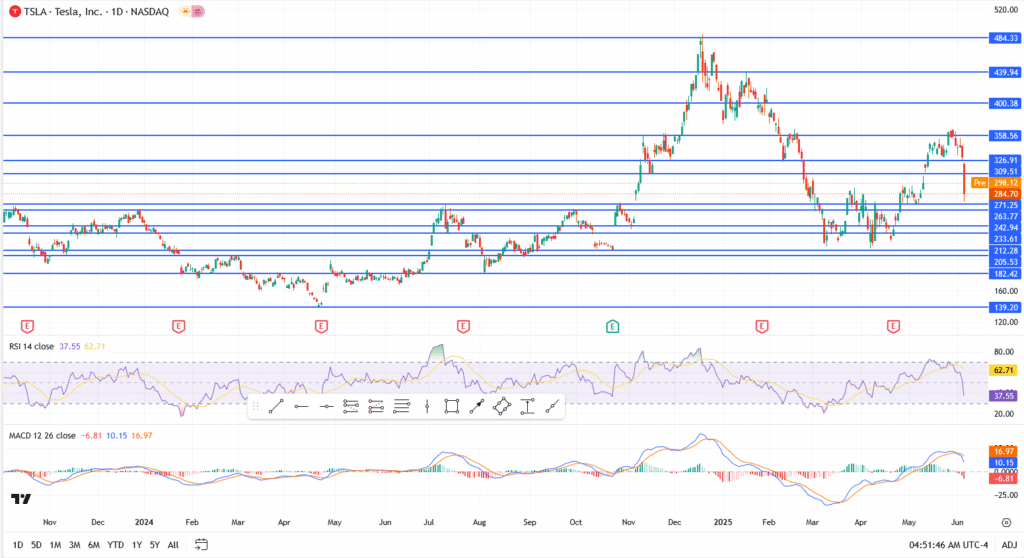

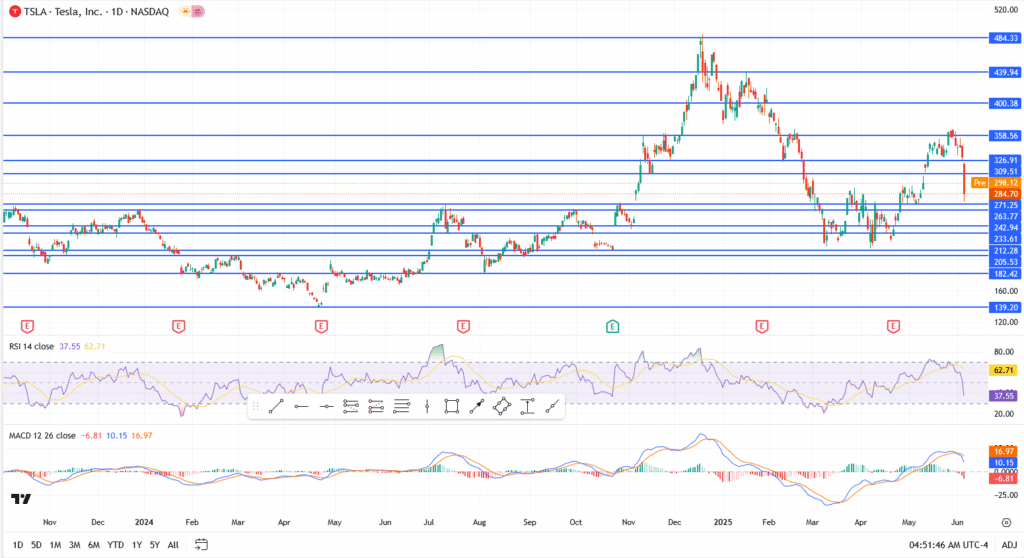

Tesla Inc. shares decreased. (NASDAQ: TSLA) to $ 284.70, which is the lowest closure price in nearly three months. Follow the retreat back between Musk and Trump, which started earlier this week and intensified after MUSK has publicly criticized a “beautiful, beautiful bill”, a comprehensive tax reform that was passed on the party lines.

In response, Trump took the social realization of the shooting, interrogating Musk’s motives and warning that the billionaire “should be careful for what he wished.” The publication immediately caused speculation that Tesla’s business model, which relies heavily on Federal EV credits and US government contracts, could be subject to political scrutiny.

$ 150 billion is erased in the market value

The Tesla market ceiling fell from about $ 945 billion to less than $ 790 billion within hours, making it one of the largest stock losses for one day in the company’s history. The trading volume increased, as analysts pointed to an increasing concern about Tesla’s organizational risks under Trump’s administration.

According to Fortune, many institutional investors have begun to reassess their property in Tesla in light of the escalating dispute and uncertainty in politics.

The artistic collapse adds to the slide

- Tesla arrow erupted from the main support at $ 298

- Closed at $ 284.70, with the following support areas at $ 271.25 and 263.77 dollars

- RSI decreased to 37.55, approaching the extra sales area

- MACD has turned to landing, confirming the short -term pressure

See too

Political risks are chatting

This last episode highlights the weakness of the Tesla assessment of the political opposite winds. With Musk increasingly on social media and Trump’s reference to a review of corporate tax incentives, Tesla now finds itself in the midst of a high -risk power struggle, investors can no longer ignore.

Unless the company or the White House moves to cancel the discourse escalation, it is possible that the fluctuation will continue next week.