Grasim Industries Elliott Wave Technical Analysis [Video]

Grasim Industries Elliott Wave Technical Analysis

job: direction.

situation: The rush.

building: Marine Blue Wave 3.

position: Gray wave 1.

Next trend higher: Marine blue wave 3 (active).

details: Navy Blue Wave 2 appears. Sea Blue 3 of 1 is now in toys.

Canceling the level inaccurate: 2299.

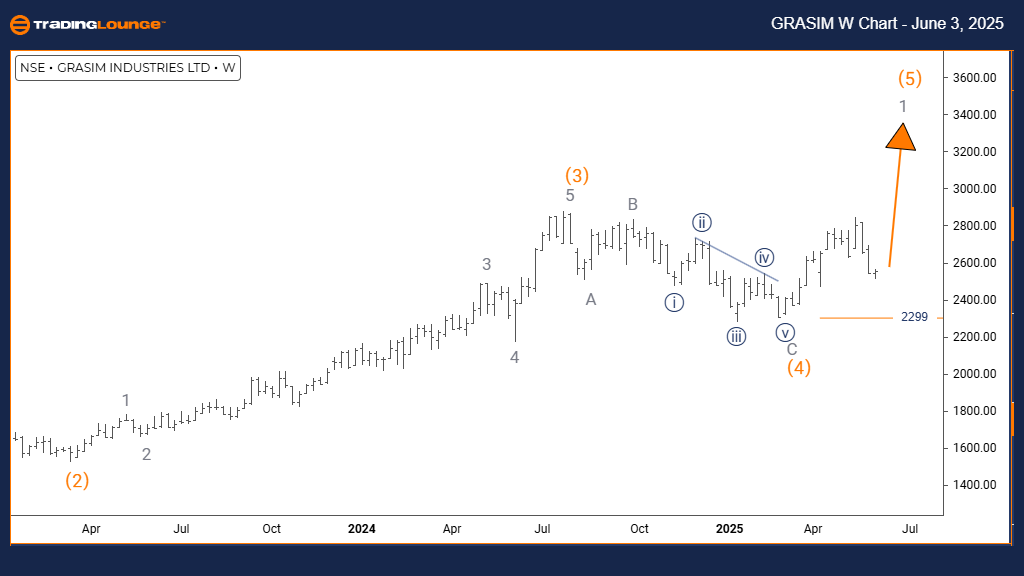

Daily graph analysis shows that Grasim Industries is gaining strong bullish momentum within the upward trend. The current preparation highlights the three marine blue wave that is formed within the broader upward framework of the gray wave. This indicates the end of the Two Blue Wave and the arrow is now moving to what is the most dynamic part of the Elliott wave motive.

The completion of the Navy Blue Wave Two indicates that the three marine blue wave appears, characterized by increased purchase pressure. It was placed inside the first gray wave, this stage bears great upward potential. The main support level in 2299 is a health verification point – which decreases below that will nullify the structure of the current wave and may indicate the reassessment of the direction.

This analysis provides investors with basic visions in placing the arrow in its broader upward trend. Grasim Industries may now face a phase of a broken gathering, which provides a useful sophisticated trend before starting the next corrective step. The following potential development is the third marine blue wave inside the gray wave structure.

Traders should monitor price activity to confirm the third wave momentum and stay vigilant for any decrease less than 2299.

The daytime graph

Grasim Industries Elliott Wave Technical Analysis

job: direction.

situation: The rush.

building: Gray wave 1.

position: Orange wave 5.

Next direction lower grades: Gray wave 2.

details: The orange wave appears to be 4 complete; Gray wave 1 of 5 currently ongoing.

Canceling the level inaccurate: 2299.

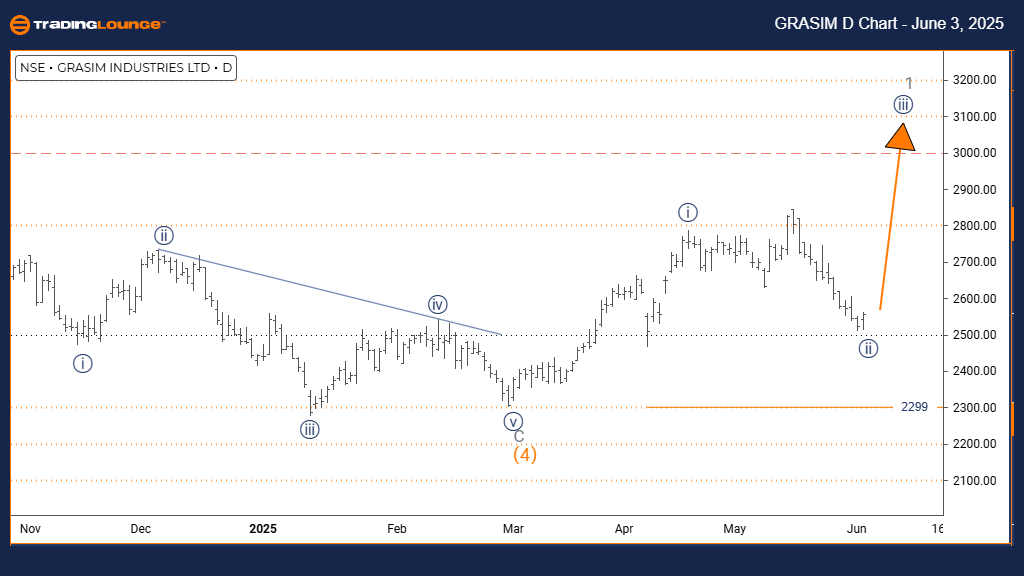

The Grasim Industries is near the final stage of its upward direction. The analysis indicates the gray wave that is formed within a broader sequence bearing the name of the fifth orange wave. This indicates the end of the fourth orange wave and the beginning of the final impulsive wave in the current upward trend.

With the completion of the fourth orange wave, the movement indicates the gray wave to the continued upward pressure. However, since this is the last wave of the cycle, merchants should remain cautious for signs of weakening momentum. The level of 2299 is still very important – that is, a break down this may be called the number of the wave subject to a question and indicates a larger corrective pattern.

This long -term technical view helps to understand Grasim in the market cycle. There may be a final leg up to complete the five -wave sequence before the great decline begins. This stage calls for wise trade management and monitoring possible signs of reflection.

Participants should closely watch for indicators such as difference or slowdown, which often accompanies the ripening of the fifth wave. While the current preparation remains optimistic, the plan stresses the need for vigilance as the course approaches the completion.

The weekly graph