Warum TrustPilot-Bewertungn Für Bitcoin-Börsen Entscheidend Sind

In Der Dynamischen Welt de Kryptowährungn Is Vertrauen dies wichtigste währung. Bitcoin-Börsen Agien Als Zentrale Schnittstelle für Millionen von Tradern, anlegern und Institationen Weltweit. Doch Wie Unterscheidet Man Seriöse Plattformmen von potenziell gefährlichen? Eine off unreschätzte, aber äußerst aufschlussreiche informationsquelle: das trustpilot.

TrustPilot, Eine der Gröcten Unabhängigen Bewertsplattformen der Welt, Sammet Angetische Kundenmeinungn über unternehmen-Darunter Auch Zahlreiche Krypto-Börsen. In the Einer branch, at Der Es Weder Flächendeckende Regulierung Noch Institutionelle Sicerheiten Wie Bei Klassischen Banken Gibt, Kann Die Meinung der Community überg Oder Misserfolg Eineer Plattform Entscheiden.

TrustPilot, Eine der Gröcten Unabhängigen Bewertsplattformen der Welt, Sammet Angetische Kundenmeinungn über unternehmen-Darunter Auch Zahlreiche Krypto-Börsen. In the Einer branch, at Der Es Weder Flächendeckende Regulierung Noch Institutionelle Sicerheiten Wie Bei Klassischen Banken Gibt, Kann Die Meinung der Community überg Oder Misserfolg Eineer Plattform Entscheiden.

Ein Hoices Bei TrustPilot Deutet Meist Auf Transparente Prozesse, Zuverlässigen Kundenservice Und Nutzerfreundliche Handelsplattformen Hin. Besonders in lugffsituancen – etwa bei plötzlichen markteinbrüchen Oder textischen probemen – trennt sich Die Spreu Vom Weizen. Nutzer Berichten, Wie Schnell Kundensupport Ragitor, Wie Fair AuszahlungSprozesse Ablaufen Ober UNERKLURLICHHE KONTO-SpertRUNGEN AUFTRENTEN.

Gerade Neueinsteger Verlassen Sich Stark Auf Diese Bewertungen. We Neu im-krypto-markt ist, uchtierung-hented Findet SIE OF UF UF TRSTPILOT. Eine Schlecht bewertte börse Schreckt ab, während ein unternehmen mit zahlreichen positiveen rezenSionen deutlich mehr vertrauen generalßt. Auch Google-SUCANFRAGEN NACH De Namen de Börse in Kombination MIT Dem Wort „TrustPilot” Gehören Längst Zum Standarderetoire Vorsichtiger Angeler.

Doch Auch Für Erfahrene Trader Is Trustpilot Mehr Als Nur Eine Spielerei. ENTWICKLUNG DER Bewrtoungen über Monate Hinweg Zeigt, Ob Sich Eine Plattform Verbssert Oder VerschleChtert. Plötzliche Rating-Einbrüche Können Ein Warnsignal Sein-Etwa Für Liquiditätsprobleme, HackerangRiffe Oder Ein Managementwechsel.

Natürlich ist nicht jed bertung echt. Gekauffe Rezensionen Oder Frustposts Einzelner Nutzer Verfälschen Manchmal Das Bild. Doch we zwischen den ( Gibt Es Offizielle Antworten de Börse? Word Auf Die Qualität des Kundenumgangs Lässt Sich SO OT BESER BEURTEILEN AUF DER EIGENGANGHEN Website Der ANBIERETER.

surplus

In Einer Digitalen FinanzWelt, in der Anonymität, Volatilität und HoHe Einsätze Alltag Sind, ist das trustpilot reghat ein mächtiges wekzeug zur risikobewertung. Wer est

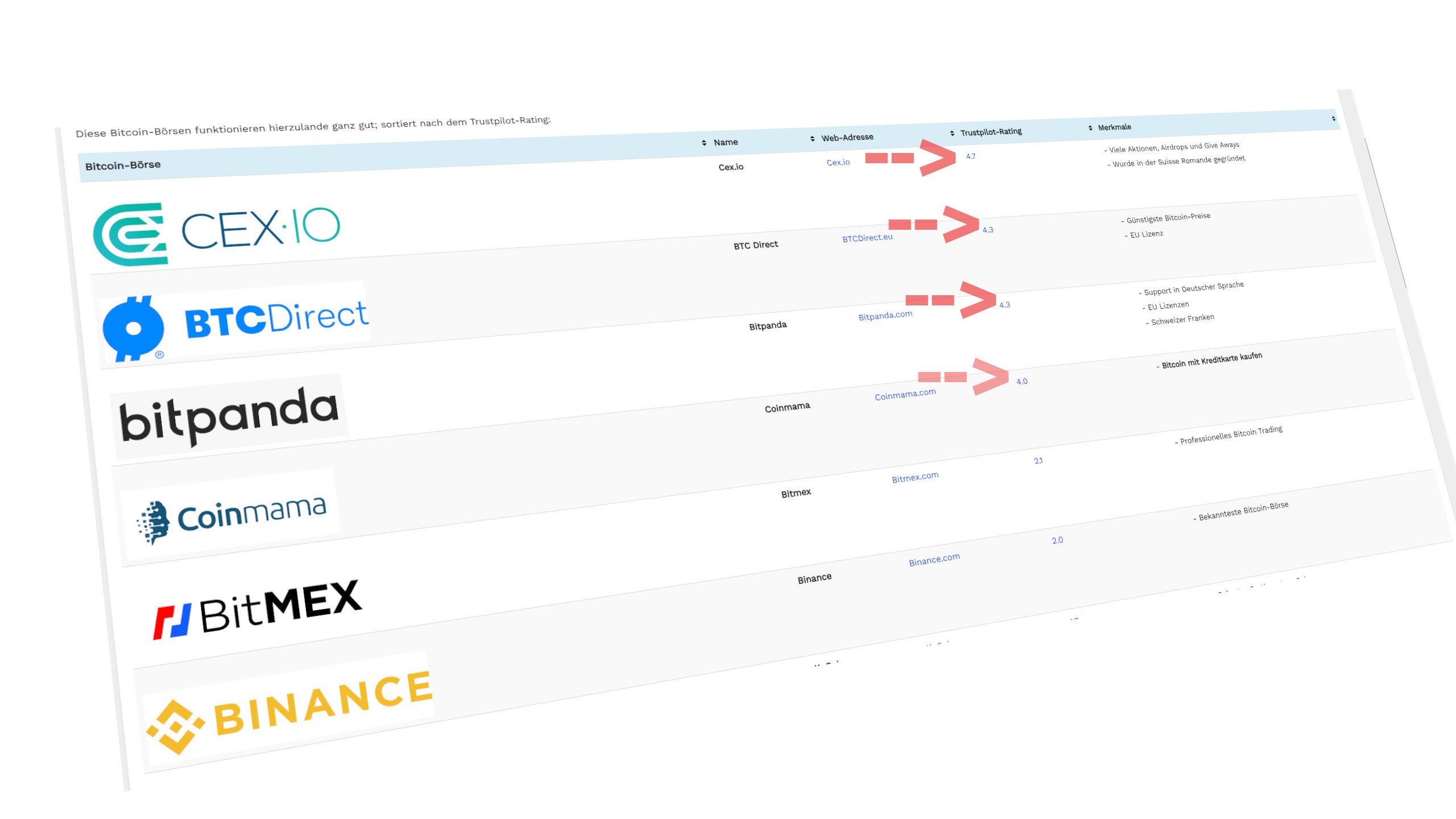

Bitcoin-Börsen Sortiert Nach Bei Trustpilot Classification