Experts see a great future for Ethereum, despite market conflicts

Amid the ongoing market challenges for ETHEREUM (ETH), industry experts make amazing comparisons between the current situation of cryptocurrencies and early growth paths of technology giants such as Amazon (AMZN), Microsoft (MSFT) and Tesla (TSLA).

They claim that investing in ETH is now similar to buying high -growth shares a decade ago, with the expectation that Ethereum will eventually make great gains in the future with increased adoption.

Ethereum origin is the next big growth?

In a detailed post on X (previously Twitter), Defi Dad claimed that many investors are mainly offered ETH pricing. According to him, ETH is evaluated as a stable and directed stock towards value instead of high -growth assets that have the ability to become.

Please stop trying ETH analysis like ProCter & Gamble. Buy ETH closer to buying high -growth stock like Amzn, MSFT or TSLA for decades, ” I mentioned.

The analyst suggested that this is the decisive time “for the potential domination of ETHEREUM in the Blockchain space. Ethereum stressed its continuous innovation, but instead of giving priority for the growth of immediate user, the network focused heavily on security. Put this commitment to reliability ethereum as a more trusted settlement layer in the industry.

He added: “The ETHEREUM strategy for the development of EVM dominance can resemble the Amazon.”

In addition, it highlighted the role of layer 2 (L2) solutions in the eTHEREUM ecosystem. While the L2S was not profitable for Ethereum, the expert is believed to be working as a basic distribution network.

Defi Dad noted that ETHEREUM, such as Bitcoin (BTC), turned into a trusted origin, and attracted Wall Street investors and governments that initially questioned cryptocurrencies. He highlighted that Ethereum is now the favorite Blockchain for banks and institutions that enter the space on the series, although they reserve the possibility of disrupting these same entities.

Another expert chanted this perspective. He suggested that the price of Ethereum may suffer from ascending momentum if investors start confidence in seeing L2 scaling solutions. Since the market recognizes the possible future benefits of these expansion improvements, the demand for ETAREM may increase, which causes its price up.

“It is like growth shares (Uber, Netflix Etc): First get users, from revenues come,” Ignas books On x.

He is Ethereum in a downward cycle? Market trends indicate this

This view comes amid the difficult market conditions of ETH. Since late 2024, ETH was on the continuous declining direction. In fact, Altcoin threw 29.4 % of its value last month alone.

At the time of writing this report, ETH was trading at $ 1948, which reflects a modest increase of 2.6 % in the past 24 hours.

Beincrypto recently reported that ETHEREUM’s daily active headlines have reached an annual decrease, which raised concerns about the low risk of adoption and inflation. The market hegemony of Ethereum also declined to the levels that were last seen in 2020, exacerbating investor concerns.

In another ETH expectation, Standard Charreed recently reduced its goal of 2025 goals for ETHEREUM by 60 %, which reduced it from $ 10,000 to $ 4,000.

“We expect ETH to continue its structural decrease, and we reduce the target price level at the end of 2025,” indicated by Jeffrey Kendrick, the international head of digital asset research at Standard Chartered.

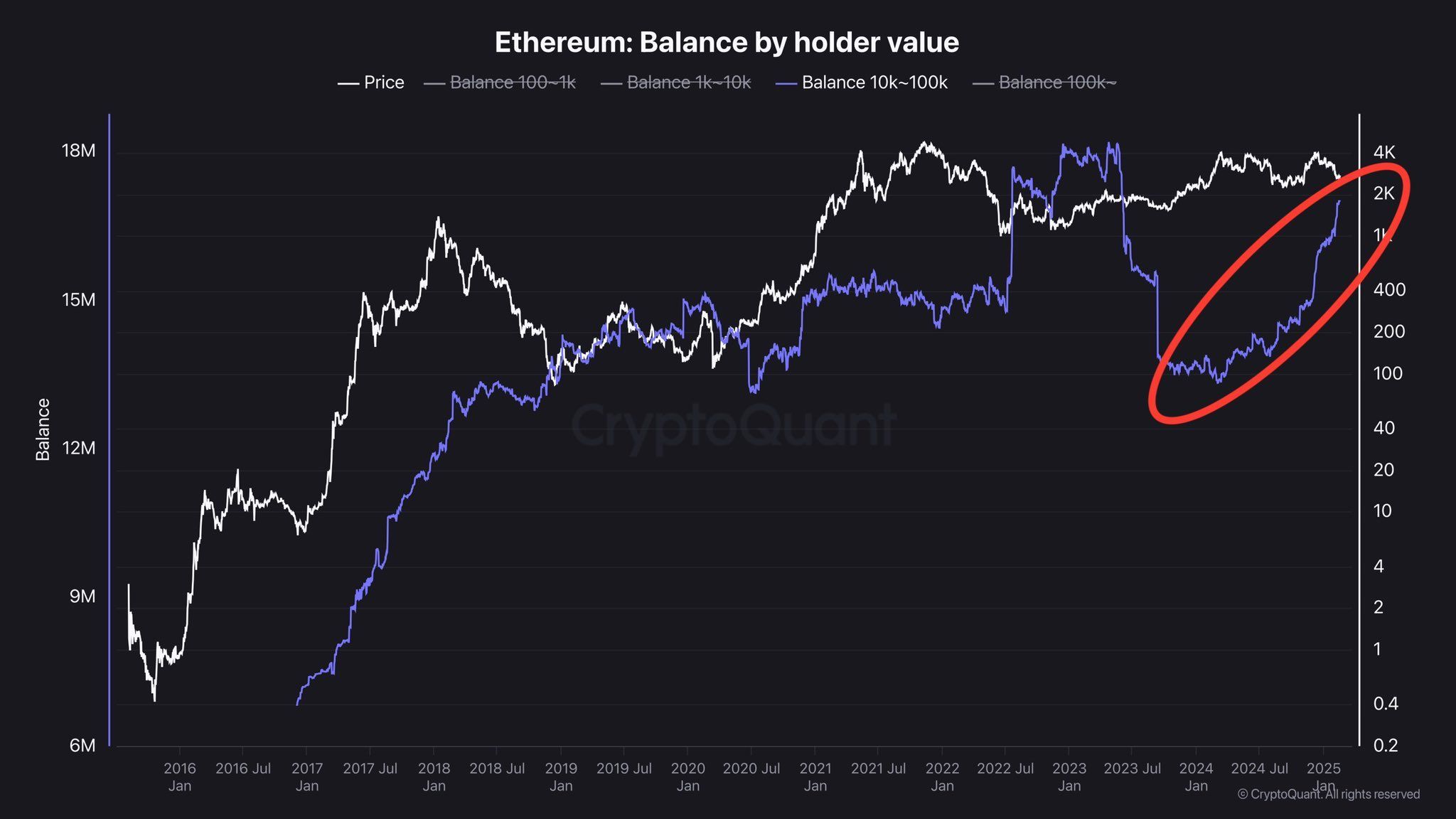

Nevertheless, the data on the series suggested a contradictory narration. Analyst Queen Francois revealed that the whale governor – investors who hold large quantities of ETH – may increase the currency increasingly.

The analyst pointed out that “adult holders buy strongly. They play you.”

This has alluded to the bullish feelings in the long term between institutional and high investors.

While Ethereum’s expectations in the short term are still unconfirmed, these developments indicate that institutional players are still putting themselves in the ETH ecosystem. Whether Ethereum follows the path of technology giants or faces more market challenges.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.