Bitcoin Golden Cross in Play – The analyst reveals the best course of work

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin price during the past 24 hours has been no less than wonderful. After integrating for several days in a tightening scope, the market exceeded the support zone, which turned to $ 10,5503 earlier this week and began a sharp rise on the last trading day. This allowed Bitcoin to pay In new levels at all, And no signs of slowdown appear.

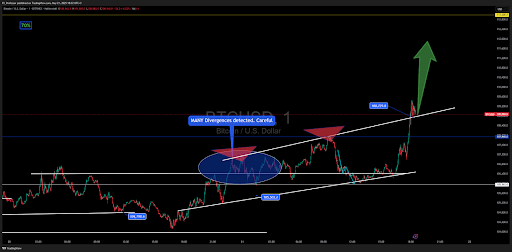

Interestingly, technical analysis shows that the gathering starts Golden Cross approach Between the moving averages 50 and 200 days, the FX_PROFESSOR provided a different experience on the golden cross that was very detained.

The noise analyst analyzes the golden cross as a late signal

In a conversation The analysis published on TradingviewFX_PROFESS more due to the golden cross for Bitcoin. While most of the market commentators explain this intersection on a simple moving average for 50 days above 200 days as a strong upward assertion, the analyst rejected it as a delay index. The analyst described it as the effects where retailers are late late at the scene of the accident.

Related reading

Instead of waiting for gold Transit to Flash GreenFX_professor noticed the pre -will pressure areas as the true signal of the value. In the event that the Bitcoin price is made in recent months, the analyst pointed to a $ 74,394 region and $ 79,000 as an area of accumulation and early positions, before the golden cross is visible. As such, by the time when the cross appeared recently, the bitcoin price procedure had already increased significantly.

The golden cross is often used by merchants as a sign to enter a long position, as it indicates that the price of the original is likely to continue to rise. However, this analysis follows a trend between experienced traders who look at the golden cross as more than a backward assertion more than the assembly player.

The analyst says that early entry and structure areas are more important

According to FX_PROFESOR, indicators like EMAS or SMAS can be useful but should never come before understanding the price structure, trend lines and actual time pressure areas. Share a snapshot of its Bitcoin price scheme that combines the custom EMAS with a parallel signature method to discover the place of starting the price. Video on the graph are inputs that are formed early in April when Bitcoin Support wore about $ 74,000A long time before Cross confirmation.

Related reading

Now, with bitcoin pushing Towards the next target area Nearly $ 113,000, the analyst’s strategy continues to verify itself in actual time. However, the affirmation of the golden cross is still optimistic about the movement of Bitcoin prices to move forward, even if the rise in the middle of the road is to the peak level.

At the time of this report, Bitcoin is traded at $ 110,734. This is a slight decline from the highest new level ever at $ 111,544, which was recorded just three hours ago. Bitcoin price continues to rise by 3.1 % over the past 24 hours, and new high levels can be ever possible before weekly closure.

Distinctive image from Getty Images, Chart from TradingView.com