ETHEREUM’s Taker-BUY-Sell Rases-Is 3000 dollars imminent?

ETHEREUM (ETH) has been traded within a narrow range since the beginning of February, and swings between the main support levels and resistance levels.

However, despite this side price movement, futures dealers are still flexible while continuing to open purchase contracts, indicating confidence in ETH capabilities.

The futures market in Ethereum appears flexibility

Readings from the ETH/USD graph reveal for one day that the pioneer altcoin has been circulated inside a horizontal channel since the beginning of the month, where it faces resistance at $ 2,799 while supporting support at $ 2585. Nevertheless, its future merchants maintained their upscale position and increased their purchase orders.

One of the main indicators of these upcoming feelings is the percentage of the ethereum professional, which has risen to its highest point since early January. According to Cryptoquant, it is at 1.09 at the time of the press.

The buyer of buyer of the assets of assets measures the proportion of purchase and sale sizes in the future contract market. The above values indicate the purchase of more than the sales volume, while the values mentioned below indicate that more future traders sell their property.

The advanced selling rate in those heading at 1.09 reflects the increasing optimism among its future traders, amid the performance of its flat prices in the past few weeks.

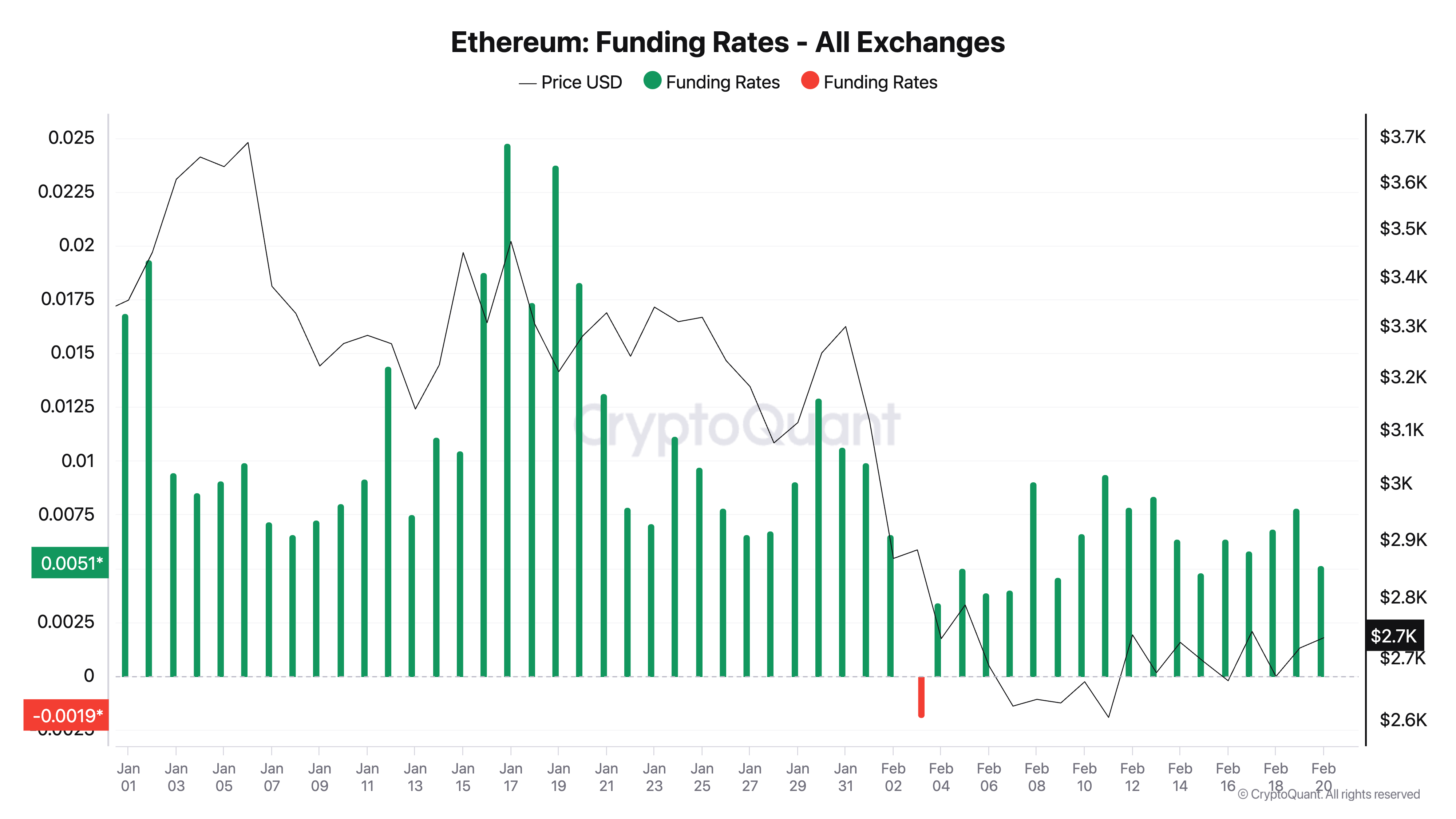

Moreover, the ETH financing rate remained positive amid the standardization of prices. To this writing, the scale is at 0.0051 %.

The financing rate is the periodic payment that is exchanged between long and short future contract holders based on the difference between the immediate price of the asset and the price of futures. When the asset financing rate is positive, this means that long -standing holders pay an acronym, indicating the market bias towards upward morale.

During the unification periods of such prices, a positive financing rate indicates that buyers are ready to pay in addition to job jobs, which indicates confidence in the capabilities of the original to separate upward once the standardization stage ends.

Bulls ETH is looking to break $ 2,758 – a road to $ 3000?

A possible lounge over the resistance at $ 2,799 can pay for $ 2,967. If the ETH request reinforces this level, it may gather above $ 3000 decisive The price point to trade is at $ 3,202.

However, if the bears are regained and imposed a lower rest of support at $ 2,585, the ETH price may decrease to $ 2,467. If the bulls are unable to defend this level, the decrease may last to $ 2,150.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.