ETHEREUM Prices Predicting: Short Long Long Long Long Live Signs

ETHEREUM (ETH) is currently $ 1,594, indicating a 1.90 % decrease over the past 24 hours, as traders interact with a mixture of derivative market activity, reckless trends and whale movements.

The symbol witnessed a decrease of 5.23 % since it reached a height of $ 1,682 on April 14, 2025, indicating short -term declining feelings.

The price of Ethereum may decrease to $ 1500 if the support allows the field

The motivation behind short -term homosexuality is driven by an unprecedented flow from 77000 ETH to a derivative exchange, a pattern that often warns of sharp prices.

This increase in derivative activity, according to Macro analysis in April and the series by CryptoquantIt exceeds the previous peaks of 65000 ETH, indicating increased fluctuations, with ETH test now decisive support levels on the plans.

In the time frame of the hour, the price approaches biological support at $ 1551, and slipping to this may lead to a decrease to the $ 1500 region, which leads to an exaggeration of a declining mood.

With regard to this pressure, the backed ethereum balance is 120,000 ETH in just five days, which suggests that the icons that are not full of symbols may reach the market soon, increasing the potential of the sale.

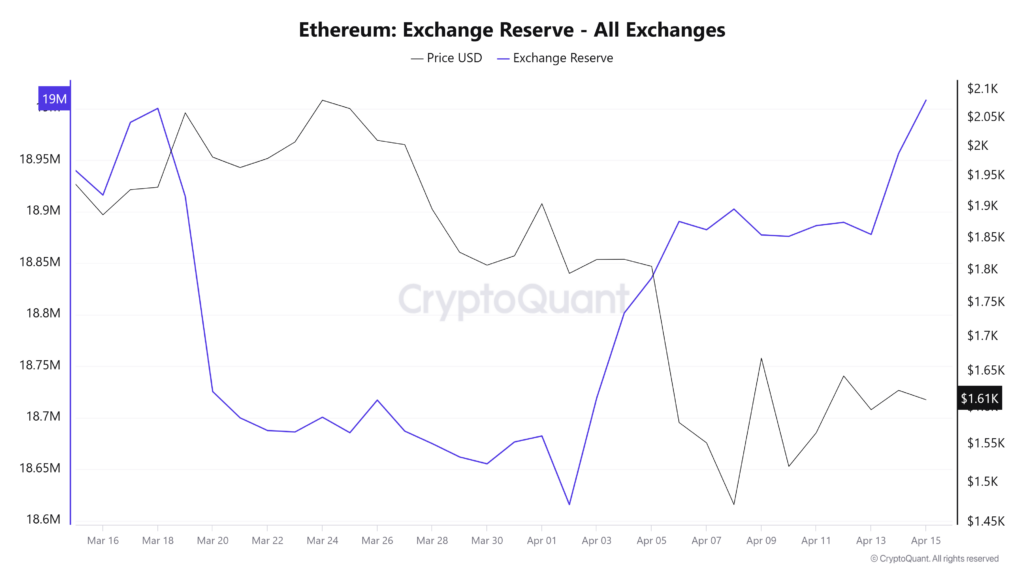

This volatile reduction coincides with about 192 million dollars, coincides with a leap in ETH’s Exchange, which rose by about 400,000 ETH since early April, when he withdrew the price for a short period of $ 1500 last week.

Such a height of exchange reserves often indicates that more distinctive symbols to seize them, which usually leads to the movement of the descending prices with the demand for supply.

However, in the midst of these challenges, adult holders, which are better referred to as whales, began controlling between 10,000 to 100,000 ETH in buying again, and set 320,000 ETH within the past 48 hours after unloading 570,000 ETH earlier this month.

The accumulation of renewable whales may enhance the price of ETH, providing a temporary store against the pressure pressure of renewable external flows and the growth growth growth, though this The whales recently transferred 20,000 ETH (about $ 32.4 million) to KrakenWith concerns about the potential sale process and overcoming short -term expectations in the short term.

A possible gathering if ETH crosses more than 1,600 dollars

Technically, the ETH at a crossroads, as it seeks to the lower border of a similar triangle style on the graph for 4 hours, where the bulls should carry a company to avoid a deeper segment.

If the minimum limits persist, the price may rise more than $ 1,600 and challenge the resistance of $ 1,688, characterized by a line of descending direction from late March, with an outbreak that is likely to lead it to $ 1,800.

However, the decline may see a decrease in the ETH to $ 1522, and if this fails, the next station may be $ 1412, a crucial level to keep upside down hopes.

Indicators such as the RSI and Stochastic oscillator tend to be neutral, indicating the increasing landmark that can intensify if support allows the field.

On the daily chart, ETH was unable to benefit from $ 1,689 a reflection, and a weak closure can see today that it was drifting about $ 1450 – $ 1500 soon.

In the middle of the period, caution prevails as the support of $ 1537 is under pressure, and the violation here may raise a decline to $ 1,300, and it weighs the confidence of investors.

Despite these obstacles in the short term, Ethereum horizons shine in the long term, fueled by optimism about institutional adoption and the rise of the ETHEREUM current -based investment funds.

Experts expect that ETH will rise to between 6000 and 14,000 dollars by 2025, and its central role in decentralized financing (Defi) and unlawful symbols (NFTS) pushes, along with the increasing interest of companies.

Defi, with more than $ 47 billion closed on ETHEREUM, restores liquidity after childbirth, although $ 937 million in centers is still weak if ETH decreases to $ 917.99, and links the fate of the currency to the stability of the sector.

DEFI borrowers play safely, setting the liquidation rates about $ 917.99, with a few situations at a risk between $ 1,400 and 1500 dollars, reflecting a guarding approach among volatile markets.

The broader economic factors, such as fears of the American customs tariffs on China, also dare to ETH, where global trade is alternately related to encryption markets.

These identification concerns, related to suggestions during the last Trump era, have disturbed the exporters, and partly explained the decline in those who wish recently as investors have surrounded their bets.

However, the founding Ethereum foundation in Defi and NFTS, as well as promotions such as ethereum 2.0, keeps it ready to succeed in the long term, even as the disturbance continues in the short term.

Since ETH dances around critical technical levels, market monitors must weigh these short -term tensions against strong basics that indicate a brighter future.