ETHEREUM Prices Analysis: Eval for ETH expectations after decline to $ 1,800

ETHEREUM continues to face pressure after its rejection from the $ 2100 region, with the price decreased now below the main support levels and the low demand areas test.

Technical analysis

Daily chart

In the daily time frame, ETH is still firmly in a declining structure, continuous and its highest level. Refusal from the $ 2,200 region and a later collapse less than 1900 dollars declining momentum, as the price is now turning towards the next main demand area of about 1,600 dollars.

The moving average for 200 days also goes down a little bottom and sits much higher than the price movement, which enhances the long -term declining bias. Moreover, the relative strength index hovers near the sale area, but without any upward difference or momentum, there is a minimal sign of reflection. Unless ETH $ 2200 with a strong conviction, the less resistance path remains on the negative side.

The graph for 4 hours

The graph for 4 hours confirms the collapse of the emerging canal that has supported the previous recovery attempts to ETH. The price failed to stick to a level of $ 1900, which served as support during monotheism, and is now declining, at about $ 1,800.

A clean rejection of $ 2,100 and sharp sale indicates that buyers quickly lost momentum, and the sellers entered strongly. The Relative Power Index is currently in deep sales lands, but without forming a strong structure or ascending structure, there is little evidence of attention to a decline. Currently, ETH looks weak, and even in the event of a short -term bounce, it may be directed at $ 1900 unless the strongest buyers enter.

Feelings Analysis

by Edris derakhshi (Tradingrge)

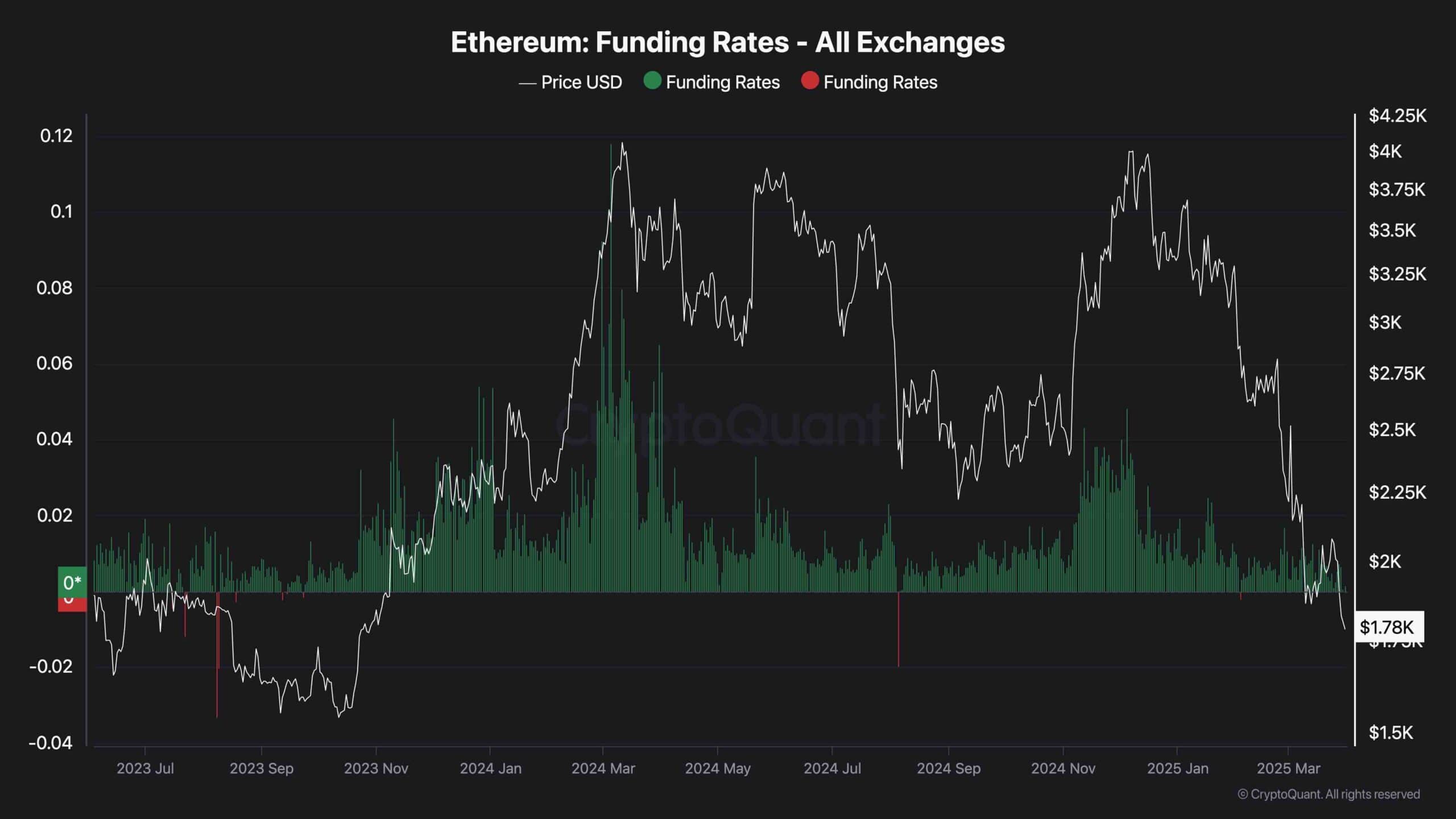

Funding rates

Ethereum financing rates in all major stock exchanges turned to a slightly neutral or negative, indicating a significant decrease in aggressive long positioning. This shift indicates that merchants have become more defensive and less prepared to chase the upward trend, which usually corresponds to the period of continuous negative cooling or erosion.

While neutral financing may reduce the possibility of a liquidation chain, it also indicates that confidence lacks a strong upward reflection. Feelings are still cautious, and unless there is a return to positive financing in addition to restoring the main technical levels, the market is likely to remain under pressure.

Post Ethereum Price: Evaluing ETH after decreasing to $ 1,800 first appeared on Cryptopotato.