How Ripple RLUSD became a fast -growing Stablecooin in June

RLUSD Stablecoin has gained a momentum, as one of the fastest growing assets has appeared in the encryption space.

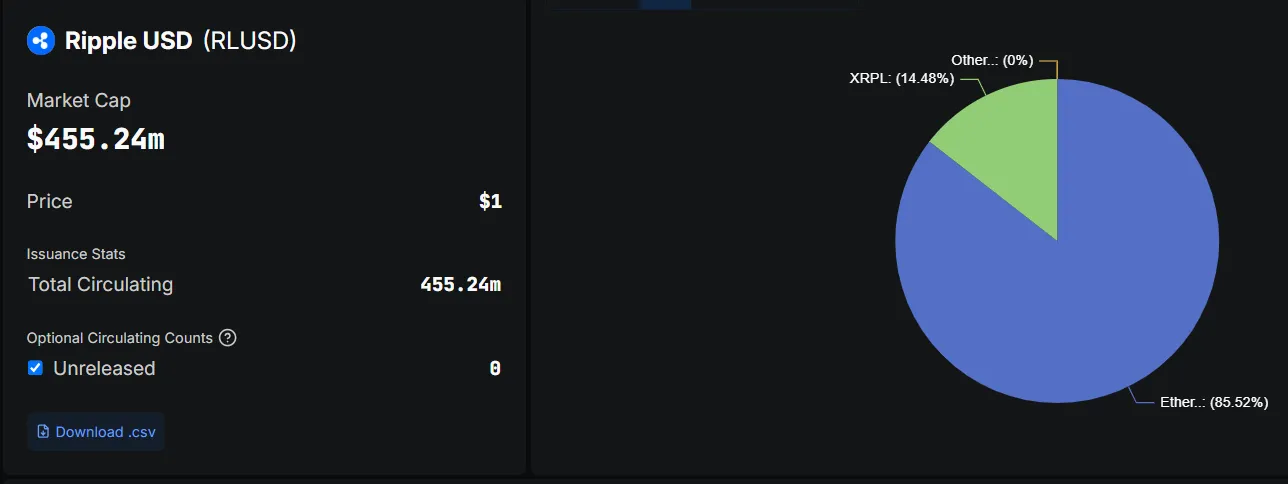

Defillama data reveals that the circulating RLUSD supplies increased by 47 % this month, reaching $ 455 million in June. This means that its supplies increased by more than $ 150 million this month.

Ripple RLUSD acquires land like ethereum quad supplies

According to DataNearly $ 390 million of RLUSD supplies on ETAREUM, while there are $ 65 million on the XRP book from Ripple.

It is worth noting that Stablecoin’s supplies on Ethereum have grown four times since January, according to the Blockchain analytics platform.

Market analysts noted that many of the main factors contributed to the impressive market growth in RLUSD.

One of the main drivers is the approval of the American genius law, which provides clear regulatory guidelines for the dollar -backed stability.

This legal framework is expected to encourage more growth in the sector by enabling Stablecoin version under well -specified regulations.

Moreover, the legal status of Ripple with the US Securities and Stock Exchange Committee (SEC) enhances the RLUSD resumption in this industry.

After a five -year legal battle, the CEO of Ripple Brad Garlinghouse announced that the company will rid it. This step indicates a possible end of the prolonged legal conflict.

Given, Market Observer expects the development development of RLUSD as a trusted Stablecoin as a body for players in this field.

In December 2024, Ripple RLUSD was launched as a US dollar Stablecooin designed to meet organizational standards and provide global access. Digital assets are promoted under the license of New York Trust and supported by short -term and cash funds.

In addition to the American legislative progress, RLUSD also obtained approval from the Dubai Financial Services Authority (DFSA), which is organizing the International Center in Dubai Financial (DIFC).

This approval allows companies within DIFC to use RLUSD for various virtual asset services, including payments and treasury management.

DIFC is home to about 7,000 registered companies and works as a major financial center for the Middle East, Africa and South Asia. This location is the way to the way for a broader accreditation for RLUSD across these areas.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.