ETHEREUM only 6 % away from the green monthly closure over $ 2.2 thousand

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

On Monday, ETHEREUM (ETH) has regained the support of $ 2000, supported by the market recovery. After reaching the highest level of two weeks at $ 2.104, an analyst indicated that the cryptocurrency may end positively.

Related reading

Ethereum approaches the monthly green closure

Within the past 24 hours, ETHEREUM has increased by 6.2 % of the $ 1980 brand to $ 2.104. Recovery at the beginning of the week eth made a re -test of the resistance of $ 2100 for the first time a week and near the decisive price range.

Amid the last performance, Rekt Capital male The price of the encrypted currency is “not far” from converting the deviation on the negative side into a negative fabric in the monthly timetable.

ETH decreased to less than $ 2,196 -3900 dollars on March 9, fell to 1750 dollars in the following days, and its lowest level since November 2023. After re-testing the historic demand yard, “Ethereum is now only +5 % of its mode to restore the macro component,” the analyst explained.

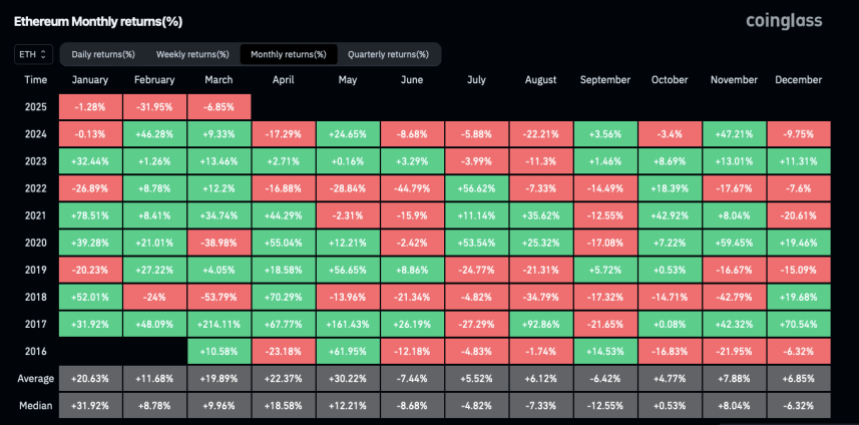

The restoration of this level before the closure of March will witness “this entire negative sub -side of $ 2200 at the end of my side.” Moreover, COINGLASS data shows that the current price procedure for ETHEREUM is 6.8 % away from March Green’s transformation.

The cryptocurrency was opened per month at $ 2237, and the closure of this bleeding chain may end for a period of three months. However, if it fails to close March with positive returns, ETH may face four months of red for the first time since 2018.

“King of Altcoins” has witnessed the worst Q1 in seven years, currently decreased by 37.46 % of the opening of 2025. However, ETHEREUM has historically witnessed Q2 up, with only the second quarter closed in red on two occasions.

The recovery of the lower group of the total group of ETH can see that the cryptocurrency climbs to its highest levels in the next three months.

Can the ETH 2200?

Analyst Ali Martinez Duplicate Outside the main levels to be monitored, indicating that the most important support zone in Ethereum ranges between $ 1,886 and $ 1.944, as more than 3 million investors bought about 6.12 million ETH.

Meanwhile, its most important resistance ranges between $ 2,250 and $ 2,610, with 12.28 million ETH 65 million titles.

He added that “a decisive break over this area would deny the Habbiya view.” Likewise, Crypto Jelle High This eth tries to restore the main resistance of $ 2200, which can nourish the “monster deviation” if it is recovered.

Analyst Ted Bodes suggested that the ETHEREUM manipulation stage “has almost ended.” Previously, the analyst confirmed that the ETH scheme offered a power of three (PO3) in making, indicating that the cryptocurrency is in the manipulation stage.

Related reading

According to the analyst, “a break over $ 2,200 and the expansion stage will start.” he male This hack can be possible as Eth Retted Support LePriendline Support, which has been re -tested only three times since 2021.

Another twice, “they have been distinguished by the session,” which may indicate that ETHEREUM’s bleeding is preparing to recover if he repeats his historical performance.

As of the writing of these lines, ETHEREUM is trading $ 2090, with a rate of $ 4.3 % in the daily time frame.

Distinctive photo of Unsplash.com, Chart from Tradingview.com