Ethereum leads Q1 2025 DAPP fees with $ 1.02 billion

In the first quarter of 2025, ETHEREUM strengthened its main position in the decentralized application platforms sector (DAP), with $ 1.021 billion of fee revenues.

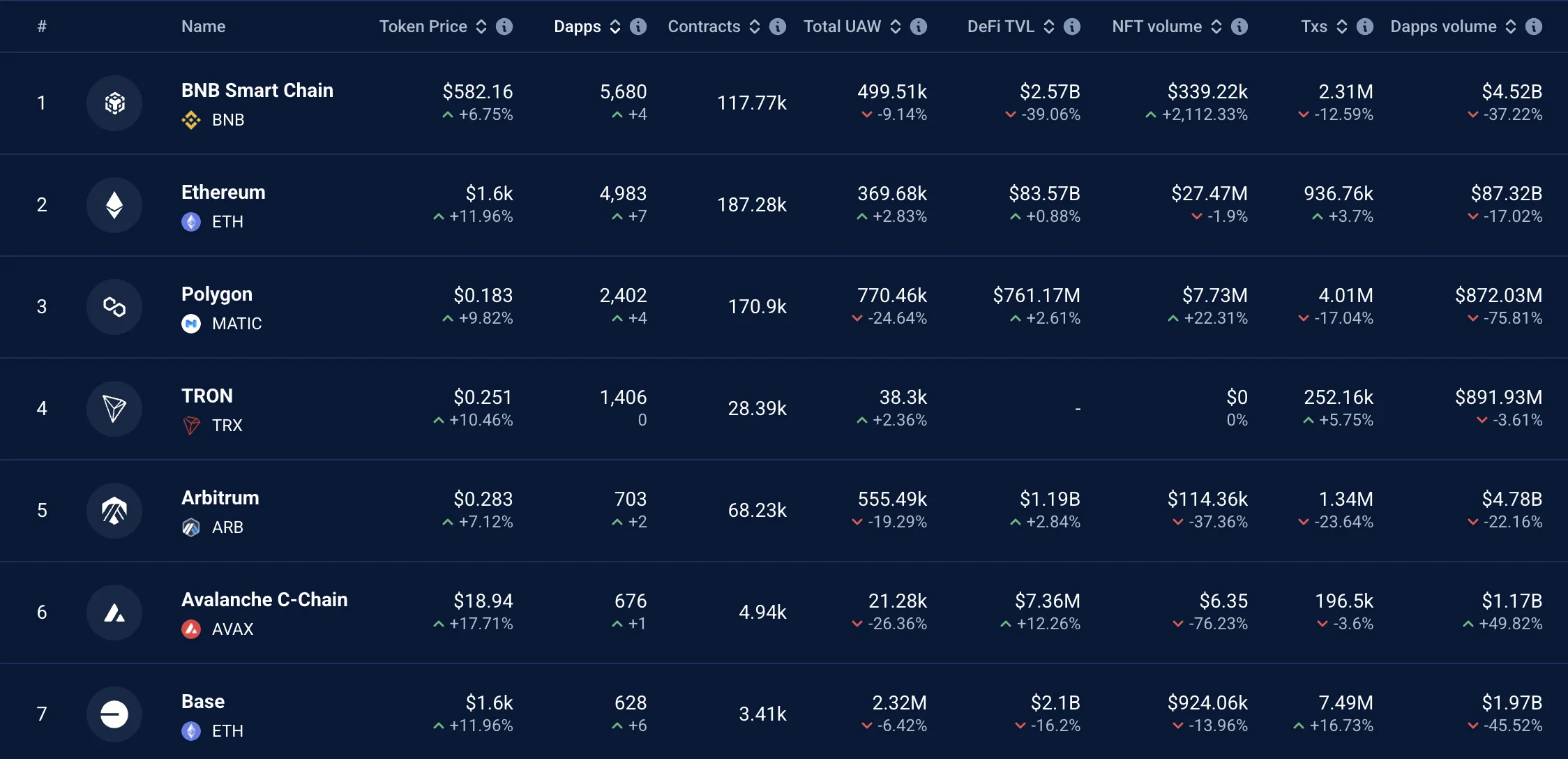

Other networks such as Base (Coinbase’s Layer-2), the BNB, Irvi series, and the Avalanche C-Chein series are recorded, but are late for ETAREUM.

Llockchains revenue scene between Blockchains

According to Taken Terminal, ETHEREUM maintained his higher position among DAPP platforms, with DAPP fee revenues of $ 1.021 billion in the first quarter of 2025. This number sheds light on Etherum dominance and strong growth within the DAPP ecosystem.

Base, Coinbase Layer-2, ranked second with $ 193 million of DAPP fee revenues, which show remarkable but still behind Ethereum. The BNB series followed the third place with $ 170 million, the definition of $ 73.8 million, and the Cvalanche series in fifth place with $ 27.68 million.

DAPP FEES revenue is a major measure for Blockchain activity and user value. On ethereum, popular DAPS includes Defi protocols such as Uiswap and AAVE, NFT platforms such as Opensea, Blockchain games, and social applications. The growth of the DAPP fee revenue in Ethereum indicates the high demand for these applications despite competition from other networks and the costs of high transactions (gas fees) are often on Mainnet.

Why ethereum performs

Several factors explain the continuous ethereum leadership in DAPP fee revenues. First, Ethereum was the first Blockchain supporting smart contracts, and laying the foundation for its DAPP ecosystem. According to DAPPRADAR data, Ethereum is still Blockchain with the largest DAPPS, as it hosts more than 4,983 DAPPS active, below the BNB series.

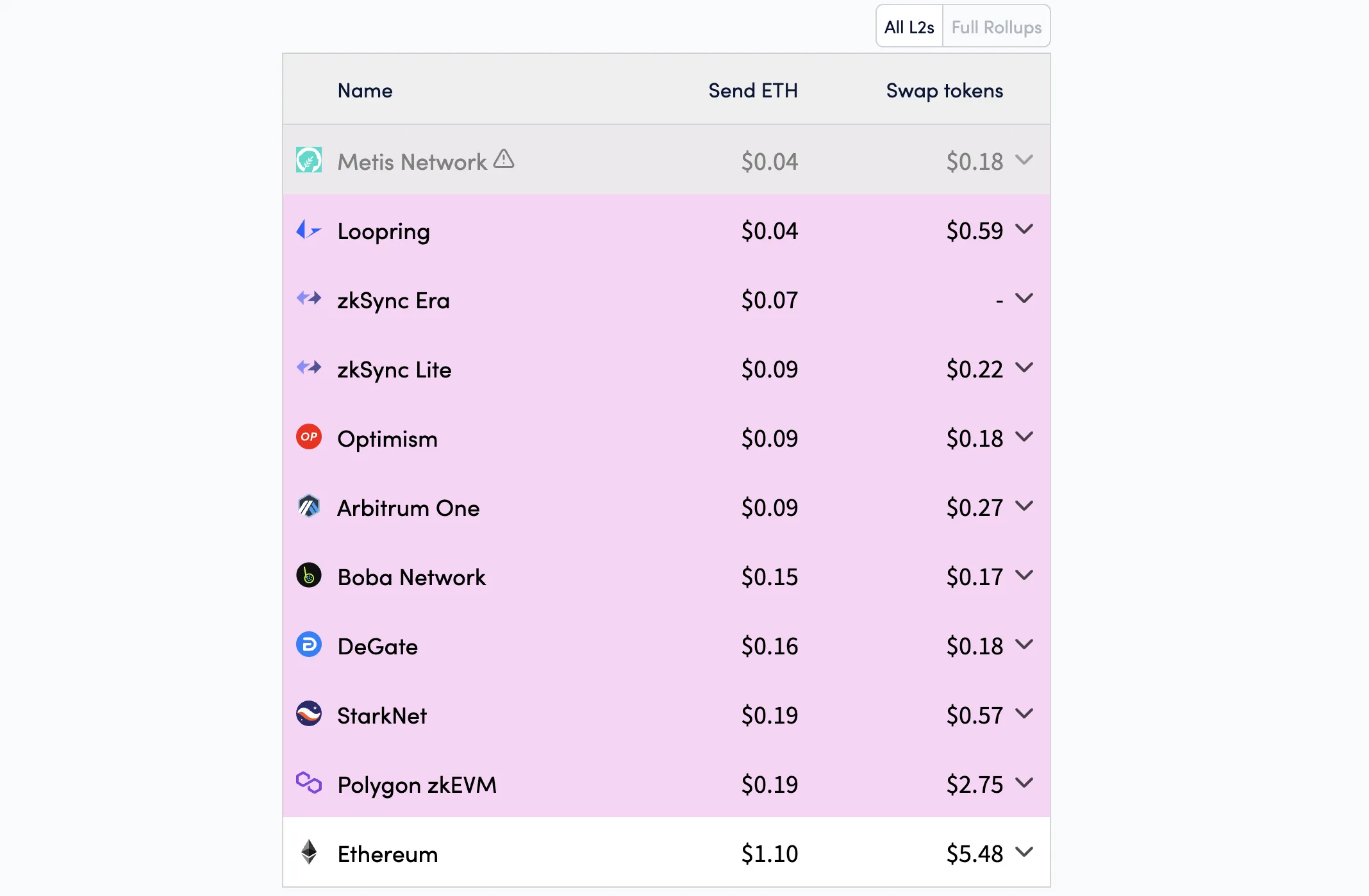

Second, it makes it security and reliability of ETHEREUM, the preferred option for developers and users. Despite the high costs of Mainnet transactions, ETHEREUM improved performance through promotions such as Dencun (performed in 2024), which reduced costs on layer 2 networks and enhance expansion.

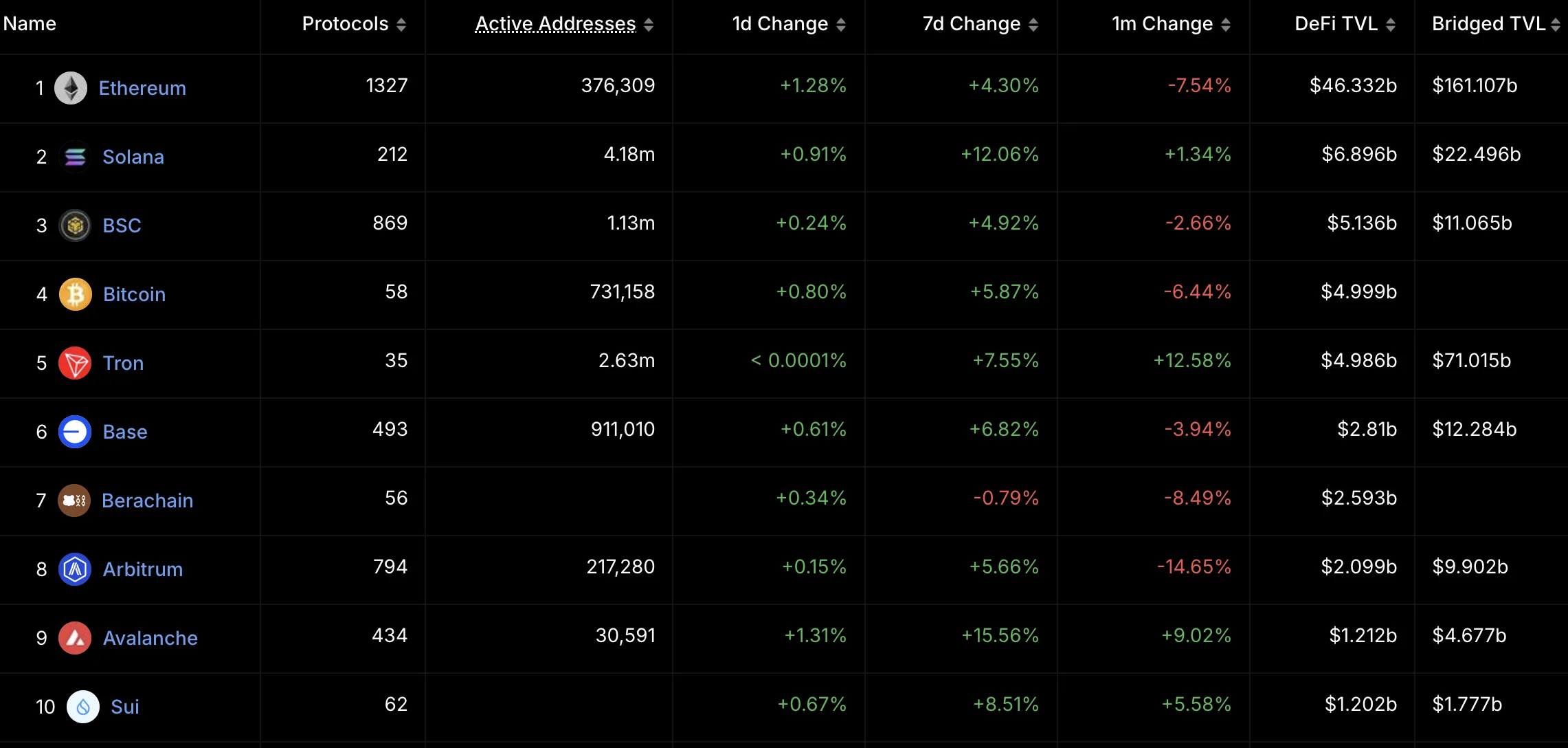

Third, the ethereum ecological system remains a major driver for fee revenues. According to Defillalama, the total closed value (TVL) in Defi’s Ethereum Protocols reached $ 46 billion, and represents 51 % of TVL in the Defi Market.

While Ethereum performs, other networks also show great growth. According to Tokeen Terminal, Base, Layer-2’s Coinbase achieved $ 193 million of DAPP FEE revenues, 45 % over Q4 2024.

The BNB series, which includes $ 170 million, is still a strong competitor due to low costs and diversified ecosystem, including platforms like Pancakeeswap. Arbitrum, another ETHEREUM-2, recorded $ 73.8 million, driven by Defi and Blockchain Gaming DAPPS. With $ 27.68 million, Avalanche Crrrr-Rist excels in financing and NFTS but cannot match the ETHEREUM scale.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.