ETHEREUM (ETH) cannot violate $ 2000 as sellers control

ETHEREUM (ETH) is still struggling without a $ 2000 mark after he briefly reached the threshold after the last FOMC meeting. The bullish momentum has faded quickly, and ETH again shows signs of weakness.

Technical indicators, including RSI and DMI, indicate an increase in the short -term pressure. Traders are now monitoring the main support and resistance levels to see if the ETH will continue to correct it or try to recover.

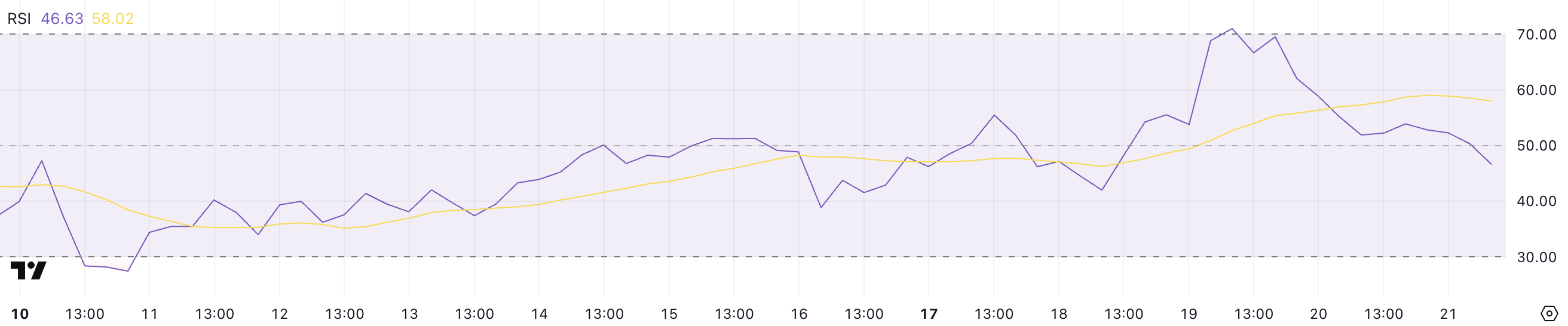

Ethereum RSI has decreased after touching peak levels

The ETHEREUM lineage index fell sharply to 46.63 out of 71 only two days ago, indicating a transformation in the momentum.

RSI is a momentum that measures the speed and change of price movements, usually on a scale from 0 to 100. Readings above 70 suggest that the original may excel, while levels of less than 30 indicate that they may be sold.

With ETH, RSI is now near 46, entered a neutral area, indicating that the last upscale momentum has faded. This may mean a period of monotheism or more risk of the negative side if sellers maintain control.

Traders may now expect ETH stability and bounce in the event of a return to the request or continue to correct it if the downward pressure is more powerful.

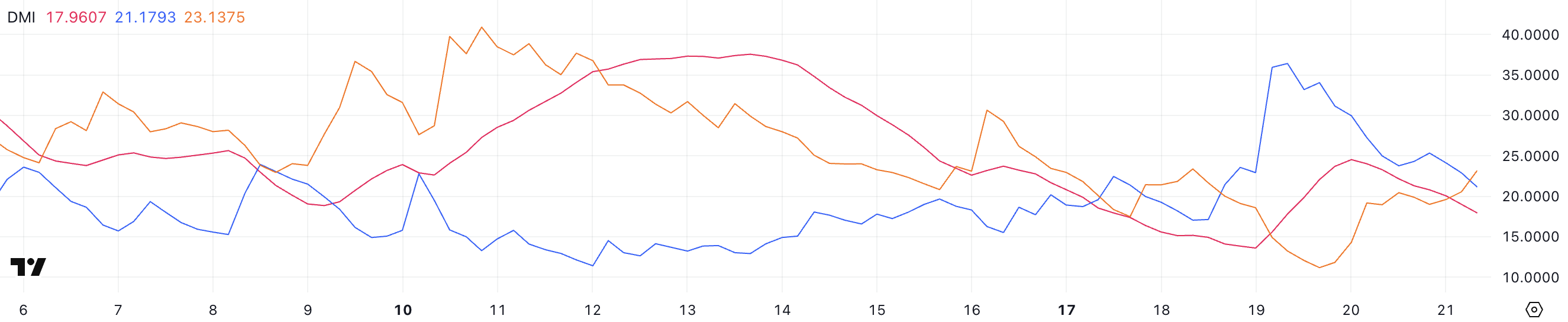

Eth DMI shows sellers again in control

The DMI chart from Ethereum explains that ADX has decreased to 17.96 from 24.5 yesterday, indicating twice the strength of the direction.

The average trend (ADX) measures the strength of the trend, with values above 25, which indicates a strong direction and values less than 20 indicates a weak or ranges market.

Meanwhile, ETH +Di fell to 21.17 out of 34, indicating that the bullish momentum fades. Meanwhile, -Di rose to 23.12 of 11.17, indicating an increase in the declining pressure.

With the ADX and -Di crossing over +DI +, ETHEREUM may face additional aspect or enter the standardization phase where sellers acquire more effect on the price procedure.

Can Ethereum 30 % increase?

The Ethereum price is currently in a corrective stage, and if this trend continues, it may test the main support levels at $ 1867 and $ 1,823.

The collapse below these areas can open the door for a deeper decrease of about $ 1759, with the risk of ETH to less than $ 1700 for the first time since October 2023.

However, if Ethereum is able to reflect the current declining direction and restore bullish momentum, this may lead to resistance at $ 2,106.

It can see the most powerful ETH rav with $ 2,320 and up to $ 2546, providing a possible rise of about 30 % of the current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.