Ethereum crumbles as Solana steals the show: What’s next?

Solana now processes an average of 60 million daily transactions compared to Ethereum’s 1 million, proving that scalability matters more than reputation in today’s blockchain wars. Is Ethereum dead?

Ethereum’s fight for relevance

From being celebrated as a pioneer in smart contracts to now facing relentless competition and internal discord, Ethereum’s (ETH) journey has started to look less like a steady climb and more like a rocky descent.

To understand Ethereum’s predicament, let’s rewind to November 2021, when its total value locked hit an all-time high of $107 billion, riding a wave of optimism as ETH’s price surged to a lifetime high of $4,890.

Fast forward to the end of 2023, and that number had dwindled to just $30 billion — a staggering decline. Although 2024 offered a glimmer of recovery, with TVL climbing to $66 billion by mid-year, as of January 2025, Ethereum remains stuck at $64.5 billion.

Meanwhile, its closest competitor, Solana (SOL), has scripted a far more compelling comeback story. After plunging from a TVL of $10 billion in late 2021 to a mere $210 million in early 2023, Solana roared back to life, hitting an all-time high of over $12 billion this month — outpacing Ethereum’s recovery in both speed and scale.

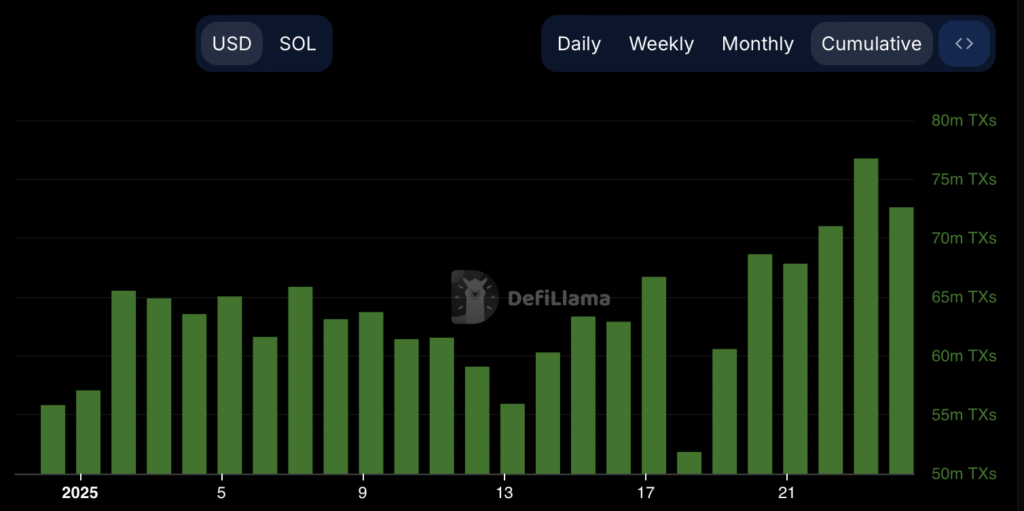

Beyond TVL, Ethereum appears to be losing ground on critical metrics like transaction volume and user fees. While Ethereum processes an average of 1-1.2 million daily transactions as of early 2025, Solana dwarfs this with a jaw-dropping 60-65 million transactions per day.

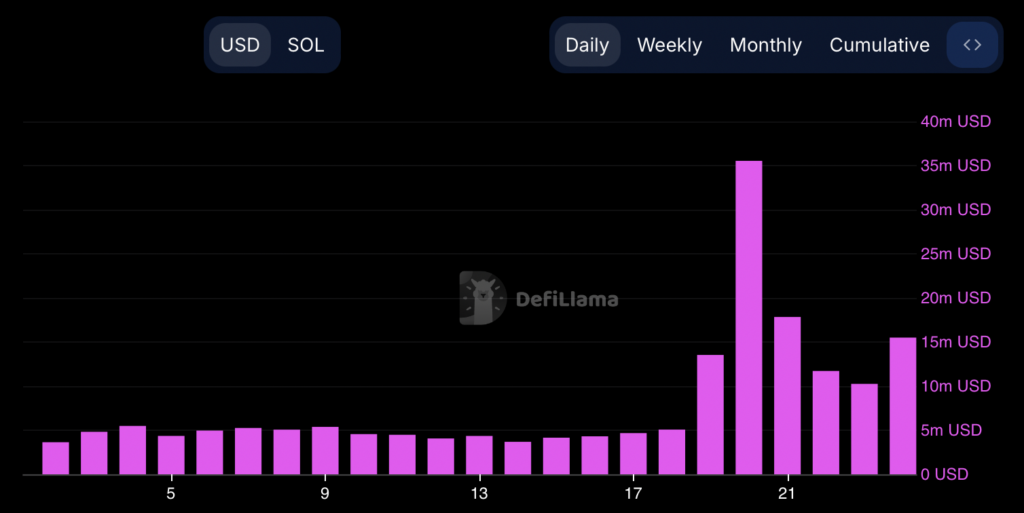

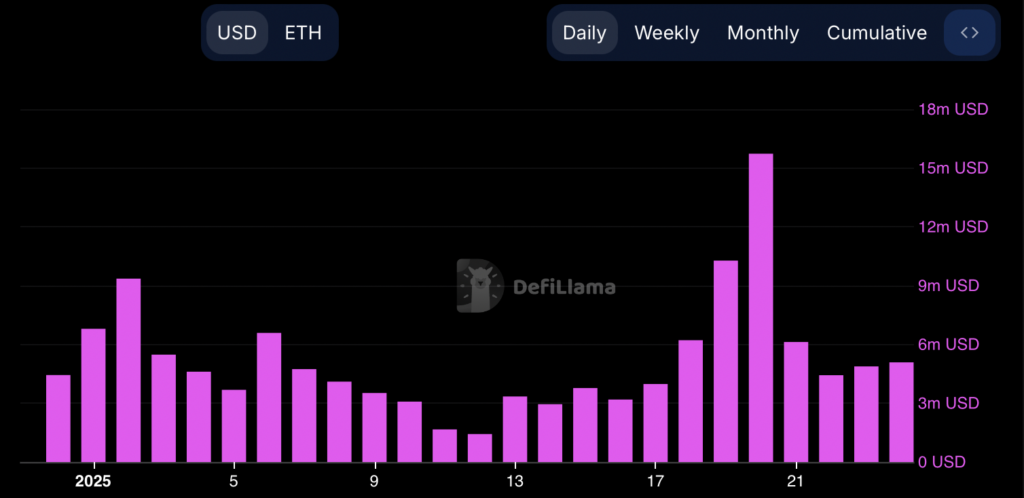

And despite Ethereum charging higher fees per transaction, Solana’s daily fee volume is consistently higher, averaging $5-6 million this month and peaking at $35 million during the buzz surrounding the inauguration of Donald Trump as the 47th U.S. president. In comparison, Ethereum’s fee volume hovered around $3-4 million on average, with a modest spike to $15 million on the day Trump was inaugurated.

Let’s dive deeper into the concerns surrounding Ethereum and how this once-blockchain pioneer is having a run for its life.

The Ethereum Foundation’s identity crisis

Ethereum’s struggles are not limited to technological hurdles. The Ethereum Foundation (EF), a nonprofit organization long viewed as the backbone of Ethereum’s development, is itself in a state of upheaval.

Internal discontent, growing competition, and questions about the foundation’s vision have left the EF grappling with its identity at a time when Ethereum’s future has never been more precarious.

The pressure has led Ethereum’s co-founder, Vitalik Buterin, to step in with sweeping plans to overhaul the EF’s leadership structure.

For over a year, Buterin has been quietly working on a restructuring initiative aimed at addressing inefficiencies and improving communication between the EF and Ethereum’s developers.

“We are in the process of large changes to EF leadership structure,” Buterin revealed in a recent X post, adding that the ultimate goal is to establish a “proper board” to guide the foundation.

Yet, this effort has not been without controversy. Critics argue that Buterin’s central role in the process undermines Ethereum’s ethos of decentralization. Others see it as a necessary intervention to salvage the EF’s declining reputation.

One of the EF’s most polarizing strategies is its reliance on a “rollup-centric” roadmap, which prioritizes scaling Ethereum through layer-2 solutions.

While these rollups have improved transaction speeds and reduced costs, they’ve also introduced new risks, such as diminished security guarantees and declining base fee revenues for Ethereum’s core network.

Critics argue that these trade-offs highlight the EF’s inability to deliver a long-term scaling solution that rivals like Solana have already achieved.

Solana’s ability to handle millions of transactions per day with near-zero fees has become a glaring benchmark, leaving Ethereum struggling to keep pace.

Adding to the turbulence is the controversy surrounding Aya Miyaguchi, the EF’s executive director since 2018. Accusations of inefficiency and conflict-of-interest scandals have dogged her leadership, leading to a wave of online criticism and even a social media campaign calling for her resignation.

While Miyaguchi remains in her role, the backlash has grown toxic, with some critics resorting to personal attacks and threats.

Buterin, visibly frustrated, took to X to condemn these actions as “pure evil,” warning that they are driving top developers away from Ethereum.

“Some of Ethereum’s best devs have been messaging me recently, expressing their disgust with the toxic social media environment,” Vitalik tweeted recently, pushing back against calls for leadership changes at the EF.

He sharply critiqued, “YOU ARE MAKING MY JOB HARDER,” slamming the social media trollers and disgruntled users, as frustrations over stalled innovations and a hostile online community take center stage.

The Second Foundation: A competing vision for Ethereum’s future?

In December 2024, Konstantin Lomashuk, the founder of Lido — a protocol managing over 28% of Ethereum’s staked ETH — dropped a hint on X about plans to reshape Ethereum’s ecosystem.

The idea, which he called the “Second Foundation,” was initially teased as a way to introduce competition to Ethereum’s leadership and decision-making processes.

On Jan. 22, Lomashuk doubled down on this vision, sharing an official page for the Second Foundation on X, signalling that this wasn’t just an idea.

— Konstantin Lomashuk cyber/acc (@Lomashuk) January 22, 2025

The Second Foundation is designed to decentralize power within Ethereum by creating a parallel entity that challenges the Ethereum Foundation. Lomashuk has been critical of the EF’s insular structure, describing it as “super deep” and inaccessible to outsiders without years of research expertise.

“Without competition, we risk losing the right path,” he wrote in a December post. The Second Foundation, he believes, will bring fresh perspectives and faster innovation to Ethereum.

One of the foundational principles of the Second Foundation is to preserve Ethereum’s decentralization and censorship resistance while introducing more robust governance mechanisms.

Lomashuk has highlighted plans to implement dual governance within Lido, starting in Q1 2025, as an example of the kind of innovation the Second Foundation would champion.

The Second Foundation’s vision also includes addressing Ethereum’s staking mechanism, a critical component of its proof-of-stake security model.

Lomashuk has proposed that Ethereum aim for at least 66% of its total supply to be staked, arguing that this threshold is vital to prevent validators from being concentrated in centralized custodians.

“If there needs to be a limit, it should come from the Ethereum protocol itself and apply uniformly to all liquid staking protocols,” he said in response to ongoing debates about Lido’s staking dominance.

Prominent figures take aim at Ethereum’s path forward

While the EF works to reform its leadership and scale its ecosystem, critics argue that the platform lacks urgency, vision, and a coherent strategy to maintain its dominance.

Two key figures in the crypto world — Kyle Samani, Managing Partner at Multicoin Capital, and Justin Sun, founder of Tron — have taken to social media to highlight Ethereum’s shortcomings and suggest bold, if polarizing, strategies for its revival.

As the founder of Multicoin Capital, an investment firm deeply focused on blockchain, Samani credits Ethereum for igniting his passion for crypto. “ETH was my first meaningful source of wealth,” he tweeted.

Despite its early promise, his optimism has soured. The breaking point, he revealed, was Devcon 3, Ethereum’s annual developer conference held in November 2017.

Despite obvious scaling challenges — skyrocketing gas fees and increasing network congestion — Samani was stunned that scaling wasn’t even a focus of Buterin’s keynote.

“How can you not recognize what’s going on around you and set forth a credible plan with concrete and aggressive timelines?” he wrote. That moment, Samani explained, was when he “lost faith in Ethereum.”

Seven years later, Samani believes little has changed. He points to what he calls Ethereum’s “total lack of urgency” and its failure to align leadership with the needs of its core constituents. Without a clear “North Star,” as he puts it, Ethereum risks being overtaken by competitors that prioritize speed, scalability, and user experience.

Meanwhile, Sun, known for his provocative style, went a step further by offering a radical five-point plan for Ethereum’s revival, claiming his leadership could push ETH to $10,000.

If EF and Ethereum Were Under My Leadership

“#ETH to $10,000”

My First Week Plan

1. Halt ETH Sales immediately and Optimize Revenue

EF will immediately cease selling ETH for at least three years. Operational costs will be covered through AAVE lending, staking yields, and…

— H.E. Justin Sun

(@justinsuntron) January 22, 2025

The plan includes halting all ETH sales for three years, taxing Layer-2 solutions to generate $5 billion annually, and drastically downsizing the EF staff to create a merit-based, high-performance organization.

Sun’s plan also emphasizes increasing fee burns and reducing node rewards to strengthen Ethereum’s deflationary tokenomics while abandoning layer-2 rollups to focus exclusively on layer-1 scalability.

While Sun’s ideas may seem radical, they tap into genuine frustrations about Ethereum’s inefficiencies. The EF has long been criticized for its slow decision-making and perceived detachment from community concerns.

Yet, the feasibility of Sun’s vision is questionable. Taxing layer-2 solutions risks undermining Ethereum’s rollup-centric roadmap, a key scaling strategy, while downsizing the EF could strip it of the resources needed to maintain its innovation pipeline.

Community and developers turn their back on Ethereum

Ethereum’s challenges are no longer confined to leadership controversies or competitor attacks — its very community is fracturing.

Beanie, a well-known crypto venture capitalist, recently critiqued, “Ethereum Foundation is run by a high school teacher from Japan that hates competition, believes in equality of outcome over opportunity, and doesn’t recognize blockchain consensus as a means of governance.”

His critique of EF’s leadership culture as “woke” and overly ideological has resonated with those who feel the foundation is prioritizing philosophical ideals over practical innovation.

The calls for leadership reforms have also reached a boiling point. “If Aya Miyaguchi does not step down, I will re-evaluate my investment thesis on $ETH,” declared Hedgex, a crypto investor, while publicly removing the “.eth” from his username — reflecting a growing disillusionment within the community.

If @AyaMiyagotchi does not step down I will re-evaluate my investment thesis on $ETH the asset.

In the meantime, I have removed .eth from my name.

The people want change. It’s time for change.

— Hedgex (

,

) (@hedge__x) January 20, 2025

His sentiment was echoed by Eric Conner, a former Ethereum maximalist, who lamented, “I am no longer a dot eth. Perhaps someday those in leadership roles will realign with the community, but for now, I am out.”

The seeds of discontent were planted well before 2025. In October 2023, Mike Alfred, a value investor, said, “Ethereum looks sick. The world computer and ultrasound money narratives have failed. DeFi and NFTs have largely been abandoned. Vitalik and other insiders are looting the protocol.

The sentiment has only worsened over time, with John E. Deaton, a crypto lawyer and longtime observer of the space, stating, “I’ve never witnessed ETH sentiment so low. Post after post shows people who used to be ETH’s biggest supporters moving on.”

At a time when trust and unity are critical, the Ethereum leadership must act decisively. Whether through reforms, better communication, or a stronger focus on its decentralized principles, the network needs to bridge the widening gap between its ideals and the community’s expectations.

If it fails to adapt, Ethereum risks ceding its leadership position to competitors better equipped to meet the moment.