ETHEREUM Burning number decreased 95 % – what does it mean for ETH?

During the past few months, Ethereum has seen a significant decrease in the user activity on Blockchain. This slowdown reduces the mesh burning rate – a mechanism that helps reduce ETH supplies over time.

With burning fewer distinctive symbols, the circulating ETH supplies rose, leading to inflationary pressure on the original. As a result, the currency has struggled to maintain a stable price above the level of $ 2000 in recent months.

The decrease in the burning rate is equal to more coins in trading

According to ultrasound, 72,927 ETH, which is valued at $ 134 million at the current market prices, was added to the ETH trading offer last month alone.

At the time of the press, this sits at 120,730,199 ETH, which is much higher than the pre -retail levels.

This increase in ETH supplies is driven by a decrease in the user’s activity on the ETHEREUM network, which reduces the burning rate. The ETHEREUM burning mechanism, which was presented through EIP-1559, destroys part of the transaction fees to reduce the circulating offer of ETH.

However, this mechanism is directly associated with the use of the network. Therefore, when fewer transactions such as this occur, less ETH is burned, which leads to an ETH height.

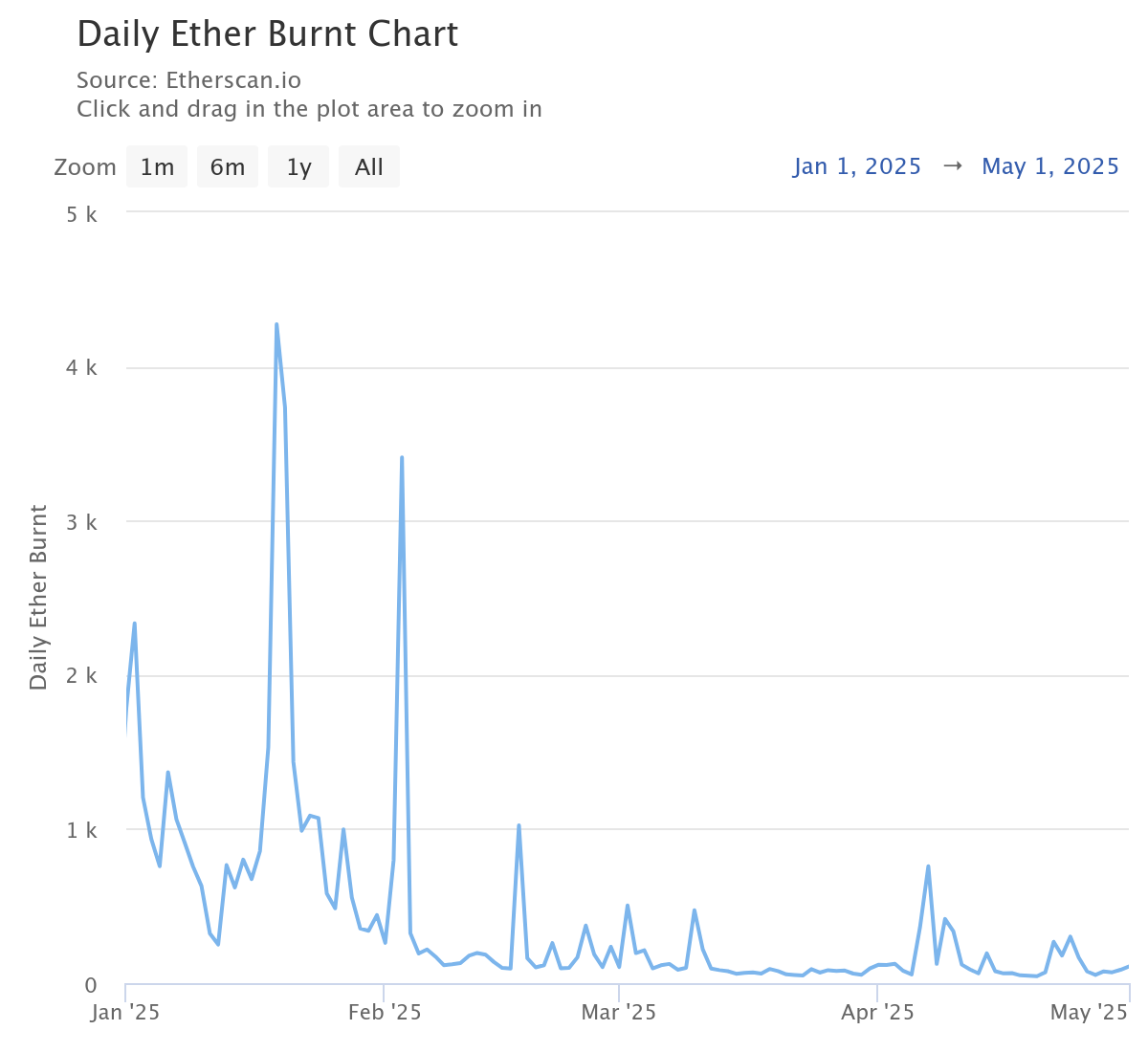

According to ETHERSCAN, the daily quantity of ETH Burnt decreased by 95 % of the year. In fact, the network recently recorded the lowest amount of burned metal currencies in one day on April 20.

Why do Ethereum Blockchain users leave?

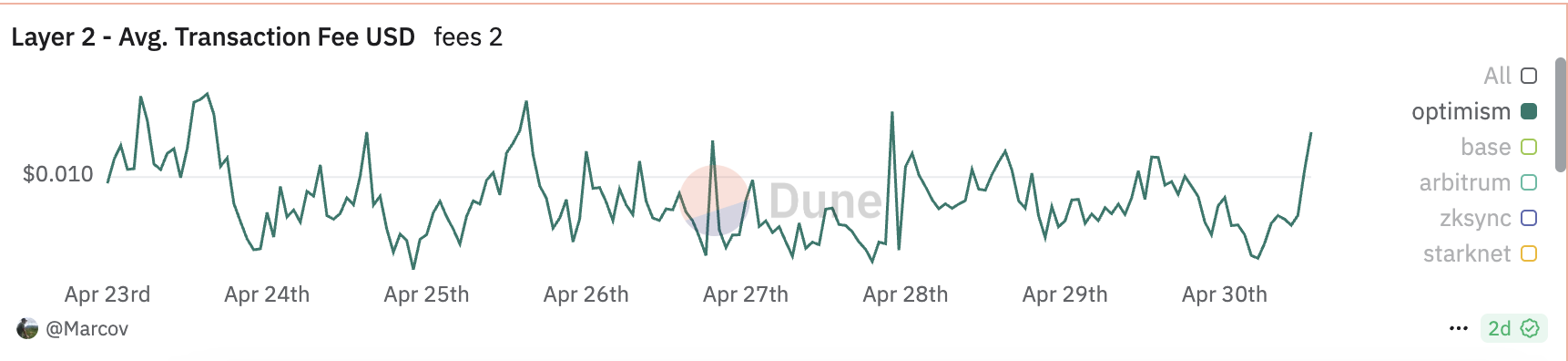

Many users and developers migrate from ETHEREUM solutions to Layer-2 (L2) such as optimism and definition. These networks provide much lower transaction fees and faster implementation, reducing the user’s activity on Mainnet from ETAREUM.

For example, as of April 30, the average treatment fee on Mainnet of optimism was only $ 0.024. On the contrary, completing the transaction directly on ETHEREUM users costs $ 0.18 on the same day, which is more expensive for more than seven times.

Moreover, thanks to the last Meme Coin Mania, “Ethereum Killers”, such as Solana, has gained a large traction over the past few months, prompting users away from L1.

These trends together led to a decrease in the number of ETHEREUM transactions, thus a decrease in the network combustion rate.

How do you accumulate ethereum basics?

User’s low demand in Ethereum and the height of ETH supply raised important questions about the strength of their basics.

When asked how to compare ETHEREUM currently to other Layer-1 networks (Layer-1) networks amid twice the broader market, Vincent Liu, chief investment official in Kronos Research, presented his point of view.

“Ethereum’s basics are still strong for the other layer, especially when you think about its closed value (TVL) amounting to 368.921 billion dollars, which it places at the top of the leaders,” Liu said.

Although Leo acknowledged that ETHEREUM is fifth in the 24 -hour fees, behind Tron, Solana, Hyperlequid, Bitcoin and BNB. He stressed that the network continues to “show a great demand and use.”

Temujin Louie, CEO of Wanchain, is a similar perspective. While talking to Beincrypto, Louis note:

“Compared to the other layer, the essentials remain the ETHEREUM power. Unlike many 1 -layer 1 layer of inflation as part of its design, ETHEREUM structure after the edge makes it possible to be low.

Although the growing activity through layer 2 (L2) and “ETHEREUM killers” like Solana may have contributed to the decrease in the user’s demand for ETHEREUM itself, Loui believes that L1 “remains a pioneer in decentralization and has an unlimited busy record that continues to secure its place in the market.”

What about the price of ETH?

Even with strong essentials, the low activity on ETHEREUM raises challenges for ETH in the short to average. Commenting on this, Liu explained that the decrease in the network activity generally indicates the weakest demand for ETH.

Meanwhile, the increased etage of the ETHEREUM metal model, which is designed to support price estimate, undermines.

“This mixture can lead to identity price movements, especially since investors are looking forward to the alternative layer 1 that provides expansion and fewer fees,” Liu warned.

Kadan Stadelman, CTO from the Komodo platform, also highlighted the role of total economic factors:

“If Ethereum has an expanded decrease in use, the price may decrease dramatically depending on the amount of use that decreases, especially if the Federal Reserve continues its policy to tighten quantitatively compared to quantitative mitigation. In the short term, this may mean that prices have decreased to a range of $ 2000.

Eth Eyes 2000 dollars amid strengthening the relative strength index

ETH is currently trading at $ 1834, indicating a decrease in the price of 1 % over the past day. Despite the brief decline, the bullish pressure in the metal cash markets continues to reinforce, on which the RSI’s relative is reflected.

At the time of the press, this momentum is at 57.68. RSI readings in ETH refer to upward conditions. This indicates that Altcoin has a field of upward movement if the purchase pressure increases.

In this scenario, its price may collapse over $ 2027.

However, if you lose pressure on the momentum, the ETH value may decrease to $ 1733.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.