ETH risk a 25 % decrease after the encryption market decreased

Ethereum price today: $ 3,060

- Ethereum investors reserved more than $ 430 million during the weekend.

- Whale and derivatives are still optimistic despite the high sales activity.

- ETHEREUM can test 25 % if it maintains a significant decrease in size to less than the support level of $ 3,000.

ETHEREUM (ETH) decreased by 8 % on Friday after the increase in the sale in the encryption market after the start of the Chinese artificial intelligence. The highest altcoin can be about to verify the correct step, which can send a decrease in the price to more than 25 %. However, whale and derivative dealers are still optimistic, and slowly buying.

ETHEREUM is rising, whales are still optimistic

A few Ethereum investors panicked and sold their assets during the weekend, as they sent the top of Altcoin to less than the level of $ 3200. This is evident in the scale network achieved for profit/loss, indicating that investors have seized profits of more than $ 430 million on Saturday. As the price dropped to the two, some investors have achieved more than $ 50 million of losses.

ETH network has achieved profit/loss. Source: Santime

The sales activity began by both short -term and long -term holders, as shown in a rise in the sleeper circulatory scale in all the age ranges of investors. If this trend continues, the ETH decline may accelerate.

Eth sleeping circulatory. Source: Santime

However, the Ethereum supply distribution reveals that whales are slowly bought, as they attract more than 120,000 ETH in the past three days.

ETH supply (10K – 100K) distribution. Source: Santime

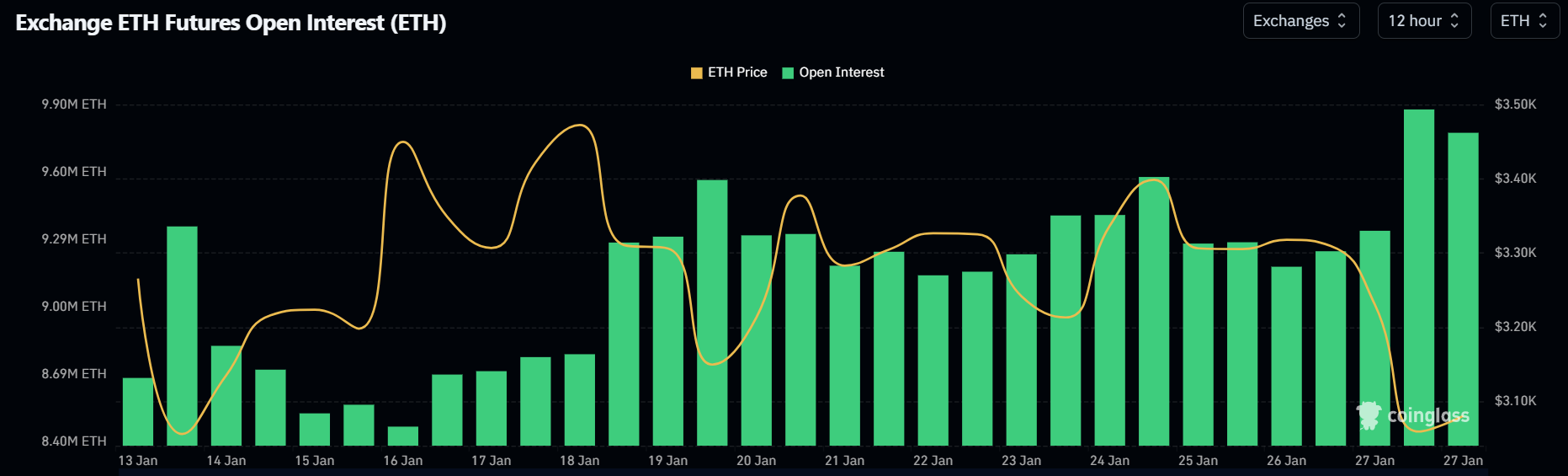

A similar visible trend in the derivative market with the rise in the interests of the future contracts ETHEREUM to 9.77 million ETH on Monday, despite the low prices. This indicates that investors may be betting on rapid prices instead of closing positions due to panic.

An open interest. Source: Coinglass

At the same time, on Friday CallAnd most of the second -class executives agreed that they can implement the “List” and “original” lists to improve decentralization in ETHEREUM.

In addition, the investment capital company composed a mail On Saturday, he called for an acceleration in the pace of ETHEREUM development instead of slowing the promotions to protect its decentralized position.

“There is a reasonable debate about what the Northern Ethereum star should be. But wherever you think Ethereum should go, it is better to get there faster there,” says the post.

ETHEREUM price expectations: ETH can see a 25 % decrease if the support level of $ 3,000 fails

ETHEREUM has seen more than $ 140.22 million in futures references during the past 24 hours, for all Coinglass data. The total amount of long and short strained positions was 121.61 million dollars and 18.62 million dollars, respectively.

Ethereum is developing a head and shoulder pattern (H&S) on the chart for 8 hours after declining below the level of $ 3200-which was defended by the bulls last month. Altcoin Alawite moves towards support near the psychological level of $ 3,000.

Eth/USDT 8 hours graph

If ETH maintains a significant decrease in size to less than $ 3000, more than 25 % may be suspended to find support near the historically high demand area of $ 2200. The level is obtained by measuring the height of the H&S style and dropping it down from the level of $ 3000.

On the other hand, the level of $ 2,817, which was a decisive support level between April and July 2024, could help prevent such a sharp decline. However, the violation of this level will accelerate the declining pressure.

In the upward direction, the eth can start in the upward trend if it gathered over the descending trend line extending from December 16.

The RSI and RAM (Stoch) is less than its neutral levels, indicating the dominant dominant momentum.

The daily closure of the candlestick over $ 3550 will nullify the relegation thesis.

Common questions between ethereum

ETHEREUM is an open -and -unlawful Blockchain source with smart contract functions. The original currency (ETH) is the second largest encrypted and Altcoin number one by market value. ETHEREUM network is designed to build encryption solutions such as decentralized financing (Defi), Gamefi, non -stable symbols (NFTS), decentralized independent organizations (DAOS), etc.

ETHEREUM is a non -central Blockchain technology, where developers can build and publish applications that work without the need for a central authority. To facilitate this, the network takes advantage of the virtual programming language and the virtual ethereum device that helps developers to create applications and release them with smart contract functions.

Smart contracts are publicly verified symbols that are automated by the agreements between two or more parties. Basically, these symbols are self -executed, when the pre -specified conditions are met.

Staking is a process to gain the return on the inactive encryption assets by being imprisoned in the encryption protocol for a specific period as a way to contribute to its safety. Ethereum moved from the proof of work (POW) to the mechanism of the consensus of leading bullets (POS) on September 15, 202, at the “integration” baptism event. The merger was a major part of the Ethereum road map to achieve high -level expansion, decentralization and security with sustainable survival. Unlike POW, which requires expensive use of devices, POS reduces the entry barrier by taking advantage of the use of encrypted codes as a basic basis for the consensus.

Gas is the unit to measure the transactions fees that users pay in exchange for making transactions on Ethereum. During the network congestion, the gas can be very high, causing the priority of transactions based on their fees.

%20[19.12.56,%2027%20Jan,%202025]-638736000768423731.png)

%20[19.13.09,%2027%20Jan,%202025]-638736001099011064.png)