ETF extends in the United States in Bitcoin ETF negative with $ 275 million in external flows

The Crypto Market witnessed a sharp sale overnight Thursday and the balance on Friday, as the Bitcoin price (BTC) decreased to less than 80,000 dollars.

Altcoins also threw, including Thorchin.

In the midst of this, the market for the stock exchange in the stock exchange in the United States was recorded on the eighth consecutive of negative flows.

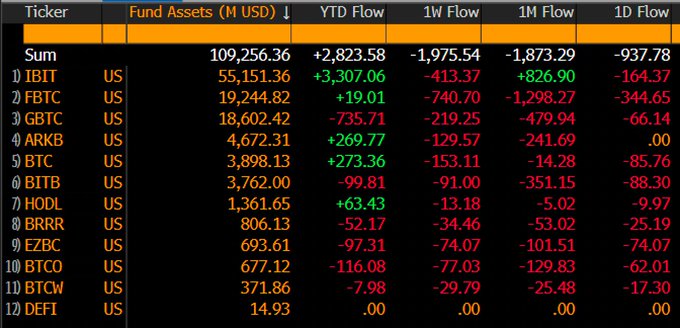

per Data from SosovalueThe ETFS market in the United States has witnessed the net net flows of more than $ 275 million.

This horrific performance of US Bitcoin permits extended to eight consecutive days, and returning to February 18.

The last $ 275 million from the BTC ETFS spot

On Thursday, a record number of investment funds in Bitcoin Spot indicates that the largest external flows were from ISHares Bitcoin Trust from Blackrock (Ibit).

ETF, which represents the largest flows and net assets, has seen the exit of more than $ 189 million.

Industry experts have indicated the sale of the last BTC and Ether as one of the downward pressure in the market.

Elsewhere throughout the American ETFS BTC ETFS market, the BTCW’s Wisdomtree and BRRR from Valkyrie are the second external flow per day.

BTCW has seen investors withdrawing more than $ 53.7 million from their positions, while BRR registered more than $ 12.8 million.

ARK & 21shares, Invesco and Hashdex have seen zero flows, while Bitb’s Bitb is the only BTC ETF in the United States to record net flows at more than $ 17.6 million.

More than $ 3.2 billion in external flows in 8 days

With the end of the month, 275.8 million dollars came out of Blackrock, Fidelity, Grayscale, and others.

In total, they add to more than $ 3.2 billion in the past eight days.

The net flows on February 27 were significantly less than what the market witnessed earlier in the week.

However, with the sale of some prominent exporters, expectations are not inspiring at the present time.

More than $ 1.1 billion in net external flows is highlighted on February 25 and more than 754 million dollars on February 26, the peak of external flows last week.

Eric Balunas, a large ETF analyst in Bloomberg, indicated that the investment funds circulated in Bitcoin were “feeling a pulse.”

However, these external flows are less than 2 % of the assets and that most buyers wander.

“As I said, two steps will be one step back,” the ETF analyst indicated earlier in the week.

Bitco Etfs feels a pinch, approximately $ 1 billion yesterday and $ 1.8 billion per week. On the bright side, that is, less than 2 % of the assets, with nickel insulation taking into account the clouds, more than 98 % of the money. As I said, two FWD steps will be one step. Get used to …

Despite external flows, the strong performance in 2024 means that net box flows are $ 36.85 billion.

Meanwhile, the total net assets exceed 94.3 billion dollars, which represents about 5.69 % of the maximum bitcoin market.

Bitcoin price under pressure

Instant investment funds in the instant Bitcoin have witnessed external flows, the effect was noticeable on the price of BTC.

It has been combined with winding tariff fears and recent industry events such as a $ 1.4 billion bybit penetration for the decrease in feelings.

The BTC price in this environment fell to less than 80 thousand dollars.

The data shows that the value of the higher digital assets decreased by more than 18 % last week.

Earlier, the potential decline analyst expected $ 75,000.

ETFS Post US Bitcoin ETF extends on a negative line with $ 275 million in external flows first on Invezz